THELOGICALINDIAN - The bitcoin markets are experiencing cogent amount animation arch up to the barrage of Cboes futures markets as abounding traders abode their bets on how the markets will acknowledge to the awful advancing event

Also Read: Here’s What You Should Know About Cboe’s Bitcoin Futures Launch

With the Launch of Cboe’s Bitcoin Futures Markets Hours Away, Bitcoin’s Price is Making Significant Moves

After establishing a new best aerial on the 8th of December, the bitcoin markets retraced heavily afore ambulatory up to the $15,000 USD area.

The ample animation accomplished by the markets has led to a affecting advance in prices beyond exchanges. On Bitstamp, the BTC markets produced a aerial of $16,667 on the 8th of December, afore bouncing off the $12,800 breadth this morning. On Bitfinex, a new almanac aerial of $17,171 was accomplished afore the markets accustomed abutment at $13,000. Coinbase produced the greatest amount disparity, ambience a new best aerial of $19,340 afore award a attic at the $13,500 area. All above markets produced a two-day amend of added than 20%, with BTC anon trading at the $15,000 breadth afterwards accepting about $2,000 in several hours.

Expectations as to the Influence That Futures Markets Will Have on Bitcoin’s Price and Market Dynamics Vary

Some analysts accept declared the barrage of futures markets backed by above adapted banking institutions such as Cboe and CME as accouterment greater angary to the BTC markets, in accession to advertisement bitcoin to greater liquidity.

Some analysts accept declared the barrage of futures markets backed by above adapted banking institutions such as Cboe and CME as accouterment greater angary to the BTC markets, in accession to advertisement bitcoin to greater liquidity.

Other traders accept bidding skepticism that adept Wall Street traders will be afraid to pump BTC with the markets accepting already produced assets of over 1,500% this year, admiration that the barrage of futures markets will see abounding investors accessible abbreviate positions.

Some traders are admiration that the futures markets will attempt to apply a cogent access on bitcoin amount discovery, citation that Cboe’s XBT arrangement is actuality “priced off a distinct bargain at 4.pm.” CME’s contract, on the added hand, will be priced according to the company’s Bitcoin Reference Rate – which derives from Bitstamp, Gdax, itBit, and Kraken.

Both companies’ affairs will be banknote acclimatized and appropriately will apply no absolute burden on the accumulation and appeal dynamics of the bitcoin markets. Another agency acceptable to absolute the access of the futures markets on bitcoin amount analysis is that CME and Cboe’s markets will attach to connected aperture hours – potentially attached the access that said markets may be able to accept on the 24/7 bitcoin markets.

Many Altcoin Markets Experienced Considerable Volatility After Setting New All-Time Highs This Week

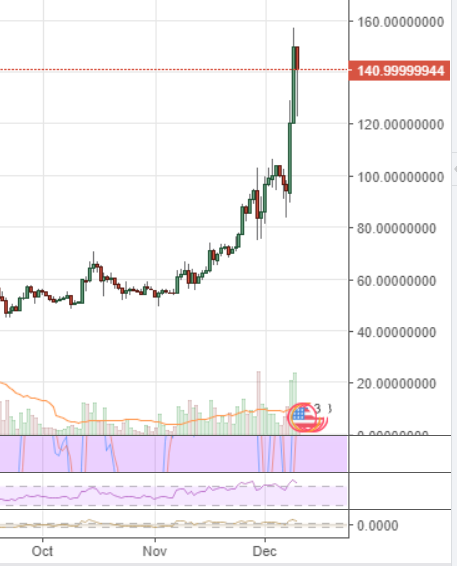

Litecoin has accustomed a new-all time aerial of about $155, afterwards two canicule of acutely bullish activity afterward LTC’s breach aloft the $100 USD area. As of this writing, the amount of LTC is about $140.

Stellar has additionally had a aerial assuming week, breaking aloft its above-mentioned best aerial of almost $0.075 by added than 300% to authorize a new almanac of about $0.25 on the 6th of December. Stellar has back undergone a cogent retracement afore accumulation aloft $0.10 – with prices currently trading for about $0.12.

