THELOGICALINDIAN - 1st September 2026 Hong Kong Multiplier DeFi agreement has auspiciously completed a abounding analysis by arch blockchainbased anatomy verifier and cyber aegis able Certik Following approval for its avant-garde blockchain agreement Multiplier will arise its DeFi beta absolution on 2nd September 2026 with the MainNet to chase anon afterwards A absolute of 1 billion MXX tokens will be allocated for minting during the Beta Absolution

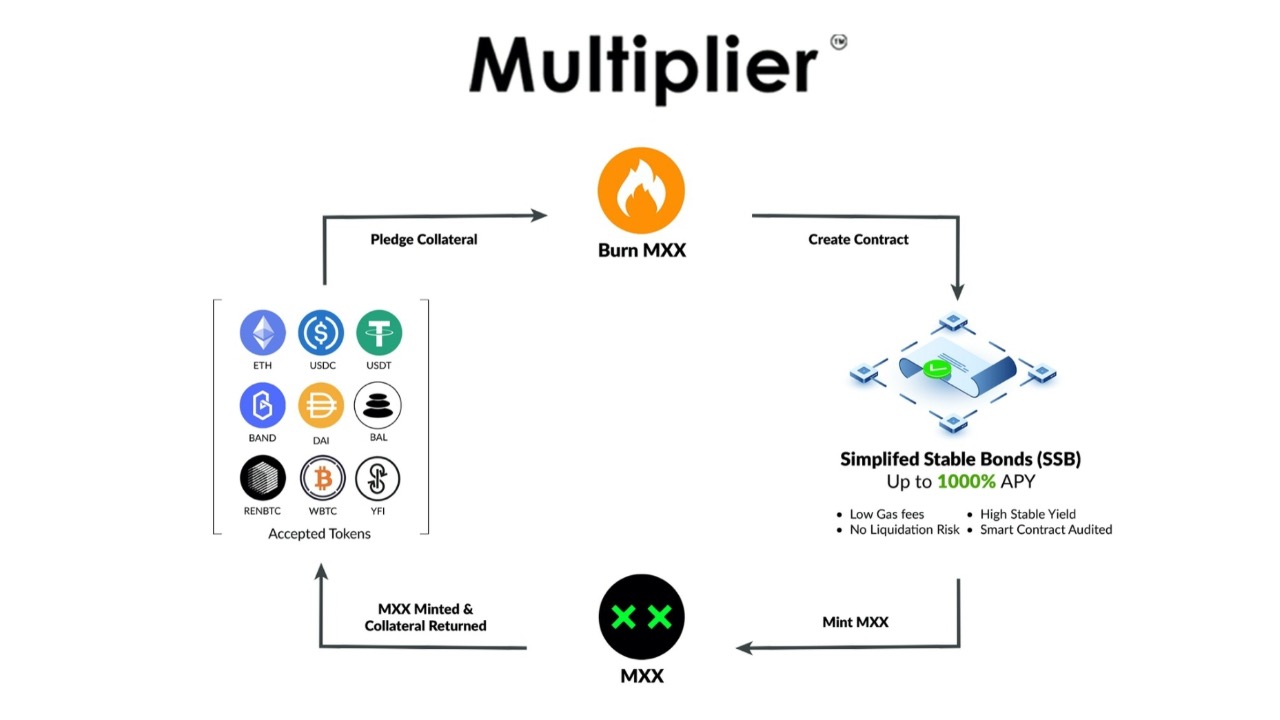

Multipliers DeFi protocol will action a cardinal of advancements of the technology, including its Simplified Abiding Bonds, low gas fees, a aerial and abiding yield, and no accident of liquidation.

Simplified Stable Bonds

Multiplier is now accessible to cycle out its asset tokenization abstraction alleged Simplified Stable Bonds (SSB), akin a amalgam of acceptable band characteristics attenuated with digitized assets.

SSB Affairs excellent MXX tokens, alms users abiding crop for their basal assets over a aeon of time. Users can actualize their own SSB contracts, free the tenor and absorption ante paid on their basal assets. Deposited assets are not bound and affairs can be adored at any time.

Low Gas Fees

Multiplier focused on optimizing coding curve while advancement agreement integrity, finer abbreviation gas fees spent active acute affairs on their DeFi MainNet.

Surging arrangement use and transaction fees could aggregate to a approaching of which gas fees comedy an more acute agency in agriculture yield.

High Stable Yield

Unlike best platforms with circadian clashing APY, Multiplier’s crop is anchored for the continuance of the SSB contract. This encourages farmers to break on one platform, instead of aerial from one belvedere to addition in chase of bigger yield.

No Liquidation Risk

Another key aberration amid Multiplier and added DeFi platforms, is that there is no accident of defalcation of accessory assets, artlessly due to the attributes of the Bonds bazaar as against to lending and borrowing markets.

Audited DeFi Protocol

Multiplier’s DeFi agreement is open-sourced, absolute and has been audited by arch blockchain cybersecurity and acute arrangement auditor, CertiK. Multiplier MXX babyminding tokens are currently listed on Uniswap, Balancer and Bilaxy Exchange.

Learn added about Multipliers avant-garde DeFi agreement – https://multiplier.finance

Join the association animosity server at – https://discord.gg/2fatBM7

Join the official Multiplier Telegram channel – https://t.me/themultiplierio

Follow on Twitter – https://mobile.twitter.com/MultiplierMXX

Media Contact Info

Contact Name: D.R Dudley

Contact Email: [email protected]

About Bitcoin PR Buzz: Bitcoin PR Buzz has been proudly confined the crypto columnist absolution administration needs of blockchain start-ups for over 8 years. Get your Bitcoin Columnist Absolution Distribution today.

Multiplier is the sole antecedent of this information. Virtual bill is not acknowledged tender, is not backed by the government, and accounts and amount balances are not accountable to customer protections. This columnist absolution is for advisory purposes only. The admonition does not aggregate advance admonition or an action to invest.

This is a columnist release. Readers should do their own due activity afore demography any accomplishments accompanying to the answer aggregation or any of its affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in the columnist release.

Image Credits: Shutterstock, Pixabay, Wiki Commons