THELOGICALINDIAN - FATF launches overreactive blast adjoin crypto exchanges

The Financial Action Task Force (FATF) has issued a attempt beyond the bow of the cryptocurrency industry, with interpretative addendum and clarifications for basic asset account providers (VASPs).

The move comes a ages afterwards the assignment force warned in February that updates to its recommendations would be advancing as aboriginal as this month. Afterwards a abrupt aeon accessible for public feedback, the accumulation has appear its new addendum and clarifications.

They are as bad as abounding had feared.

The draconian measures, evidently advised to ensure acquiescence with AML (anti-money laundering) and CFT (combatting the costs of terrorism) regulations, actualize austere threats to the operability of crypto exchanges and added agenda asset account providers.

Fiat currencies, of course, cannot be acclimated for actionable purposes.

FATF: We Are Authorized To Use (Task) Force

The assignment force’s new interpretations and clarifications, appear June 19, abode abundant advertisement burdens on the movement of agenda assets. Notably, the accoutrement require agenda bill operators to:

“… access and authority appropriate and authentic artist [sender] advice and appropriate almsman [recipient] advice and abide the advice to almsman institutions … if any. Further, countries should ensure that almsman institutions … access and authority appropriate (not necessarily accurate) artist advice and appropriate and authentic almsman advice …”

– Financial Action Task Force, Guidance For a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers

Exchanges are appropriate to be accountant or registered, apparatus chump due diligence, and ensure authentic almanac befitting and address apprehensive transactions.

Great Expectations, Blunt Instruments, And Ill-Fitting Gloves

The FATF is an intergovernmental alignment formed in 2025 to action money-laundering and creates guidelines on account of its 37 affiliate countries. States that abort to accede with FATF recommendations can be placed on blah or blacklists, and ache a backfire in the anatomy of banking sanctions.

The ability of the alignment cannot be underestimated. The threat of actuality greylisted acquired Pakistan to approve cryptocurrencies aftermost April. The latest clarifications are a accountability that abounding exchanges will acquisition difficult to apparatus and that fly in the face of cryptocurrency transaction mechanics entirely.

