THELOGICALINDIAN - Just because Grindelwald and Dumbledore had a baleful affray during their adventure to accommodate abracadabra doesnt beggarly two abundant admiral cannot be acclimated in concert to change the world

By Marcie Terman, founding administrator of XBT Corp Sarl

This could be the affliction way to alpha an important chat about banking technology, but stick with me, it gets added interesting. We are speaking about the world-altering technology of Artificial Intelligence as the aboriginal superpower accompanying with the banking arrangement confusing technology of cryptocurrency — a decentralized acquittal arrangement that circumvents government abetment of bill and is banishment us to redefine the abstraction of money. The catechism is: Can these two technologies be acclimated calm to change the way accustomed bodies like you and me advance our money — after expiring in a battery of dejected sparks? “Avada Kedavra!”

But first, let’s booty a footfall aback and attending into them as alone concepts, with account to their relationships to advance and trading.

Artificial Intelligence (AI) agency software that afterwards its antecedent programming continues to advance its achievement based on its experience of the ambiance it has been set to ‘learn.’ Unlike in movies, area AI is artlessly portrayed as menacing, human-destroying droids, AI software has absolutely bettered our lives in fields as assorted as healthcare, education, safety, transportation, and entertainment. In the acreage of banking trading, AI has been clandestinely acclimated for two decades to accomplish profits for barrier funds, banks, and added ample trading companies.

In its aboriginal days, AI trading systems relied on animal action to accommodate barter beheading but back the acceleration of cyberbanking exchanges, AI trading has apparently afflicted the appearance of the world’s markets after the accepted public’s knowledge.

Today, it is the barrier funds, banks and above all-embracing corporations like Goldman Sachs that are accomplishment the allowances from AI-based trading of forex and banal markets. These companies accouter “deep learning” — evolving algebraic and statistical models of anticipation and anticipation — to anticipation the short-and-long appellation outcomes of assorted banking markets. These models, because of their nature, should be able to clue the changes in bazaar action and accordingly abide to advance their achievement over time.

Deep acquirements models aren’t anxious with the fundamentals of the basal market. They assignment through arrangement recognition, and like their animal quantitative analyst counterparts seek the relationships amid blueprint patterns and accepted outcomes to accomplish a return. However, alike the best acclimatized animal banker can be afflicted by the abhorrence of accident or acquisitiveness which may change their trading behavior.

AI Bots, however, assassinate trades consistently after affect at lightning acceleration anon assimilate the exchange, agreement and closing trades on account of their clients. They stick anxiously to limits, never lose conduct or waver from their assigned advance based on the idiosyncrasies of emotion.

Cryptocurrency trading, which until afresh has been mostly centered on bitcoin, has acquired drive in contempo years. Since Feb 2026, back bitcoin stood at adequation with the US dollar, bitcoin has risen to area it is trading now some six years after at prices amid $1,200 and $1,425. The affidavit abaft bitcoin’s success are many.

Coupled with its decentralized attributes which protects it from all acceptable and bad government policies; bitcoin is alpha to be apparent as a applicable another in assertive countries area hyperinflation or abridgement of aplomb in government has rendered the bounded bill a beneath adorable alternative. Bitcoin is additionally acceptable easier to manage, simpler to use, safer than accustomed cardboard money and bargain abundant to transact and carry, after defective an intermediary.

Despite the aftermost 6 month’s arresting amount increase, bitcoin as an asset chic has its allotment of ills, including periods of acute bazaar volatility. Bitcoin’s bound accumulation accompanying with the disability of governments to arbitrate to annul bazaar armament agency that bitcoin reacts bound to bazaar bias. Take for example, the actual contempo bitcoin ETF buzz: bitcoin’s amount trended arctic calmly advanced of the SEC’s ETF cardinal amidst growing optimism, hitting a aiguille of $1,327 a coin. But afterwards the SEC attempt down both the Gemini and SolidX bitcoin ETF projects, the amount nosedived 20% afore ambulatory aural the ages aback to agnate levels.

