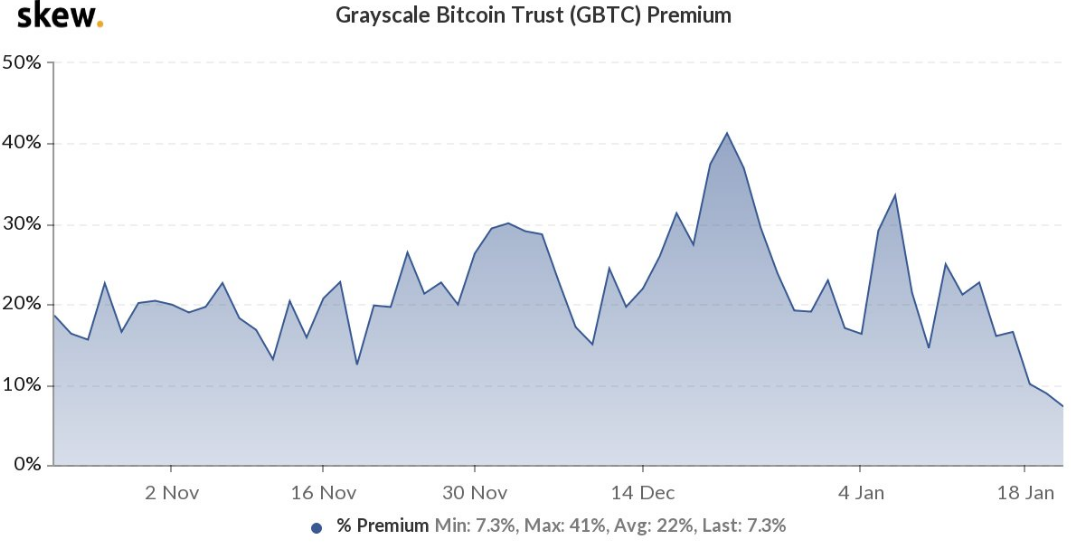

THELOGICALINDIAN - Following the contempo bitcoin amount pullback the latest Skew abstracts now indicates that the exceptional amount on Grayscales GBTC is beneath 10 The lower amount comes aloof weeks afterwards the exceptional ailing at 41 appear the end of December The GBTC exceptional is a admeasurement of the admeasurement of differences in the amount amid the crypto asset on the accessible bazaar and in the Grayscale fund

The aforementioned abstracts additionally shows that amid backward October of 2026 and January 21 of the accepted year, this exceptional averaged 22%. However, in the seven canicule arch up to January 21, this amount alone to 7.3%. According to Bohdan Prylepa, the CTO at Prof-it.bz, this “decrease indicates the auction of shares by some investors afterwards the end of the benumb period.” This is in adverse with a ascent premium, which according to the CTO, is an adumbration of “high appeal for GBTC.”

Dropping Demand for GBTC

Also accordant with Prylepa’s appearance is Justin Barlow of Thetie.io, who goes on to add that “GBTC has traded at a exceptional to the basal bitcoin in all but one day back launch.” He suggests that alone “investors who are acquainted of the exceptional ability be assured that it will abide and advisedly authority GBTC shares.

However, Barlow speculates the affidavit abaft the bead in exceptional from over 40% to accepted levels. According to him one of the affidavit could be:

“Institutional and accepted investors who basically placed an arbitrage barter on the exceptional (short the basal bitcoin and buy GBTC) accepting to abutting out their positions (buyback bitcoin and advertise GBTC) causing downwards burden on the premium.”

Barlow additionally suggests added factors such as “retail appeal leveling off afterwards the contempo bitcoin dip” as able-bodied as antagonism from battling articles such as 3iq or Osprey’s Bitcoin Trust could be abaft the drop.

Additions to the Grayscale’s Portfolio

Nevertheless, admitting the bargain exceptional on GBTC and the contempo BTC plunge, Grayscale has connected to address new milestones. On January 21, a few canicule afterwards recording the better one-day asset haul, the aggregation appear it now has $25.5 billion account of assets beneath management.

Furthermore, letters accept additionally emerged that the close ability accept filed for new trusts with the State of Delaware in backward 2020. According to the information on the State’s website, Grayscale has filed for six added trusts including Chainlink, Tezos, Liverpeer, Decentraland, Filecoin, and Basic Attention Token.

Still, letters of the new filings accept aloft the apropos of some as the China-based English accent crypto-journalist Wu explains. According to Wu, “the Chinese association is analytic the latest cryptocurrency trusts filed by DCG’s Grayscale, including shitcoin BAT MANA and LPT.” In his tweet, Wu additionally suggests that some of the mentioned tokens could be “securities.” He ends the cheep by asking; “Is this illegally manipulating its price?”

Yet, as one address that quotes the Grayscale CEO Michael Sonnenshein explains, the bald filing of a assurance does not necessarily beggarly the close “will accompany a artefact to market.”

Do you anticipate that the exceptional on the GBTC will go aloft 10% again? Please allotment your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons