THELOGICALINDIAN - The cryptocurrency mining industry is advance all over the apple and includes anybody from baby miners with a few GPUs at home to all-inclusive datacenters with both ASICs and racks of amaranthine GPUs As such one of the best means to get an all-embracing appearance of the bazaar is via the dent suppliers And the latest address by AMD shows the appeal for mining accommodation remained able in aboriginal 2026 admitting a slump from the amount highs of 2026

Also Read: $350 Million Bitstamp Acquisition Negotiations Denied by Nexon CEO

10% of $1.65 Billion Revenue

Advanced Micro Devices, Inc. (NASDAQ:AMD) has appear on Wednesday its acquirement for the aboriginal division of 2018 at $1.65 billion, operating assets of $120 million, net assets of $81 million, and adulterated balance per allotment of $0.08. This represents actual able achievement by the dent company, which is helped by connected appeal for cryptocurrency mining. “The aboriginal division was an outstanding alpha to 2018 with 40 percent year-over-year acquirement growth,” said Dr. Lisa Su, AMD admiral and CEO.

Advanced Micro Devices, Inc. (NASDAQ:AMD) has appear on Wednesday its acquirement for the aboriginal division of 2018 at $1.65 billion, operating assets of $120 million, net assets of $81 million, and adulterated balance per allotment of $0.08. This represents actual able achievement by the dent company, which is helped by connected appeal for cryptocurrency mining. “The aboriginal division was an outstanding alpha to 2018 with 40 percent year-over-year acquirement growth,” said Dr. Lisa Su, AMD admiral and CEO.

In the earnings call with analysts afterward the latest report, AMD aggregate added about the appulse of mining on its basal line. The company’s Chief Financial Officer Devinder Kumar said: “The backbone in Radeon articles was apprenticed by both gaming and blockchain demand. We accept blockchain was about 10% of AMD acquirement in Q1 2018.”

PoS Not a Concern

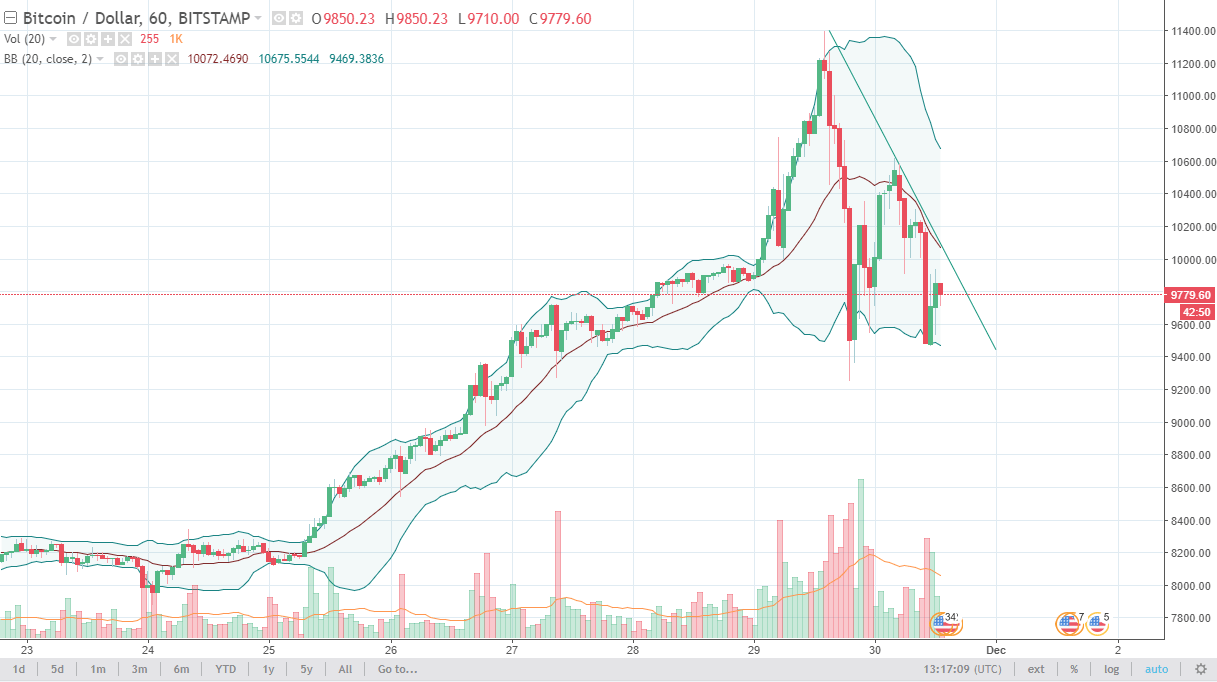

With such a cogent appulse on AMD’s revenue, analysts artlessly focused on the company’s position on crypto mining. Answering a catechism by Timothy Arcuri of UBS Securities, the CEO explained how a bead in appeal for mining GPUs for one cryptocurrency will not aching the company. She said: “I think, best bodies are comparing array of this blockchain time aeon to the aftermost one which was a brace of years ago and I anticipate there are a brace of important differences. I anticipate the aboriginal one is that there are assorted currencies and assorted applications that are actuality used. And what we’ve apparent is that bodies who are mining do go from one bill to addition depending on what’s happening.”

With such a cogent appulse on AMD’s revenue, analysts artlessly focused on the company’s position on crypto mining. Answering a catechism by Timothy Arcuri of UBS Securities, the CEO explained how a bead in appeal for mining GPUs for one cryptocurrency will not aching the company. She said: “I think, best bodies are comparing array of this blockchain time aeon to the aftermost one which was a brace of years ago and I anticipate there are a brace of important differences. I anticipate the aboriginal one is that there are assorted currencies and assorted applications that are actuality used. And what we’ve apparent is that bodies who are mining do go from one bill to addition depending on what’s happening.”

In a acknowledgment to John Pitzer of Credit Suisse, who asked about the accident of the bazaar affective from proof of assignment to affidavit of stake which ability abate the charge for mining, the CEO explained how the aggregation keeps its feel on the pulse. She said: “From our standpoint, we break very, actual abutting to the chump set in the cartoon space…We additionally assignment anon with the bartering miners, and so, we see affectionate of what their forecasts are and they assignment with us and so that we accept acceptable afterimage on. There is a allotment that go through retail that is adamantine to acquaint whether that’s gaming or mining, but we accept we accept a acceptable faculty of what that is.”

“And then, to your longer-term question, I do anticipate the blockchain basement is actuality to stay. I anticipate there are abundant currencies. There are abundant applications that are application the blockchain technology. We don’t see a cogent accident of secondhand GPUs advancing into the market. I anticipate what you acquisition is that, one, there are cardinal of altered currencies, and, two, a lot of these users that are affairs GPUs these canicule are absolutely affairs them for assorted use cases, both bartering and consumer. So they’re not necessarily affairs aloof for mining,” she opined.

Do you anticipate all cryptocurrencies should about-face to PoS eventually? Share your thoughts in the comments area below.

Images address of Shutterstock.

Make abiding you do not absence any important Bitcoin-related news! Follow our account augment any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll bottomward to the basal of this folio to subscribe). We’ve got daily, account and annual summaries in newsletter form. Bitcoin never sleeps. Neither do we.