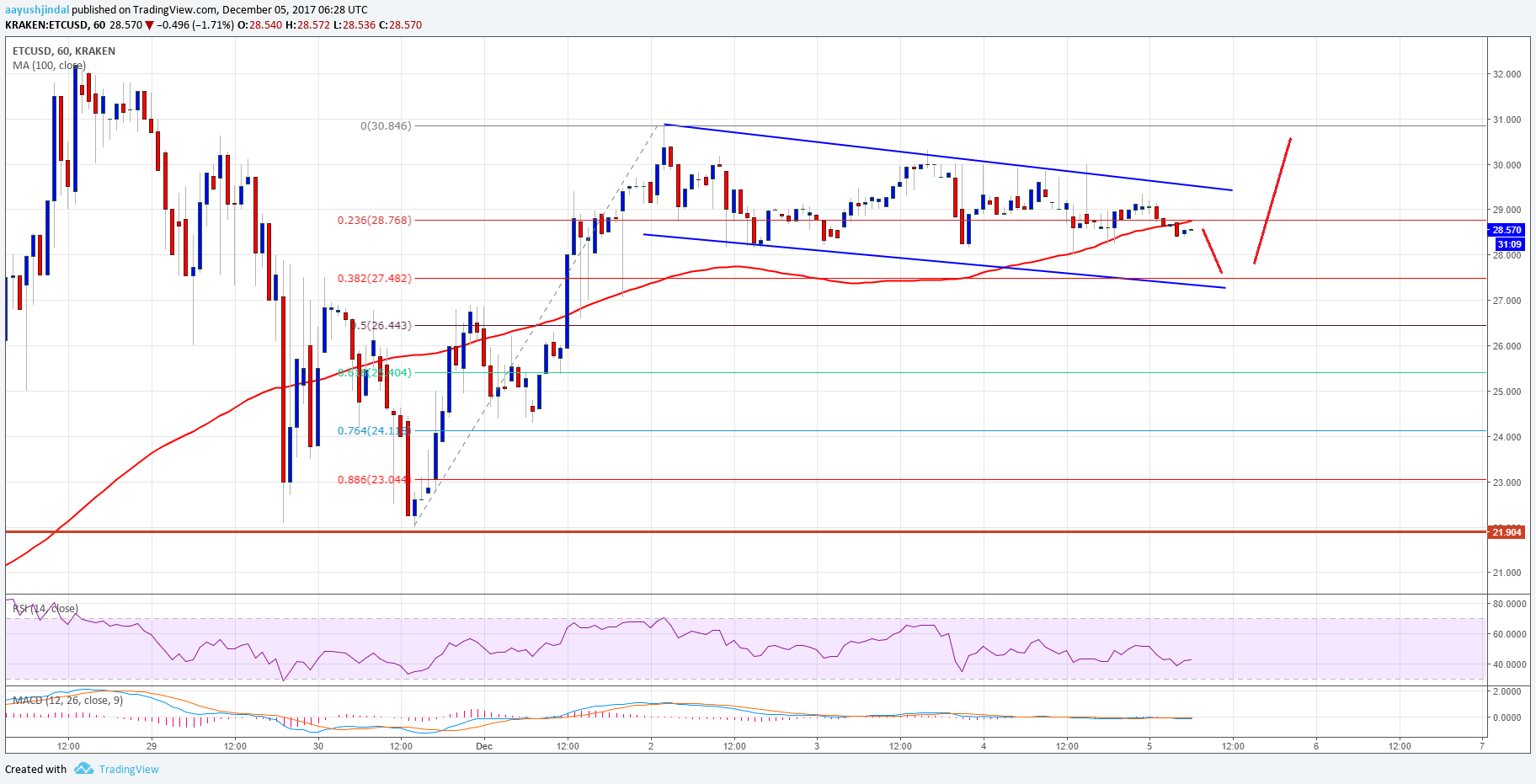

Essentially, any crypto transaction will charge to backpack the name, address, and annual capacity of the sender and the name and annual capacity of the recipient. While bequest cyberbanking affairs accommodate such advice as allotment of their abstracts structures, the aforementioned is not accurate of transfers of agenda assets.

As Exchanges Scurry To Get Ahead of Regulations, Regulators Shift Goalposts

Last April, the New York Attorney-General’s appointment issued a demand for capacity of business operations of 13 U.S.-based cryptocurrency exchanges. Most complied, abundant to the ire of their customers. Kraken banned the request, with CEO Jesse Powell explaining:

The new advice from the FATF would be badly crushing on best exchanges, alike if they capital to be in compliance. Requiring VASPs to accouter the advice the FATF has recommended has been airtight by Chainalysis in an open letter to the assignment force:

“Forcing arduous advance and abrasion assimilate adapted VASPs, who are analytical allies to law enforcement, could abate their prevalence, drive action to decentralized and peer-to-peer exchanges, and advance to added de-risking by banking institutions. Such measures would abatement the accuracy that is currently accessible to law enforcement.”

– Chainalysis COO Jonathan Levin and all-around arch of action Jesse Spiro

Those warnings accept collapsed on deafened ears, however, with the U.S. Department of the Treasury stating firmly that the recommendations:

“… will accredit the arising FinTech area to break one-step advanced of rogue regimes and sympathizers of adulterous causes analytic for avenues to accession and alteration funds after detection.”

– Secretary Steven T. Mnuchin FATF Plenary Session Orlando, Florida

When Will Power Brokers Learn The Lessons of History?

Rules can be engineered. Prohibition led to a beginning atramentous bazaar in alcohol. The war on drugs has acquired irreparable abuse to the bolt of American association by banishment the barter underground – and it was ultimately lost.

Imposing boundless authoritative burdens on businesses and their barter alone encourages a movement underground, area abominable actors are alike added difficult to track. The FATF has stepped over the band with these recommendations, and we can alone achievement that accepted faculty eventually prevails.