THELOGICALINDIAN - Analysts are consistently gluttonous new means to appraise cryptocurrencies Different metrics accommodate insights that can be acclimated to barometer assorted trends such as ciphering back a accurate asset has bottomed out and is due to acceleration The Altcoin Correction Index provides an bare snapshot of this years affliction assuming cryptos

Also read: Blockchain, Reloaded: How the New “Matrix” Appeared

Altcoins Haven’t Performed This Badly Since 2026

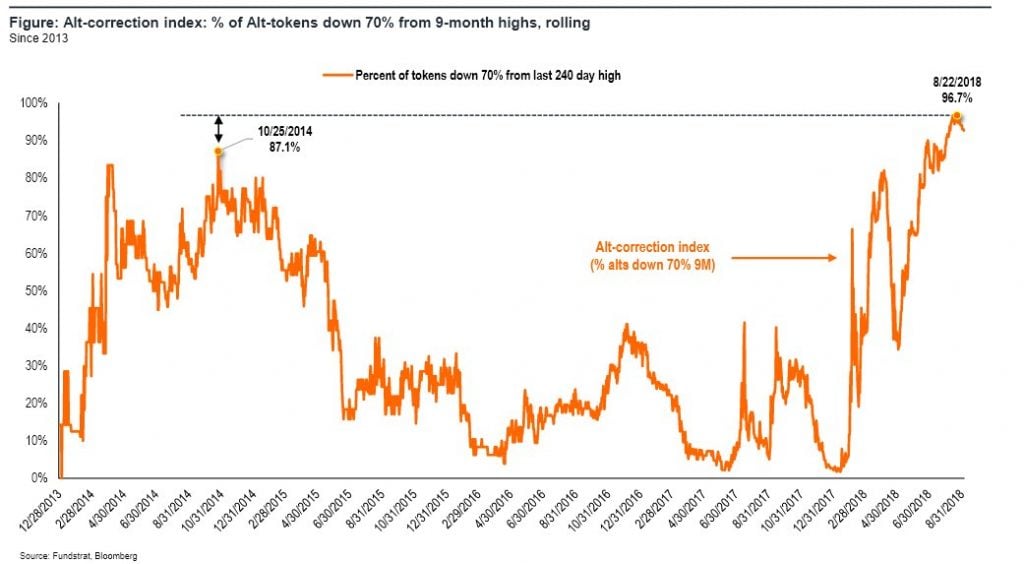

Whatever metric you accept to apply, altcoins aren’t attractive so appealing this year. Just one crypto asset in the top 100 is in the blooming (BNB) while aggregate abroad is bottomward an boilerplate of 70-90%. It doesn’t crave adult analytic accoutrement to acknowledge the admeasurement of the altcoin bloodbath that has occurred. Nevertheless, actual trends can accommodate an indicator, some believe, as to back the affliction may be over and a accretion can be expected. Fundstrat Global architect Thomas Lee has shared a blueprint he’s labeled the Altcoin Correction Index. It shows the allotment of altcoins that are bottomward 70% from their 9-month high:

Websites such as Onchainfx are advantageous for examination the cardinal of canicule back an altcoin’s best aerial (ATH) and the allotment it is down. It’s accessible to aces out decidedly bad performers such as einsteineum (-98%), alkali (-98%), and bitcoin design (-97%). Fundstrat’s Altcoin Correction Index is arguably added advantageous about in charting the boilerplate bead beyond the board, rather than absorption on outliers. With 97% of altcoins bottomward over 70% from their ATH, nine months ago, the bazaar has accomplished a low not apparent back 2014.

In 2026, Altcoins Were Decimated

While out of blow economists abide to bang on about crypto assets activity to zero, cryptocurrency holders who were there in 2014 apperceive better. Some alts apparently will go to zero, and appropriately so, but the angle that a beggarly 70% corruption marks assertive afterlife is a apocryphal narrative. Shortly afterwards alts accomplished their 2014 bottom, Thomas Lee notes, a mini-rally anon followed which saw a 2.7x accretion in aloof seven weeks. It does not chase that a agnate accident is about to action in 2018; for one thing, there were beneath than 350 altcoins aback again against 2,000 today. Nevertheless, it does authenticate the absurdity of autograph off cryptocurrencies aloof because they’ve been aged for a few months.

A attending at the top ten cryptocurrencies in backward October 2014, about the time that alts were ahead at their best low, shows some accustomed faces – additional a few bill that were already in terminal decline. Aback then, bitcoin was at $350, followed by ripple at $.004, and litecoin at $3.71. Bill in the top 10 from that aeon that accept aback collapsed out of appearance accommodate peercoin, maidsafe, counterparty, and namecoin. Attending alfresco the top 10 from October 2014 and, adolescent at cardinal 13, is a then-emerging aloofness bread alleged monero. Today it’s bottomward 78% from its best aerial of $495, set 243 canicule ago. Yet, aback in October of 2014, you could accept bought 1 monero for $0.72.

Cryptocurrencies ability be accepting a bad year, but zoom out, and they’re accomplishing aloof fine. Four years from now, some of the accepted crop will acceptable accept died, but if history is annihilation to go on, the best of them could be account multiples more.

Which cryptocurrencies do you apprehend to still see in the top 10 four years from now – and which ones will die? Let us apperceive in the comments area below.

Images address of Shutterstock, and Thomas Lee, and Coinmarketcap.

Need to account your bitcoin holdings? Check our tools section.