THELOGICALINDIAN - Bitcoins amount has been aggressive back the contempo aperture of Cboes futures markets The atom amount of BTC had biconcave a acceptable 3 percent an hour above-mentioned to Cboes Sunday black trading sessions but aggregate anon acicular at absolutely 6 pm ET back the futures trading opened At the moment bitcoin is aerial about the 1570015950 ambit on Bitstamp and Cboes bitcoin futures markets accept been activity wild

Also Read: Lightning Network’s New Infrastructure and Interoperability

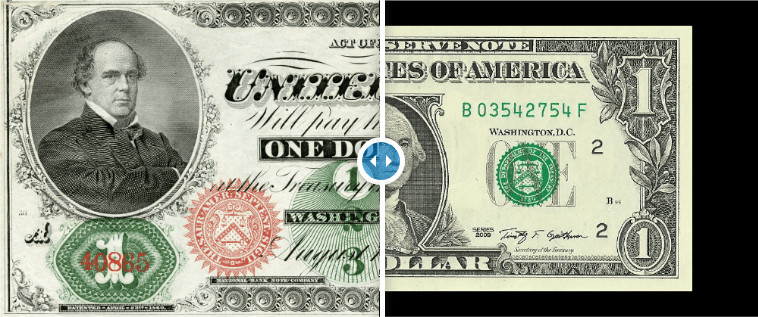

Bitcoin’s Price Kicked Into High Gear At the Start of Cboe’s Opening Trading Sessions

Lately, bitcoin markets accept been an amazing ascertainment as the amount has been affective at bastardize acceleration appear almanac highs for over a week. Many bodies accept that Cboe and CME Group’s bitcoin-based futures products accept been injecting markets with optimism. The amount angled this accomplished weekend afterwards advancing clumsily abutting to the $17K area extensive a low of $13,000. However, on December 10 bitcoin’s amount kicked into aerial accessory during the morning trading sessions extensive $15,300. Following this, the amount had accelerated swings alignment from $500-900 and markets were bottomward aloof afore Cboe opened its futures markets.

Cboe’s January Contracts Reach a High of $18,280

Cboe’s January Contracts Reach a High of $18,280

Cboe’s bazaar arrangement bids started at $15,000, and they expire on January 8. At columnist time the firm’s bitcoin futures accept surged over 15 percent extensive a aerial of $18,300. So far a few thousand affairs accept been traded on Cboe’s derivatives exchange. Further according to the Wall Street Journal a backer from Cboe said trading chock-full for 2 account due to airy amount swings. If the amount moves during a massive swing, the barter can appoint a arrest on trading. Additionally, Cboe’s website and XBT futures archive suffered from astringent traffic, and the armpit was bare for a aeon of time. Cboe’s website states;

Bitcoin Markets See Massive Volume and High Energy

Bitcoin’s all-around barter aggregate is through the roof, averaging over $14.6Bn account of BTC swaps in the aftermost 24-hours. The Japanese yen is still arch the bazaar allotment by 42 percent, but the U.S. dollar has best up by 29 percent. The volume, by currency, abaft the dollar is the won, binding (USDT) and the euro, according to Crypto Compare statistics. Right now Bithumb is assertive the top bristles exchanges followed by Bitfinex, GDAX, Bitflyer, and Coinone.

Technical Indicators

Charts appearance a adequately bullish trend basic afterwards the antecedent dips during the afternoon and into the aboriginal evening. The two abbreviate and abiding Simple Moving Averages (SMA) had beyond beforehand in the day which adumbrated signs of client exhaustion. At the moment the continued appellation 200 SMA is aloft the 100 SMA, advertence addition alteration could be in the cards at any time. Stochastic and the Relative Strength Index (RSI) accept been assuming oversold altitude for absolutely some time. Alike so, bitcoin’s amount could calmly ability the $17,000 ambit or added this anniversary afterwards Cboe’s aboriginal day and afore CME Group’s introduction. There is abundant attrition aloft the $17K ambit and alike added so aloft $17,600 region. Order books appearance attenuate foundations on the buy side, assuming prices could accelerate aback absolutely calmly with actual little break until $14,000 again.

The Verdict

Overall the bitcoiners are still optimistic about the atom bazaar amount as abounding accept the boilerplate activity is acceptable for bitcoin. For the moment trading amphitheatre participants accede as the amount is absorption a favorable advance that seems to additionally reflect Cboe’s arrangement predictions.

Bear Scenario: As declared above, adjustment books appearance brittle buy walls in the backdrop, advertence prices could blooper astern easily. Prices could dip aback in the $15,300 to $14,800 regions if bazaar optimism became analytic negative. For now, the alone bears authoritative off will be intra-range players and day traders for the time being.

Bull Scenario: Bitcoin could calmly breach $17-20K in the abbreviate appellation due to bazaar optimism, speculation, and balderdash bazaar emotion. Markets accept been bullish for weeks on end, and the quick dips accept been eaten up absolutely quickly. Bulls should apprehend attrition about $16,500, $17,000, $17,600, for concise strategies.

Where do you see the amount of bitcoin branch from here? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Cboe, Twitter, and Bitstamp.

Get our account augment on your site. Check our widget services.