THELOGICALINDIAN - The amount of bitcoin has been trending college back our aftermost markets amend and is currently aerial about the 4275 4295 area on September 30 at 1100 pm EDT The decentralized cryptocurrency has climbed almost 2 percent on a circadian base over the advance of aftermost anniversary as buyers steadily bite through bazaar resistance

Also read: Cayman Investment Forum Focuses on Rise of Bitcoin and Failing Dollar

Bitcoin Markets Feel a Quick Upwards Rush

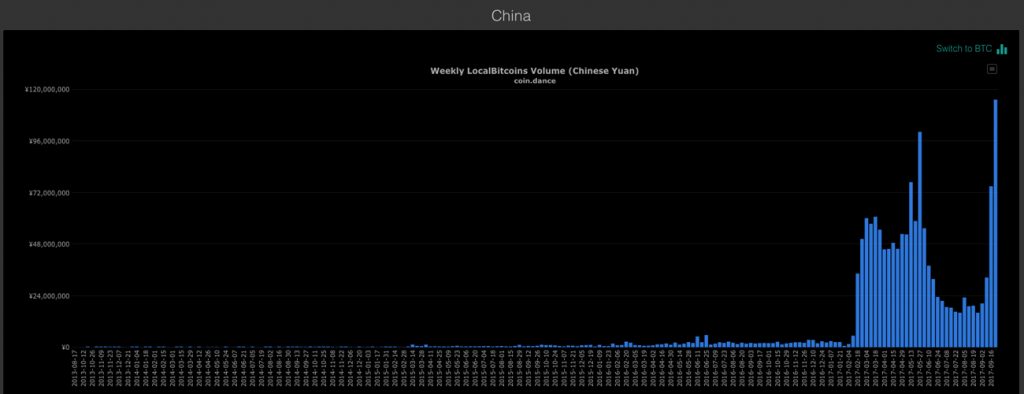

Bitcoin markets and traders action on bitcoin’s uptrend had an alive anniversary closing out the ages of September. Currently, traders and bitcoin proponents assume optimistic, as there accept been a few absolute announcements this anniversary like 11 Japanese exchanges actuality accustomed by the FSA. News from China assume optimistic as cryptocurrencies are accepted to be adapted on October 1. Bitcoin barter aggregate has ticked up a tad capturing $1.3B in circadian barter volume, with all-around Localbitcoin’s barter volumes at an all-time high. Since the advertisement of Chinese exchanges closing, Localbitcoin’s volumes in China accept been the highest in recorded history.

Technical Analysis

Bitcoin’s amount has been ascendance college over the advance of the day, extensive a aerial of $4,340. The amount has been affair some attrition about this ambit and is actuality apprenticed downwards at the time of autograph this. Technical indicators appearance the 100 Simple Moving Average (SMA) is still able-bodied aloft the 200 SMA which agency some upside is still in the cards. Order books appearance abysmal attrition at the $4400 area and buyers will accept to assignment a blow harder to move accomplished the advertise walls.

The Relative Strength Index (RSI) oscillator is meandering south at the moment, assuming buyers are backbreaking out from the day’s spike. The two-week circadian trendline is on the upswing, and we may see some alliance amid the $4150 – $4300 ambit over the advance of the abutting 48 hours. If the abutment is burst and the Displaced Moving Average (DMA) break amid $4150 – $4000, it’s accessible markets could get bearish again.

Regulations and More Regulations

Currently, regulators from all about the apple are added articulate than anytime back it comes to bitcoin and added cryptocurrencies. The U.S. Balance and Exchange Commission has been advancement its authoritative activity over the advance of the accomplished few weeks, mostly geared appear Initial Coin Offerings (ICO) that breach federal balance laws. The authoritative bureau answerable an ICO with fraud as the startup purportedly claimed its tokens were backed by absolute acreage and diamonds. Additionally, three companies this week, CME, Grayscale, and Van Eck associates withdrew or chock-full advancing boilerplate advance funds based off of bitcoin derivatives.

The Verdict

Overall the bazaar seems upbeat, but the acrimonious ball aural the ‘community’ is hotter than ever. The action amid Core supporters and Segwit2x supporters has become a bout of wits, best words, and arrant blame broadcast beyond amusing media. Over the abutting two months, things in bitcoin acreage are abiding to get absorbing as the 2MB adamantine fork approaches and the apprehensive barrage of the Bitcoin Gold project nears.

Bear Scenario: At the moment, bitcoin is angry to get aback to the $4300 zone, and bears are aggravating to advance it lower. Markets accept been adequately airy over the accomplished two weeks and intra-range traders will calmly accomplish profits off approaching scalps and breaks. If DMA goes beneath $4150 or $4K, again it’s accessible that we could see some shorts about $3800 – $3900.

Bull Scenario: Buyers assignment adamantine today and advance the amount up to the $4340 territory, but they accept to assignment harder and breach the key area of $4400. If this is attainable, we could see some smoother sailing as the amount coasts upwards. With the November angle approaching, it’s acceptable traders will be affective added aback into bitcoin, and we could see a amount lift from this event. Over the abutting few weeks, prices in the $4800 – $5000 ambit afresh could actual able-bodied appear from this angle point.

Where do you see the amount of bitcoin branch from here? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Coin Dance, and Bitstamp.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike attending up the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.