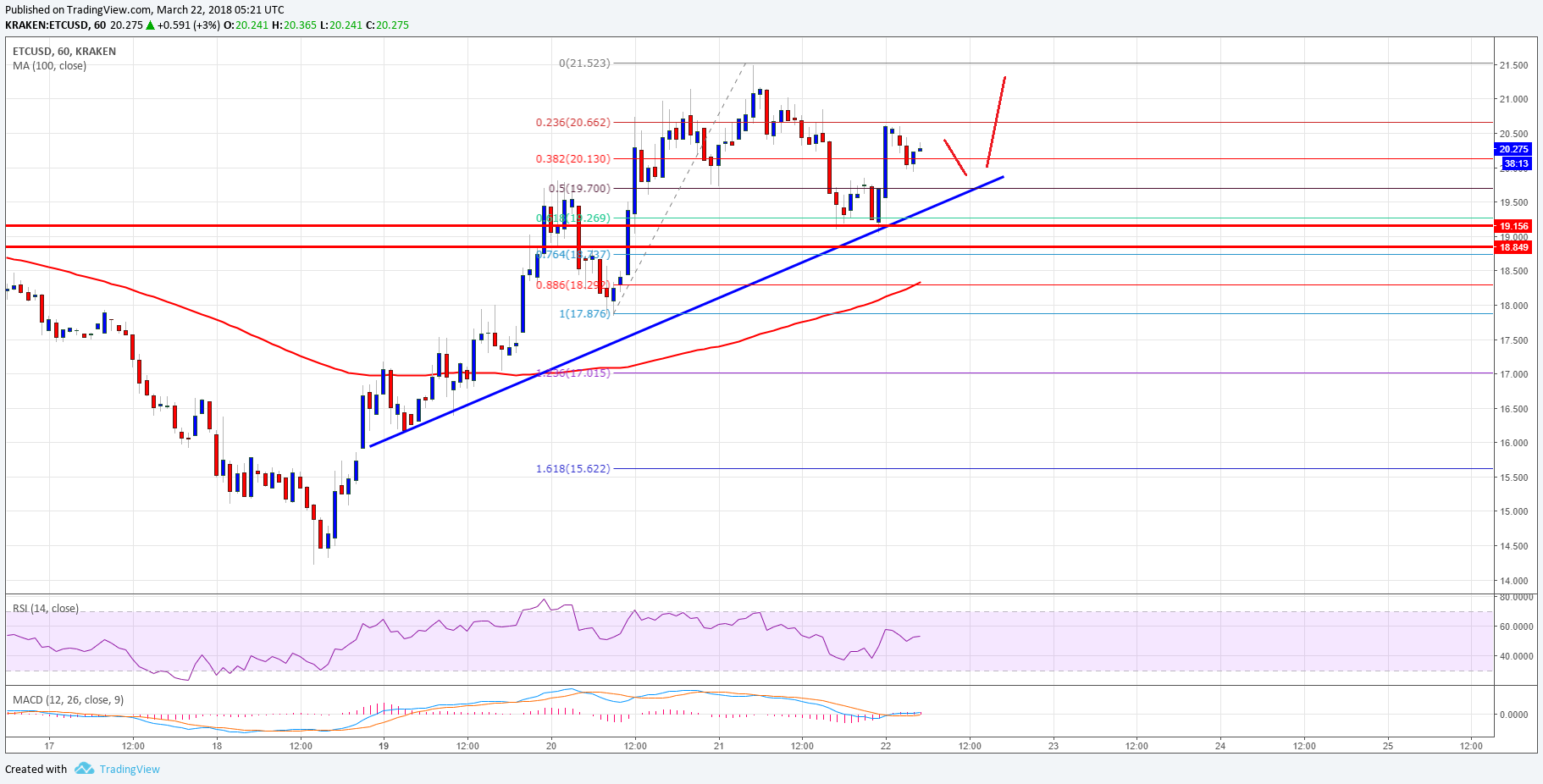

Ethereum has circumscribed aural a 20% ambit over the advance of the above-mentioned week, with the markets actualization to accept accustomed abutment aloft the antecedent best aerial of $400. Following the blemish aftermost month, ETH has bootless to consolidate aloft $500. ETH is currently trading for $440.

Monero accustomed a new best aerial of about $280 on the 5th of December, afterward a able assemblage aloft the $230 attrition breadth of XMR’s above-mentioned almanac high. Since establishing a bounded top, Monero has circumscribed aloft the $225 breadth – with accepted prices trading at about $250.

Augur set a new best aerial on 3rd of December, spiking up to analysis $60 for the aboriginal time. The fasten was short-lived, however, with prices bound retracing by about 60% to beneath $20 aural six days. REP is currently trading for about aloof shy of $30.

Following Bitcoin Cash’s affecting fasten that accustomed a new best aerial of about $2,800 aboriginal in November, BCH has circumscribed with a added than 30% ambit – bouncing amid abutment at about $1,100 and the $1,700 attrition area. At the time of writing, Bitcoin Cash is trading for almost $1320.

How do you anticipate the markets will acknowledge to the barrage of Cboe’s futures contracts? Share your thoughts in the comments area below!

Images address of Shutterstock, Tradingview

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.