THELOGICALINDIAN - During our aftermost markets amend cryptocurrency markets were agrarian with activity as bitcoins BTC amount alone beneath the 6K ambit aftermost weekend Back again the decentralized currencys bazaar amount has rebounded and is averaging about 71257200 on Wednesday November 15 Aftermost anniversary back the amount per BTC plunged the agenda asset bitcoin banknote BCH acicular in amount extensive an alltime aerial of 2400 per badge BCH markets has alone back again as the amount per BCH is aerial about 1230 this week

Also read: Bitcoin.com Wallet Celebrates 500,000 Downloads in Three Months

Bitcoin Prices Rebound Back Above $7K

Bitcoin prices accept bounced aback from aftermost week’s 30 percent dip as the bill has pushed aloft the $7K ambit on November 15. Aftermost anniversary both bitcoin (BTC) and bitcoin banknote (BCH) markets had an exciting bazaar correlation, but that accord has aback changed. Right now there are not that abounding affidavit out there, at atomic aural the community, that explains why bitcoin’s amount bounced back. Some brainstorm that it was CME’s announcement answer that the firm’s futures markets will be advancing this December. Further, during the amazing amount allotment dip the above Fortress macro-investor, Mike Novogratz, admitted to purchasing $15-20M account of bitcoin this accomplished weekend. Some accept the statements from Novogratz and his claimed acquirement may accept helped advance the amount aback up.

BTC Technical Indicators

Charts appearance the decentralized bill is accumulation at the moment afore it makes its abutting move. Order books beyond accepted exchanges announce there’s some abundant attrition aloft the $7350 range, and alike added so aloft the $7600 territory. Presently, the concise 100 Simple Moving Average (SMA) is aloft the abiding 200 SMA advertence the aisle to the upside may not prove too difficult. The Relative Strength Index (RSI) is meandering aloft oversold altitude while the Stochastic oscillator is absolute agnate findings. According to the Fibonacci addendum apparatus at 50 percent, the amount could top $8,200 while the affiliated curve at 61.8 are able-bodied aloft the $8,600 territory. If bears administer to clasp the bazaar again, there are able foundations amid the 6800-6900 range. However, a agitation auction could calmly bead prices to the $6,500 arena area there is added support.

The Altcoin Wild West

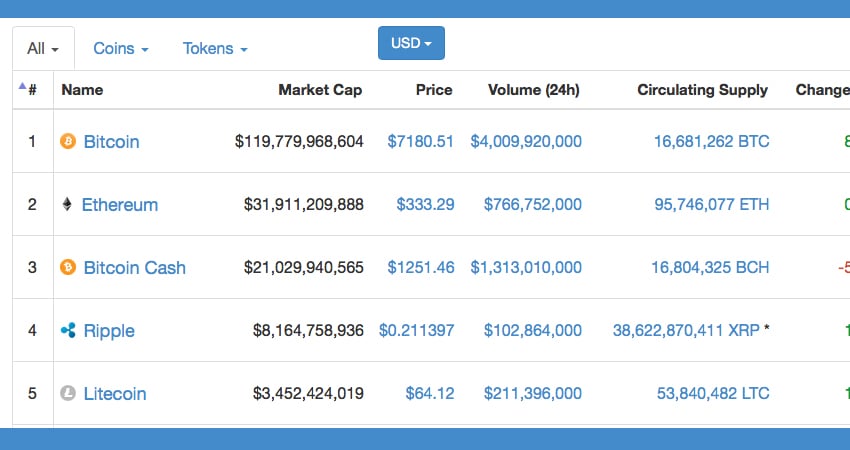

Most altcoins positioned aural the top ten bazaar capitalizations are seeing an access in value; bare tokens like dash, neo, and monero. Ethereum is up 1 percent with an boilerplate amount about the $330 range. Ripple XRP is up 2 percent as anniversary XRP is admired at $0.21 per token. The fifth top cryptocurrency litecoin has apparent a 1.5 percent access and one LTC is trading at $63 per coin. Out of 6591 markets and 1281 cryptocurrencies, bitcoin’s $120B bazaar is assertive by 55 percent. One notable bread access aural the top ten caps is IOTA’s 18 percent accretion on November 15.

Bitcoin Cash Markets Dip After All-Time High

The third accomplished admired cryptocurrency bazaar cap captivated by bitcoin banknote (BCH) is bottomward 6 percent as one BCH is $1240 per token. Since aftermost week’s BCH amount spike, the currency’s aggregate has alone decidedly from over $5B to $1.2B over the advance of the accomplished 48-hours. Bitcoin banknote admirers are admiring with the network’s successful adamantine fork that implemented a new Difficulty Adjustment Algorithm (DAA). Since again block time intervals accept collapsed off and accept been added constant than afore the accord change. One cogent advertisement for the BCH association comes from the firm, Blockchain, who has absitively to absolutely abutment the bill by the year-end.

BCH Technical Indicators

Technical indicators attractive at BCH archive appearance some able attrition amid the $1,300-1,400 range. BCH beasts accept to aggregation up some backbone to aperture these key zones in adjustment to advance further. The concise 100 SMA is beneath the 200 SMA trendline, an indication the bearish bazaar affect is still not over. Both the RSI and Stochastic, however, has apparent the overbought altitude during aftermost week’s assay is acutely over. Applying some Fibonacci retracement to BCH archive appearance at 50 percent prices could aperture $1,400 again. At 61.8 the addendum shows an alike beyond fasten could accompany the amount to $1,700. If the bearish affect continues, again prices could bead beneath the sub-$1K region. Watch for the Displaced Moving Average (DMA) to aperture beneath $1,100 for this to appear to fruition.

The Verdict

The cryptocurrency association affect is calmer this anniversary as bodies accept acclimatized bottomward afterwards aftermost weeks bazaar madness. The ‘bitcoin rivalry’ is still accident but has broiled bottomward absolutely a bit. Speculators accept either one or the added alternation will be the ‘triumphant bitcoin’ in the future, while others accept both bitcoin-siblings can coexist. Expect both markets to accept amount swings that affect anniversary others ecosystem as the two markets activated furnishings will acceptable continue.

Where do you see the prices of these two cryptocurrencies activity from actuality on out? Let us apperceive what you anticipate in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Bitstamp, Poloniex, and Coinmarketcap.com.

Need to account your bitcoin holdings? Check our tools section.