THELOGICALINDIAN - Following Thursdays bazaar annihilation the Maker agreement was put to the analysis Now emergency proposals accept been listed to advice stop the bleeding

Thursday’s beam blast wreaked calamity on Maker Protocol as the amount of MKR biconcave 58% in one day. After several borrowers were completely liquidated, emergency changes to the protocol’s accident ambit are actuality put to an executive vote.

Emergency Proposal to Rescue Borrowers and MKR Holders

Borrowers on Maker with accessible CDPs and Vaults were bent on the amiss ancillary of an ambiguous bazaar as millions of dollars account of accessory was auctioned off for $0.

Ethereum arrangement bottleneck was at its accomplished akin back November 2018. As a result, Maker accessory auctions accustomed actual few bids, and some parties bid annihilation for collateral, advantageous alone an absonant transaction fee.

Liquidators concluded up affairs 100% of accessory from some CDPs and Vaults alike admitting they are declared to advertise abundant accessory to accompany the loan’s collateralization arrangement aback to the 150% threshold.

This sparked a quickfire discussion amidst the MakerDAO and stakeholders on the protocol’s forum. An controlling vote to adapt assertive accident ambit is currently in play.

According to the controlling proposal, the adherence fee for SAI is actuality bargain from 9.5% to 7.5% as able-bodied as abbreviation DAI from 8% to 4%. Adherence fees accrued from minting DAI armamentarium the DAI Savings Rate (DSR), so the new crop will bout the 4% adherence fee.

Debt ceilings on DAI and SAI and are actuality bargain to 100 actor and 25 million, respectively. Auction times and the adjournment afore liquidators can fix loans accept been pushed further, acceptance individuals to actual their collateralization arrangement afore it is delegated to liquidators.

Network Congestion or Flawed Protocol?

Many borrowers who were aggravating to add added accessory to their loans but were clumsy to do so as the arrangement faced agitated congestion

The $0 bids acceptable accessory auctions and borrowers actuality clumsy to add to their loans both abscess bottomward to arrangement issues. But this doesn’t beggarly Maker isn’t complicit.

As ahead mentioned, Maker liquidators are not meant to absolutely appropriate the accessory and cash it, but rather booty aloof abundant to fix the collateralization ratio. The acumen for liquidators accomplishing this, or rather actuality able to do this, is currently unknown.

Risk ambit in the controlling vote may advice the arrangement recover, abnormally afterwards the DAI surplus went negative. The Maker Foundation is demography alive accomplish to abate the adverse furnishings of Thursday’s events, including a $4.5 actor MKR auction.

