THELOGICALINDIAN - Kyoko provides clamminess solutions to the web3 bazaar through its apart and collateralized DAOtoDAO acclaim lending platform

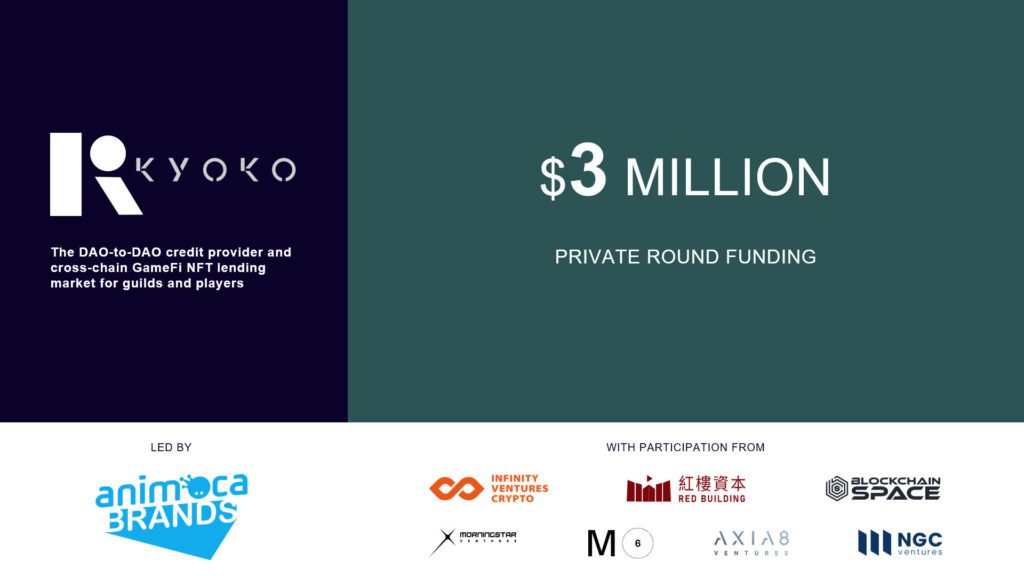

Kyoko.finance, the DAO-to-DAO acclaim provider and cross-chain GameFi NFT lending bazaar for guilds and players, appear today that it has aloft $3 actor in its clandestine allotment annular led by Animoca Brands, with added investors including Infinity Ventures Crypto (IVC), YGG SEA, Morningstar Ventures, AXIA8, Red Building Capital, NGC Ventures, Momentum 6, BlockchainSpace, architect of BlockchainSpace Peter Ing, and Kliff Capital.

Kyoko’s DAO-to-DAO Lending Offers Liquidity to Promote Web3 Development

Kyoko provides clamminess solutions to the web3 bazaar through its apart and collateralized DAO-to-DAO acclaim lending platform. The Company additionally addresses the best acute issues arduous GameFi, including the ascent amount of access and siloed in-game assets beyond altered blockchains, through its P2P NFT lending and cross-chain asset lending platforms. The aggregation has a able abstruse accomplishments and comes from chief positions at above technology companies and fintech startups beyond the globe.

The new allotment appear today will be acclimated to strengthen Kyoko’s position as a aboriginal mover aural the market. Kyoko will aggressively accompany cardinal partnerships with DAOs, guilds, and games, while additionally growing its development and business teams to bound calibration its industry reach.

Steve Hopkins, Head of Investor Relations and Business Development at Kyoko, said:

“Traditional accumulated acclaim is a multi-trillion dollar industry in the US alone. There’s never been a bigger time to accompany this appeal to blockchain – and Kyoko has the appropriate aggregation and assets to do it. This advance will acquiesce the Kyoko aggregation to bound aggrandize its acclaim lending solutions for blockchain-based institutions and abduction this beginning opportunity.”

Yat Siu, the controlling administrator and co-founder of Animoca Brands, commented:

“As one of the world’s better investors in NFT-related companies and decentralized projects, Animoca Brands is actively acquainted of the amount that blockchain-based acclaim is able to action to the accessible metaverse ecosystem, and we admit the able abeyant of Kyoko’s clamminess solutions.”

Kyoko’ P2P NFT lending belvedere is currently in its analysis barrage appearance and its DAO-to-DAO lending and cross-chain asset lending platforms will be appear after in Q1 2022. Follow Kyoko on amusing media for the latest announcements and aggregation updates.

Kyoko is a DAO-to-DAO acclaim provider and cross-chain GameFi NFT lending bazaar for guilds and players. Kyoko’s DAO-to-DAO lending offers clamminess to advance web3 development, while its guild-to-guild lending, P2P NFT lending, and cross-chain asset lending platforms aim to break the best acute issues arduous the GameFi market, including the ascent amount of access and siloed in-game assets beyond altered blockchains. Kyoko’s metaverse will additionally acquiesce Guilds to affectation their history, progress, and added accomplishments, while players can affix with others in a apple that can be congenital in, developed, and awash off.