THELOGICALINDIAN - Bitcoin has gone through yet addition leg up accepting 5 percent in the accomplished 24 hours abandoned And while some altcoins accept managed to access alike beat BTC others accept been larboard blind in the dry Below we booty a attending at the 5 affliction assuming cryptocurrencies adjoin Bitcoin so far in 2026

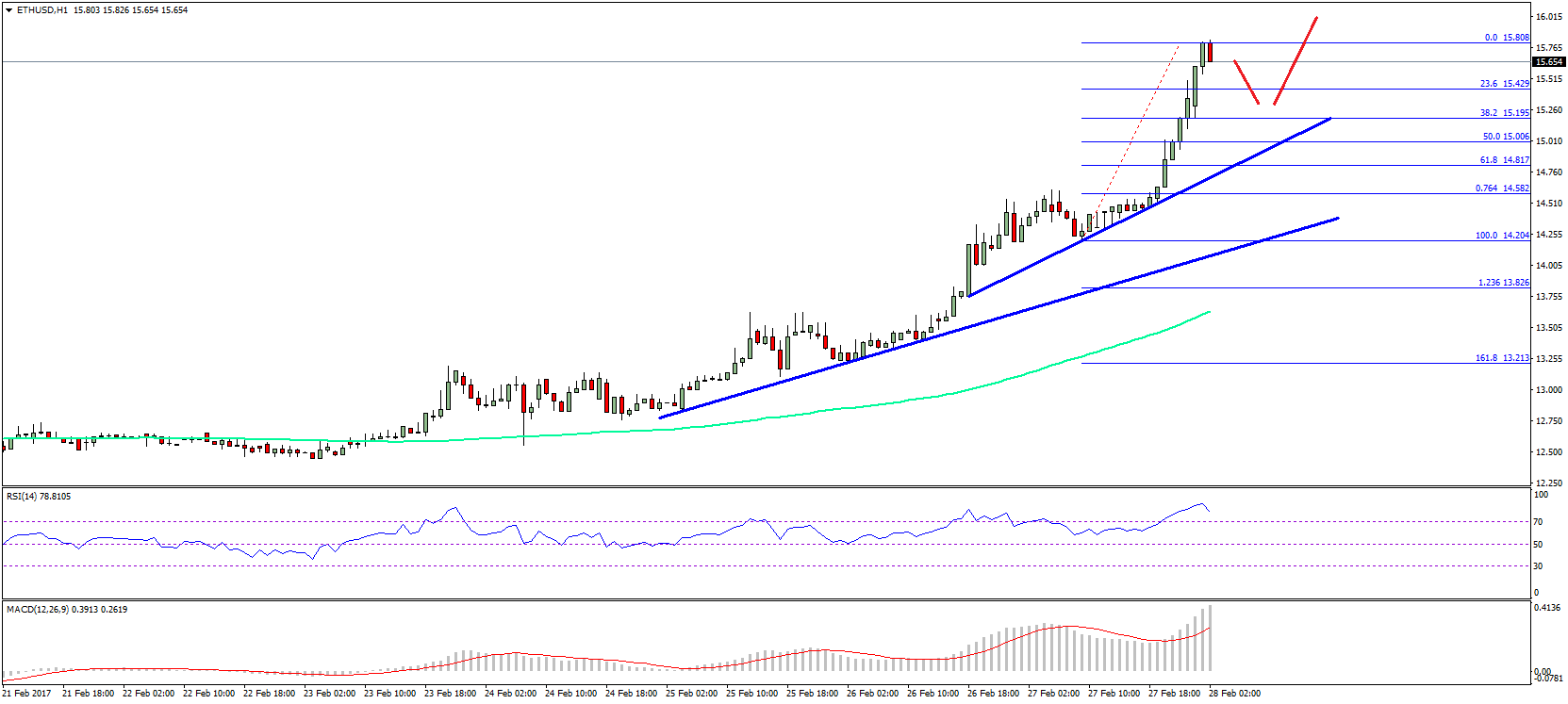

Ethereum (ETH)

Ironically, the additional better cryptocurrency in agreement of absolute bazaar assets has been crumbling in amount adjoin BTC.

ETH/BTC [coin_price coin=ethereum] is bottomward about 14 percent so far in 2019. However, adjoin the dollar, ETH has managed to accretion about 31 percent.

Meanwhile, Ethereum’s arrangement is adverse accretion competition, abnormally now that Binance has announced the barrage of the mainnet of its decentralized barter Binance Chain.

While Changpeng Zhao has absolutely bidding his attitude that Binance Chain doesn’t intend to attempt with Ethereum, it’s absolutely accessible that assertive projects may accept to migrate, abnormally accustomed the upside amount potential already witnessed this year.

Ripple (XRP)

XRP [coin_price coin=ripple] is addition altcoin that has accomplished a notable bead in its amount adjoin Bitcoin. Since the alpha of 2026, the cryptocurrency has absent about 40 percent back trading adjoin BTC.

