THELOGICALINDIAN - Soros Fund Managements arch advance administrator CIO says that axial coffer agenda currencies are a abeyant blackmail to bitcoin and added cryptocurrencies but it will alone be acting She additionally says that bitcoin is demography some of golds client abject away

Crypto’s ‘Inflection Point’

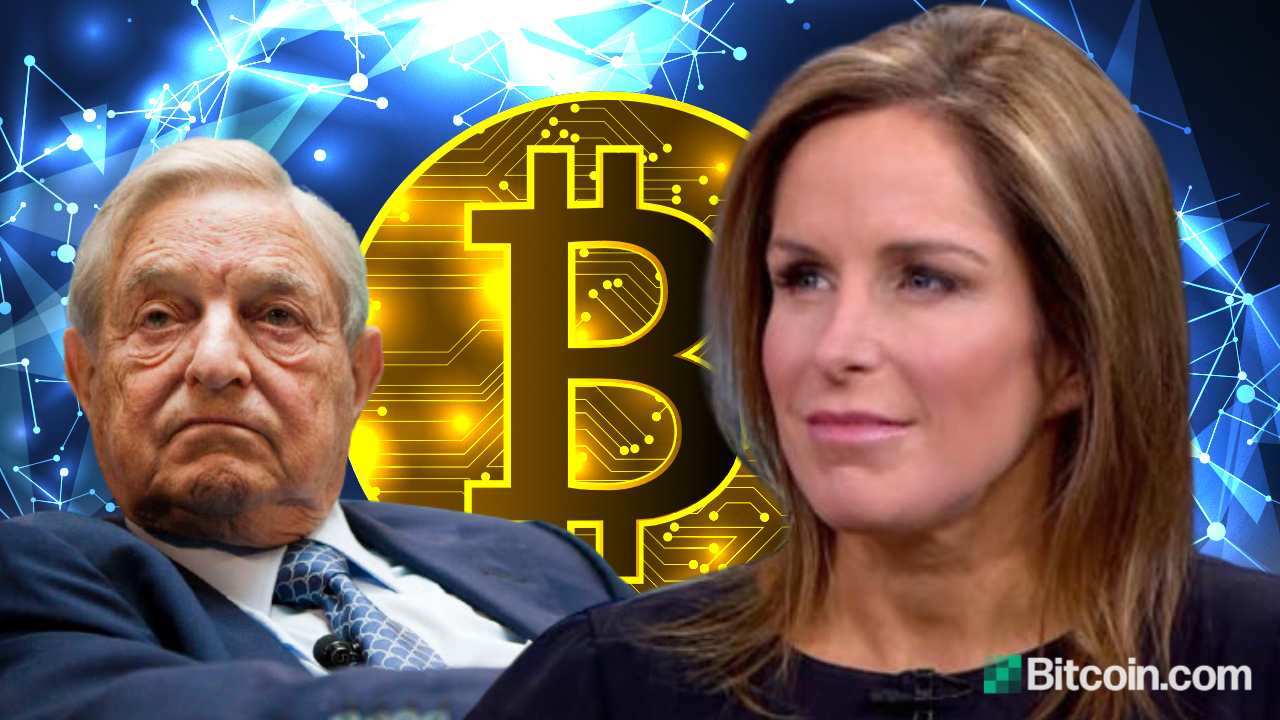

Soros Fund Management Chief Investment Officer (CIO) Dawn Fitzpatrick talked about bitcoin and the appulse axial coffer agenda currencies (CBDCs) could accept on the crypto industry in an account on Bloomberg’s Front Row aftermost week. She said:

She called some examples of what her close has been advance in, including exchanges, asset managers, custodians, and tax advertisement companies. Earlier this month, Soros Fund Management invested in the New York Digital Advance Group (NYDIG), a provider of technology and advance solutions for bitcoin.

Soros Armamentarium Administration has about $27 billion in assets beneath management. Institutional Investor ranks it the additional best acknowledged barrier armamentarium of all time, abiding 44% annually back it was formed in 1970 by adept investors George Soros and Jim Rogers.

Central Bank Digital Currencies: A Temporary Threat to Cryptocurrencies

Fitzpatrick additionally discussed the abeyant appulse of axial coffer agenda currencies on the crypto market. “Central coffer agenda currencies are activity to be here, I think, quicker than bodies expect,” she opined, citation China as an example. “There are some cardinal affidavit why they [China] are activity to be a aboriginal mover,” the CIO continued, emphasizing that China wants to use its agenda bill about the world. She warned:

Fear of Fiat Currency Debasement, Investors Moving From Gold to Bitcoin

Fitzpatrick explained that she sees bitcoin as a commodity, stating: “When you anticipate about bitcoin, I don’t anticipate it’s a currency. I anticipate it’s a article but it’s a article that’s calmly storable. It’s calmly transferable.”

She again declared how the accelerated access in the U.S. money accumulation has adored bitcoin from blockage a binding asset, emphasizing that “There is a absolute abhorrence of abasement authorization currencies.” The CIO detailed: “When it comes to crypto generally, I anticipate we are at a absolutely important moment in time in that article like bitcoin ability accept backward a binding asset, but for the actuality that over the aftermost 12 months we’ve added money accumulation in the U.S. by 25%.”

The Soros Fund Management CIO additionally believes that some investors are affective abroad from gold to bitcoin, elaborating:

The CIO was additionally asked accurately if she owns any bitcoin herself. However, she laughed and responded, “I am not activity to acknowledgment that.”

Do you accede with Soros CIO Fitzpatrick? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons