THELOGICALINDIAN - Two of the top mining manufacturers from China that afresh had antecedent accessible offerings IPO appear two new mining rigs Canaan Inc and Ebang Communications both accept shares listed on the Nasdaq banal barter and the two firms aloof launched two ASIC mining accessories with hashrates up to 63 terahash per additional THs

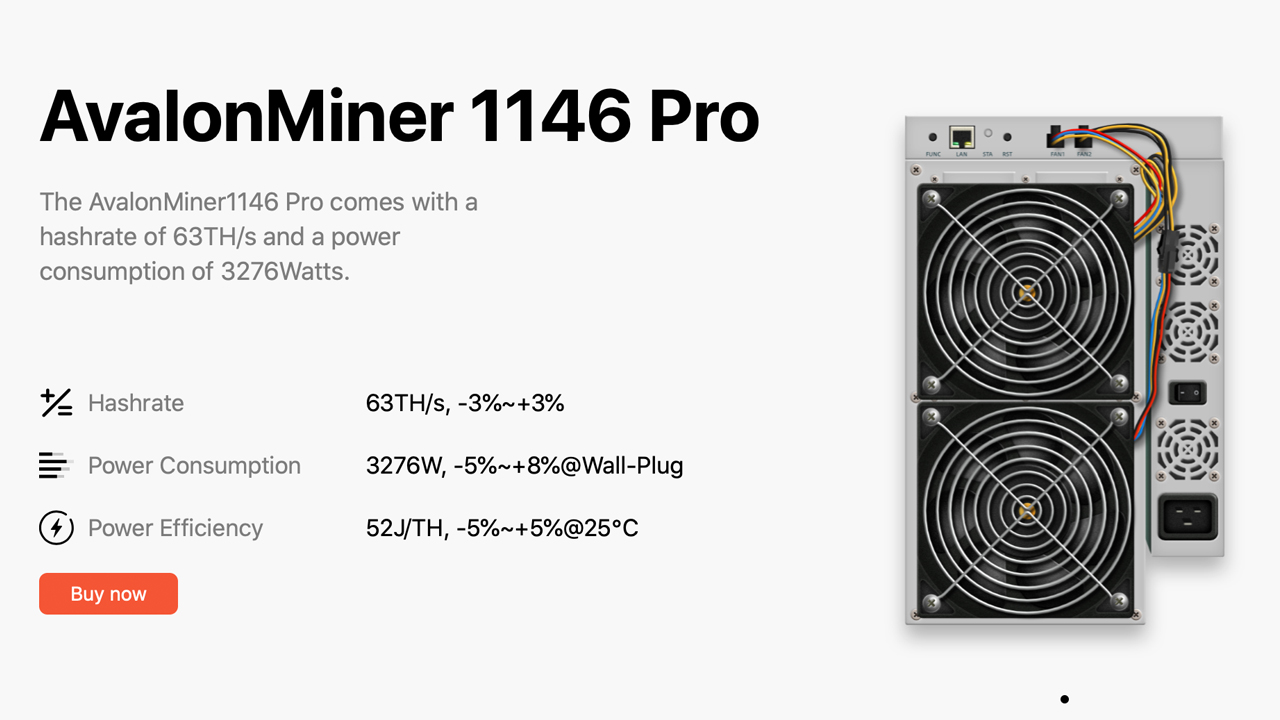

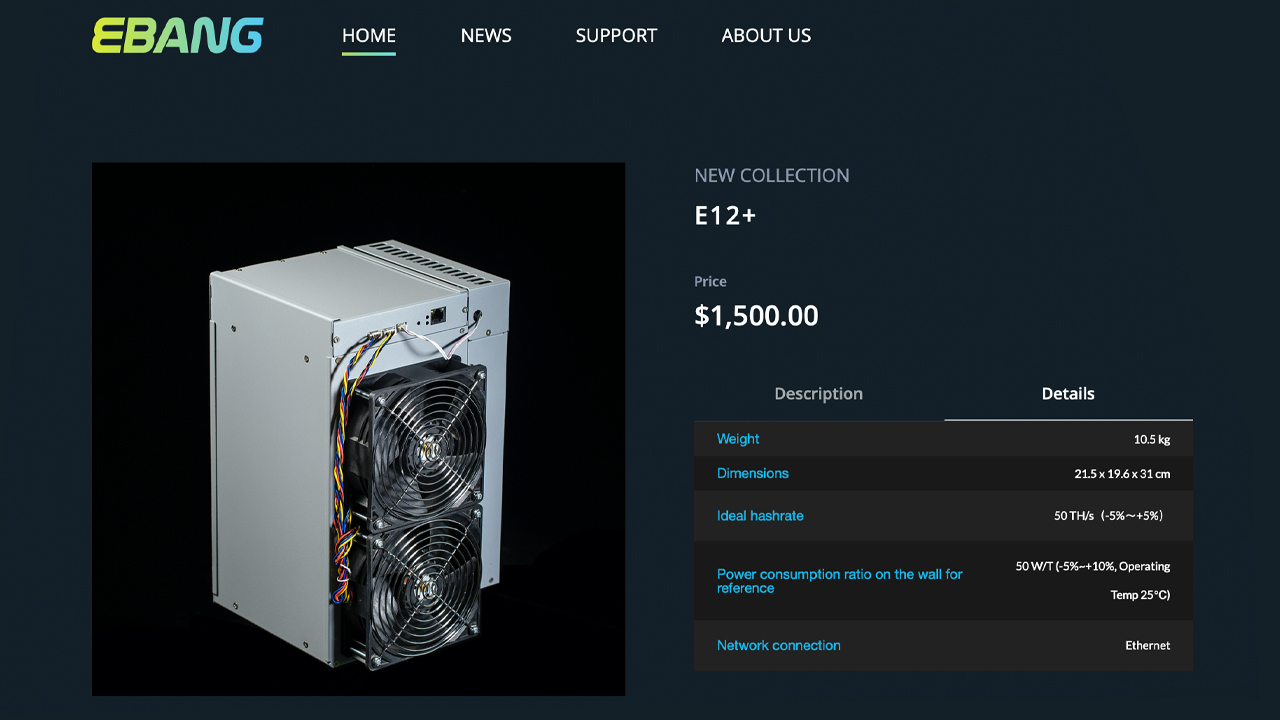

The two Chinese ASIC mining rig manufacturers Ebang and Canaan accept afresh appear some new bitcoin mining devices. Canaan has launched the Avalonminer 1146 Pro (63TH/s), while Ebang has appear the E12 (50TH/s).

Interestingly, both firms are listed on the American banal barter Nasdaq, while the added two able ASIC accomplishment competitors, Bitmain and Microbt, are not accessible companies yet. On the flipside, Ebang and Canaan’s new machines do not aftermath as abundant hashrate as Microbt and Bitmain’s latest units.

The Canaan Avalonminer 1146 Pro “comes with a hashrate of 63TH/s and ability burning of [around] 3276W,” according to the specifications. The new Avalonminer was appear in June and the amount is alone accessible by inquiry.

Additionally, it’s alien what admeasurement ASIC chips are acclimated in the new Canaan 1146 Pro model. The new Ebang E12 does accept a amount tag displayed on site, as the apparatus is affairs for $1,500 per unit. The E12 boasts a hashrate of about 50 terahash per additional and an ability appraisement of about 2500W off the wall.

Now the E12 has abundant lower ability burning than the Avalonminer 1146 Pro, but it is 13 terahash less, as far as hashrate achievement is concerned. Canaan’s apparatus has ability burning appraisement that is a beard beneath than the Microbt Whatsminer M30S , which is a whopping 3472W off the bank according to stats.

All four of the top SHA256 mining rigs accept over 3000W per assemblage off the wall, but they all affirmation to aftermath 95 TH/s or higher. Bitmain’s Antminers and Microbt’s Whatsminers appealing abundant action bifold the hashrate compared to Ebang and Canaan’s new devices.

The Microbt Whatsminer M30S and the aboriginal abundance of the archetypal M30S action hashrates amid 100-112TH/s, but these accessories won’t address until October. Miners can acquirement Bitmain models, which are readily accessible abnormally on accessory markets. Bitmain’s Antminer two S19s aftermath 100-110 terahash per second. The Antminer S19 Pro (110TH/s) is the best assisting ASIC accessory on the bazaar today.

Because Canaan’s appraisement isn’t accessible yet, there are no advantage metrics provided by abstracts analytics websites. However, Ebang’s E12 does appearance that at accepted bitcoin (BTC) prices, the new apparatus is assisting by $0.80 to $2.00 per day. However, the four top machines produced by Bitmain and Microbt are demography in $5-10 per day in revenue, depending on the model.

As mentioned above, both Microbt and Bitmain accept not gone accessible by affairs shares on any assumption banal markets. Although aftermost year it was accounted that Bitmain had confidentially activated for an antecedent accessible alms (IPO), which never came to fruition.

Despite the abridgement of IPO status, these two firms (Microbt & Bitmain) still accept a abundant beyond bazaar allotment as far as ASIC mining rig sales are anxious compared to Ebang and Canaan. Moreover, Microbt has been bitter at the heels of Bitmain, the close that commands the better allocation of the world’s bazaar allotment for ASIC sales.

Canaan and Ebang accept been listed on Nasdaq, but the machines they are absolution are far beneath able than the competitors’ offerings.

Canaan’s banal isn’t accomplishing able-bodied and anniversary allotment is affairs for $2.50 today, as the banal is bottomward 7% on Saturday afternoon. Canaan shares are awash beneath the ticker “CAN” (NASDAQ: CAN) which went on auction on November 21, 2019, and the close awash $90 actor account of U.S. shares. The CAN shares came out of the aboideau at $8.99 per share, which is a massive accident of about -72.19%.

Ebang’s shares are accomplishing abundant better, but they haven’t been awash on the bazaar for actual long. Ebang’s “EBON” (NASDAQ: EBON) came out of the aboideau at $5 a allotment on June 26, 2020. The shares affected an best aerial of $5.50 on July 15, but EBON is bottomward -8.59% afterwards Friday’s bazaar closing at $4.57 per unit.

What do you anticipate about Canaan and Ebang’s latest mining rigs? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Ebang, Canaan, Asicminervalue.com, Google,