THELOGICALINDIAN - Great Britains top banking babysitter has appear a ban on the auction of crypto derivatives to retail users

The Banking Conduct Authority (FCA), the UK’s banking regulator, has banned the auction of crypto derivatives and exchange-traded addendum (ETNs) to retail investors. Nevertheless, it leaves a blah breadth in the rule, authoritative it a non-event for Bitcoin traders.

Derivatives Ban to Protect Retail Investors

The FCA cites bazaar manipulation, volatility, aegis vulnerabilities, and an bare compassionate of these assets’ amount hypothesis as affidavit for the ban.

Sheldon Mills, acting controlling administrator of action and antagonism at the FCA, said:

“Significant amount volatility, accumulated with the inherent difficulties of account cryptoassets reliably, places retail consumers at a aerial accident of adversity losses from trading [crypto derivatives]. We accept affirmation of this accident on a cogent scale. The ban provides an adapted akin of protection.”

The FCA indicates that retail users would save 53 actor euros (~$62.5 million) from the ban. The rules for the artifice of the ban are as follows:

“The FCA has fabricated rules banning the sale, business and administration to all retail consumers of any derivatives (i.e. arrangement for aberration – CFDs, options and futures) and ETNs that advertence able communicable cryptoassets by firms acting in, or from, the UK.”

The ban fails to abode the use of across platforms, however. This blank has larboard some to admiration about the absolute furnishings of such a ban.

https://twitter.com/CanteringClark/status/1313470594667683840

Edward Drake, eToro’s arch of acquiescence and operations, aggregate with Crypto Briefing that:

“The role of adjustment is to assure consumers, which is what this latest cardinal from the FCA is aiming to do. 84% of eToro UK applicant positions are in the absolute basal asset with no leverage. As a result, we’re assured eToro will be beneath afflicted by the new legislation than abounding others in the bazaar and that our audience will abide to adore ceaseless admission to crypto as absolute assets.”

Drake added that these new regulations ability serve as a wake-up alarm to consumers to “do their appointment on what they’re advance in and be assured they are advance on a defended and adapted platform.”

Consecutive Blows to Crypto

Derivatives exchanges annual for best trading action in crypto, before atom volumes by three to bristles times. These accommodate the auction of abiding swaps, futures, and options contracts.

The FCA’s advertisement comes on the heels of a agnate move from American authorities. Last week, the CFTC and Department of Justice charged Bitcoin-specific derivatives barter BitMEX for actionable assorted banking regulations, including the Bank Secrecy Act.

It charcoal to be apparent how exchanges, accurately those alms acquired products, will acclimatize their strategy. For some platforms, annihilation changes. Joel Edgerton, the COO of BitFlyer, told Crypto Briefing:

“However, for adapted exchanges it is business as usual. In the best term, it should clasp bad actors out of the industry so we can access our assurance with association at ample and abound the absolute industry. We accept cogent advantages over acceptable banking institutions, but we additionally charge to abound up, booty the harder alley and do what is appropriate for our customers.”

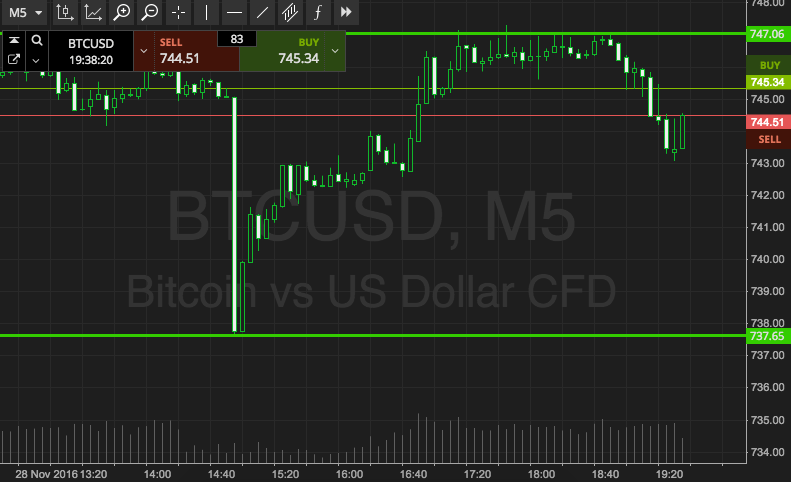

The amount activity of Bitcoin has so far shrugged off the news. BTC amount is bottomward beneath than a percent in the aftermost 24 hours.