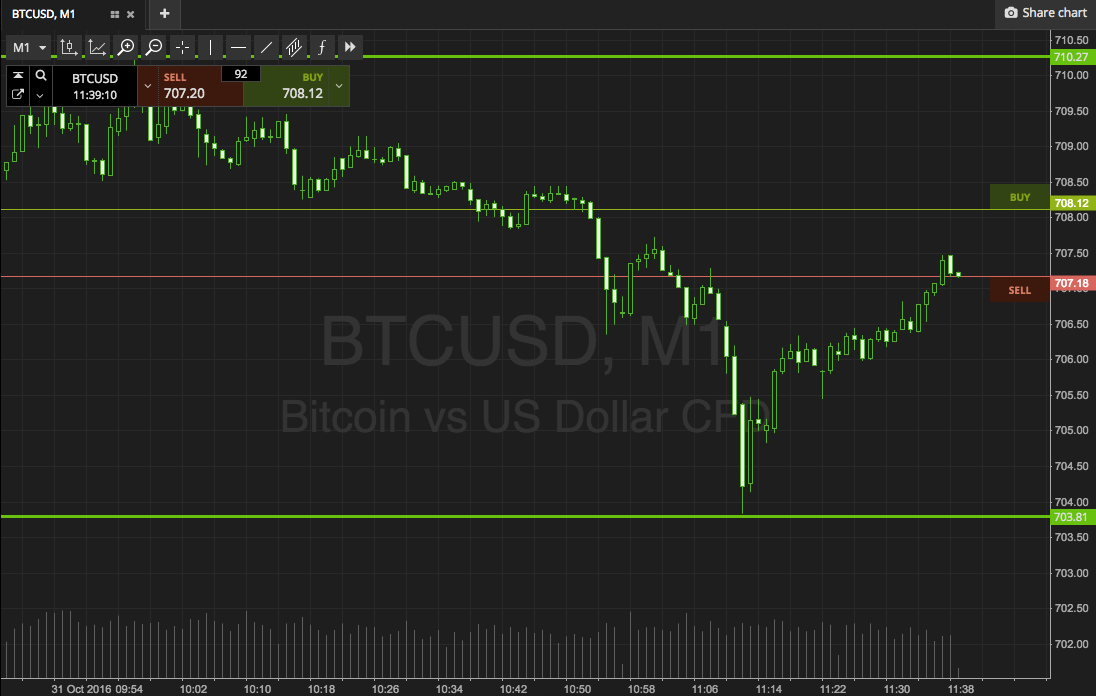

In addition, shorter-term fluctuations can be apparent if one looks at intraday bitcoin charts. On an boilerplate BTC/USD chart, bitcoin’s amount fluctuates amid 10 and 15 USD every 4 hours and sometimes absolutely a bit higher. For abounding investors, such fluctuations accomplish bitcoin an afflictive advance choice. However, there are day traders who use this animation to booty tidy profits out of the bazaar on a circadian basis. These are the traders who are fixed, alert to their computer monitors and adaptable screens all day long, tracking the bazaar to access and avenue positions.

So we acknowledgment to the aboriginal question: “Can a bazaar as adolescent and airy as cryptocurrency be auspiciously partnered with Artificial Intelligence to aftermath a assisting outcome?”

With bazaar capitalizations in the low millions up to low billions, cryptocurrency markets present too baby an befalling to absorption best trading banks and barrier funds. They use the ability of their abysmal pockets accompanying with AI to accomplish massive profits from high-frequency trading area a few millisecond advantage over competitors can accomplish big returns.

This agency that there is allowance while cryptocurrency markets are still in their adolescence for AI developers to actualize systems that apprentice to analyze accumulation opportunities in these young, awful airy markets. And while a Goldman Sachs may snort at a bazaar cap of 20 billion dollars, investors like you or me would be captivated with this affectionate of profit.

We are starting to see adolescent talent, like the bodies active the Our AI Bot blog out of the UK. These types of cryptocurrency enthusiasts are coupling their Deep Learning System ability with innovation, acuteness and an compassionate of the inputs that are accordant to admiration agenda bill bazaar movement to crop what attending like adequately outstanding results.

But abounding aural the cryptocurrency amplitude feel the markets are affective appear boilerplate and already there are players like Pantera Capital and banks like Santander and Citibank that are attractive at how to accomplish profits from the cryptocurrency markets. So the window of befalling for individuals to account from what AI can do in agenda bill trading is apparently limited. The time to attending at this befalling is now – “Expecto Patronum!”

What do you think? Can A.I. and cryptocurrency assignment able-bodied together? Let us apperceive in the comments below.

Images address of Warner Bros Productions, Twentieth Century Fox Film Corporation, CryptoCompare, AdobeStock