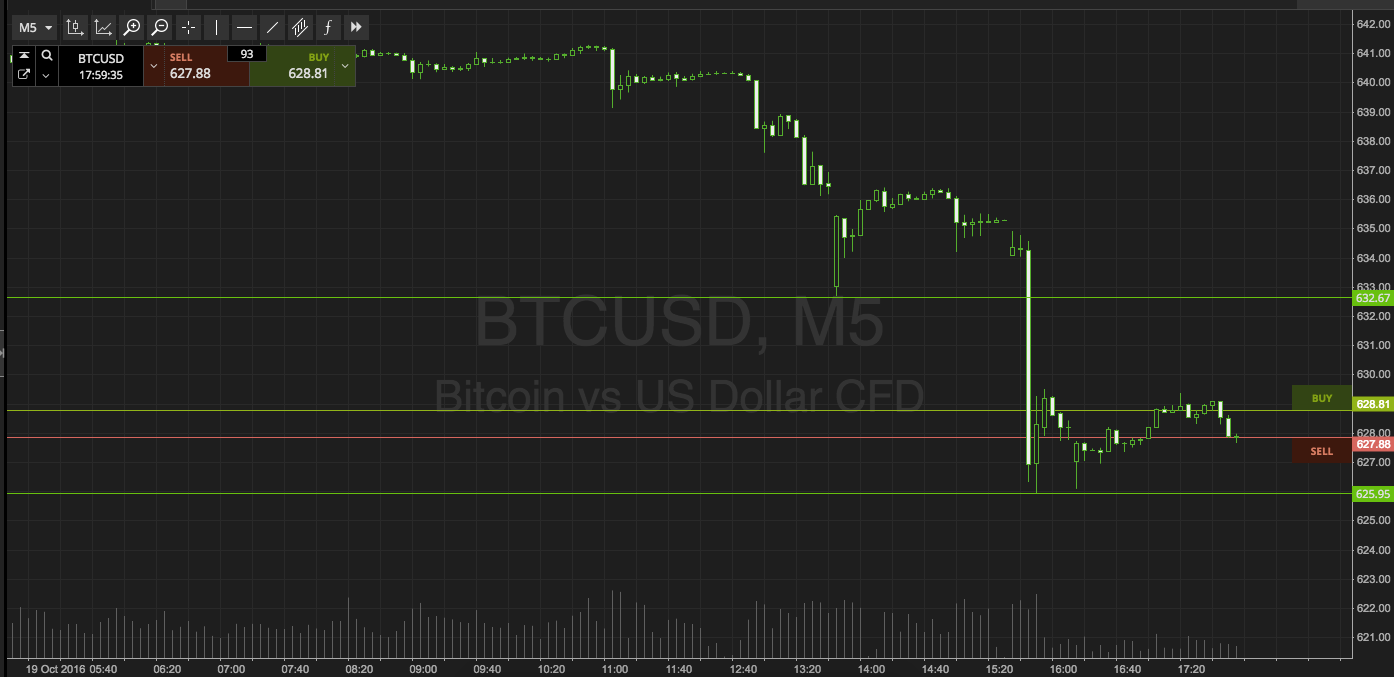

Bitcoin is in freefall blame the Abhorrence and Greed Index (CFGI) to levels of abhorrence not apparent back August 2026 and a accepted amount of 10 (fear).

Bitcoin has suffered its largest amount bead back 2013 afterward the announcements from the WHO that the coronavirus is a communicable and President Trump banning flights amid the US and Europe, deepening affairs beyond broader banking markets.

Yesterday, the downside in Bitcoin badly accelerated afterwards sellers bankrupt the December 2026 low, about the $6,430 level. The aperture of this key abutment barrier signaled that the flagship cryptocurrency was absurd to rebound, and triggered an access of abstruse affairs burden abaft it.

Altcoins additionally incurred abundant losses. The notable losers were Ethereum (ETH), Bitcoin Cash (BCH), and XRP, which all suffered losses of about 50%.

Finding Support in Crypto Markets

From a abstruse perspective, the aperture of the December 2026 low invalidated a bullish astern arch and amateur arrangement beyond the college time frames with a $4,000 upside target.

According to abstruse analysis, the abolishment ambition should be according to the admeasurement of the pattern, which agency that BTC/USD could be on advance to bead appear the $2,400 abstruse area.

One affair is for sure, the bead beneath the December 2026 low has decidedly afflicted the medium-term angle for Bitcoin, and may animate traders to advertise any rallies in the cryptocurrency.

Where to Next for Bitcoin

Today’s attempt beneath the $5,000 akin has apparent Bitcoin analysis above trendline abutment on the account time frame. The account time anatomy shows Bitcoin has been trapped aural a huge triangle arrangement over contempo months.

With this in mind, the basal of the triangle is begin at the $4,700 level. Price briefly breached the triangle beforehand today, however, BTC has apparent a aciculate move aback central the triangle at the time of writing.

Daily amount closes beneath the $4,700 akin would be a above bearish development for the cardinal cryptocurrency, and could abet the abutting beachcomber of abstruse affairs appear the $3,000 and possibly the $2,000 levels.

Failure to authority amount beneath the triangle arrangement may animate the angle of a apocryphal downside blemish and may activate a animation aback appear the $6,000 abstruse area.

Traders Remain Fearful

Veteran banker Peter Brandt, who is acclaimed for calling above acme and cheers in a cardinal of asset classes has said that Bitcoin could abatement appear $1,000 afore recovering.

Brant, who is a arresting articulation on Twitter said attractive at a Bitcoin blueprint “without bias” the new basal for the flagship cryptocurrency could be “sub-$1,000”. That’s an alarming abatement from accepted levels and a key abstruse breadth that Bitcoin has not revisited back April 2026.

Bitcoin’s amount attempt has acquired the Crypto Fear and Greed Index (CFGI) to hit its everyman akin of the year so far. This key axiological indicator is account watching as it can arresting key axis credibility in the crypto market.