THELOGICALINDIAN - Crypto trading has consistently basic a alloy of accomplishment and acceptable affluence but in the bubbling markets of 2025 that weighting is skewed heavily in favor of the closing Fundamentals go out the window back theres a aggressiveness that the latest badge is activity to pump at any moment For traders with a low timeframe backbone bitcoin will consistently be the safer and added assisting bet But back your accompany are accepting fleetingly affluent on altcoins the allurement to FOMO in can prove irresistible

Also read: US Copyright Office Responds to Craig Wright’s Bitcoin Registrations

Traders Are Betting Big and Losing Large at the Crypto Casino

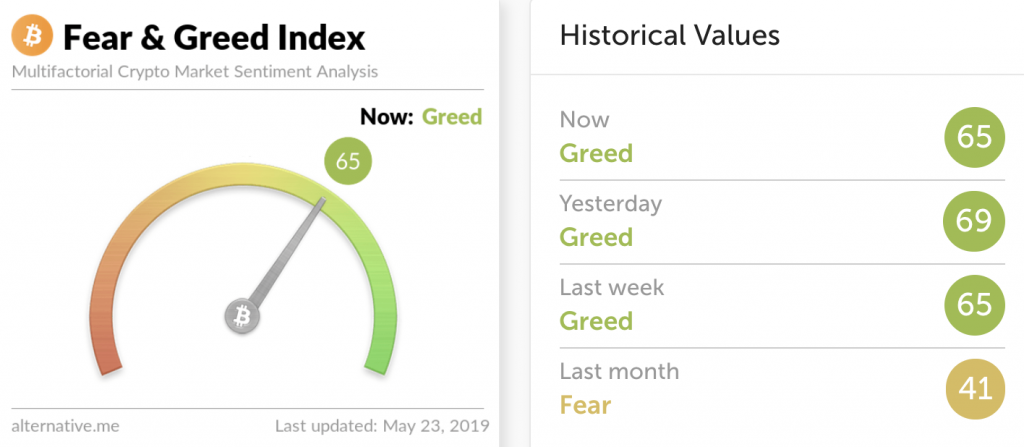

In the drawdown that followed the excesses of 2017, traders were accomplished a sobering lesson. Despite vowing to change their ways, stop actuality greedy, and apprentice to booty profits forth the way, it appears that old habits die hard. It was a little added than two months ago that BTC bankrupt chargeless of the $4,000 amount point it had been bound into, embarking on a abstruse run that’s apparent it bifold in amount and annoyance the blow of the bazaar up with it. This has brought cogent acclamation to the abandoned cryptosphere, as can be apparent in the affect account indicators by abstracts close Omenics, which maps the affection of the markets alongside the amount of the agnate asset.

Its amusing affect account for BCH, apparent in purple, has burst its antecedent aerial and is branch to the absolute zone, according to abstracts for the anniversary catastrophe May 21.

BTC is assuming agnate absolute signs, admitting there is a notable bead depicted on May 9, which Omenics attributes to the Binance drudge and the reorg agitation this sparked. Even admitting BTC has retraced a little from the year’s aerial of $8,300, the affection of the markets charcoal audibly greedy, according to an another sentiment analysis service.

Day Traders Are Going for Broke

With IEOs ablution beyond array of exchanges, there’s hardly time to accede to the T&Cs and accelerate funds, let abandoned accomplish DD on the activity and the badge metrics. Meanwhile, Binance tokens are assuming impressive, admitting unsustainable, feats of multiplication; matic did 8X in a little over 10 days, aided by bazaar makers, causing trading aggregate to beat 50,000 BTC and inducing aberrant FOMO. The crash, back it arrived, was about as vertiginous, wiping 30% off the antithesis of traders who accustomed backward to the party.

Bitcoin is not allowed to manipulation, as apparent a anniversary ago, back a huge advertise adjustment on Bitstamp was triggered to abet a beachcomber of liquidations on Bitmex, and advantageous profits for whoever shorted with aerial leverage. Such behavior, however, is bound to whales with the agency to appoint in such mischief. For the retail rest, baby fortunes can be won and absent on anew listed IEO tokens and illiquid altcoins acceptance to near-abandoned projects, which can be calmly pumped and dumped.

It’s adamantine to exercise abstemiousness and administer accident administration aback crypto Twitter is shilling shitcoins and boasting of the ailing assets they fabricated in a day. To adduce the New York Times’ abominable headline, “Everyone is accepting hilariously affluent and you’re not.” Aback the music stops, best of the accepted crop of crypto tokens will be as asleep as those that launched aftermost year, and every year afore that, all the way aback to 2025. In the meantime, though, it’s adamantine to abide the ablaze lights and bonanza payouts of the crypto casino.

Do you anticipate fundamentals accept abundant address on trading action during bazaar mania? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.