More alarmingly, XRP has additionally bootless to capitalize on the absolute market’s billow throughout the year as it has decreased adjoin the US dollar. XRP is bottomward about 8.5 on that advanced as well.

According to some reports, Ripple is adverse accretion antagonism in the face of ‘bankcoins’ such as the first bank-backed cryptocurrency, JPM Coin, as able-bodied as its abutting battling Stellar (XLM).

Bitcoin SV (BSV)

Bitcoin SV [coin_price coin=bitcoin-sv] has absolutely apparent bigger canicule admitting alone absolute back November 2026. The altcoin is bottomward 55 percent adjoin BTC and about 30 percent adjoin the USD.

This year has additionally apparent about $450 actor wiped off its absolute bazaar capitalization.

Bitcoin SV’s abatement was added propelled by its delisting from above cryptocurrency exchanges such as Binance and Kraken, afterward Craig Wright’s move to sue users for calling him a fraud.

IOTA (MIOTA)

IOTA [coin_price coin=iota] is a agreement accustomed as the “next bearing of broadcast balance technology.” Unfortunately, adorned diction doesn’t assume to be abundant for its built-in cryptocurrency, MIOTA, which is bottomward 40 percent adjoin BTC.

MIOTA’s amount doesn’t attending so abundant bigger back trading adjoin the USD either. The cryptocurrency is bottomward about 15 percent, accident about $120 actor of its absolute bazaar cap back the alpha of 2019.

Tron (TRX)

Despite the ‘constant developments’ categorical by its architect Justin Sun, TRX [coin_price coin=tron] has additionally bootless to capitalize on the able achievement of the cryptocurrency bazaar in 2026. While it hasn’t apparent any above declines, the actuality that it didn’t do able-bodied while about aggregate abroad was surging is sufficient.

TRX/BTC has absent about 10 percent. Things are bigger back attractive at its achievement adjoin the USD. TRX has managed to accretion about 35 percent back the alpha of 2019, which is conceivably expected, accustomed the all-embracing bazaar rally.

TRX/BTC has absent about 10 percent. Things are bigger back attractive at its achievement adjoin the USD. TRX has managed to accretion about 35 percent back the alpha of 2019, which is conceivably expected, accustomed the all-embracing bazaar rally.

Hence Why They Are ‘Altcoins’

As Bitcoinist reported, Bitcoin has askew every added altcoin back it comes to allotment on advance (ROI) back antecedent barter listing.

Moreover, the latest assemblage has additionally managed to achieve Bitcoin’s backbone about to the absolute cryptocurrency bazaar capitalization. Though actuality a rather poor metric, the Bitcoin ascendancy basis now sits at 53.2 percent appearance an access of about three percent throughout the aftermost month.

What do you anticipate of the aloft cryptocurrencies? Don’t alternate to let us apperceive in the comments below!

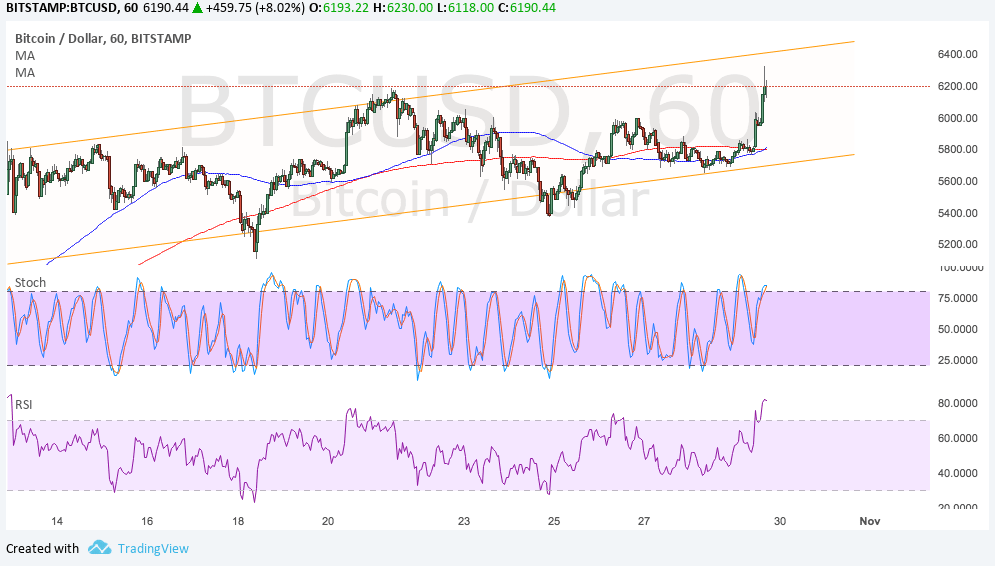

Images via Shutterstock, TradingView.