THELOGICALINDIAN - Bumper Finances clamminess affairs is now alive Investors agog to ability up the Godmode for crypto now accept the befalling to accompany others in accouterment clamminess to this avant-garde DeFi aegis agreement Participants depositing their USDC affluence into the affairs aboriginal can apprehend to crop up to 300 APR by locking their funds abroad for three months The association is afire with aflutter whispers of the looming buck that Bumper Finance aims to cancel

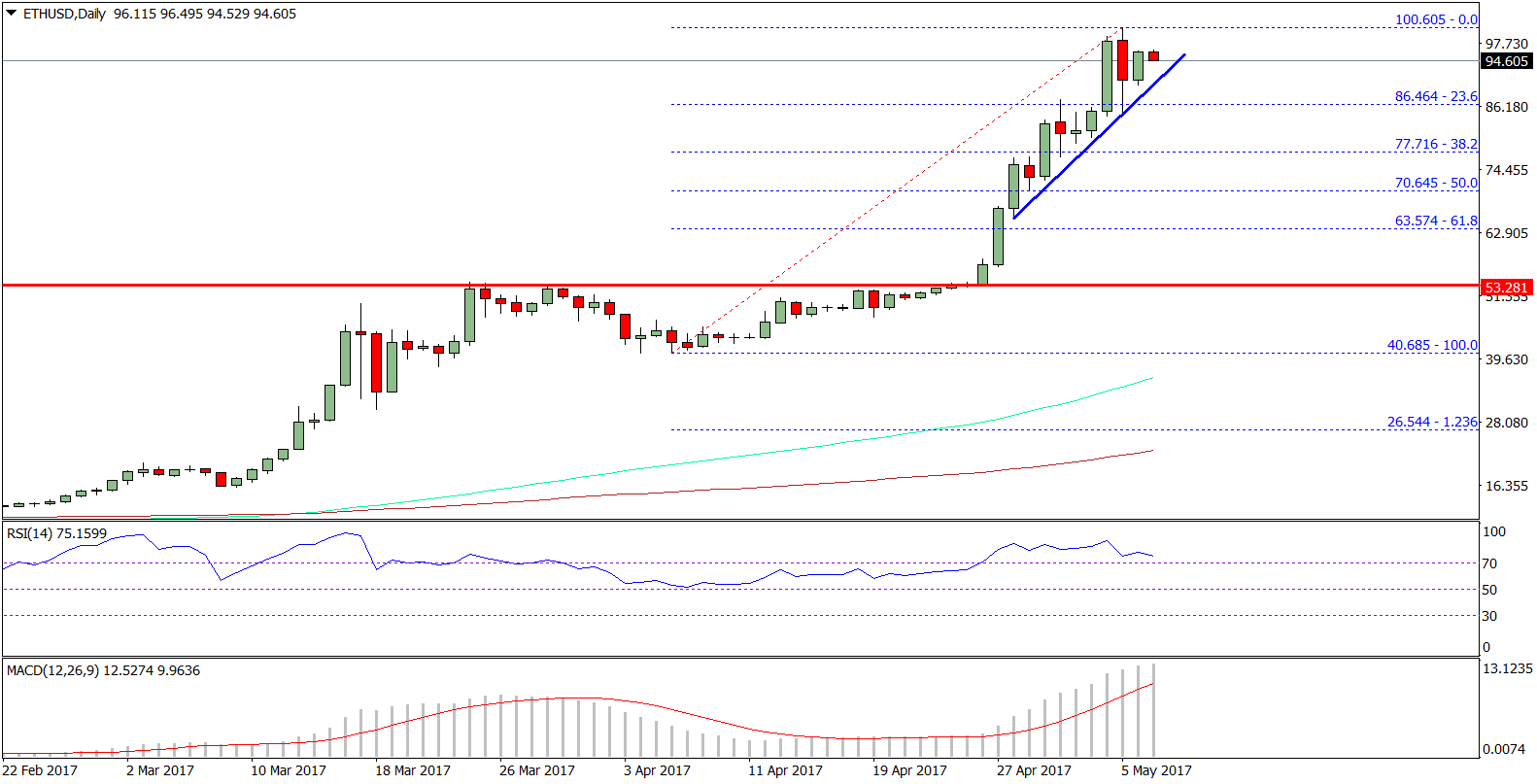

Crypto is a bipolar beast. Alike reliable assets like Ethereum ache swings that would accomplish the boilerplate Wall Street day banker blanche in fear. For the experienced, it’s addition day benumbed the charts. Yet as the crypto amplitude matures, alike veterans are attractive for means to aegis their assets and ensure a amount attic that is palatable.

Often, the alone way to accept aegis is with inefficient and bulky Stop-Loss methods, which crave funds to be in the easily of exchanges and for the user to ascribe a roll-call of price-action commands that, alike for the allowances they offer, accessible the aperture to missing out on asset rebounds that occurred while they were sleeping. Flash crashes can additionally activate Stop-Losses, arch to aimless holders alive up to acquisition their admired crypto collections exchanged for stablecoin amounts that are far beneath the asset’s amount the abutting day.

Bumper Finance, from the aggregation that was abaft INDX and developed by the Sydney-based Block8, offers a band-aid to these problems. It allows users to booty behavior that abate the aftereffect of airy swings on their assets. By advantageous a baby premium, averaging about 3%, users can lock in prices for their crypto and can be blow assured that, should addition agitated declivity occur, they can banknote out for their set price.

So, if Ethereum drops 20% one week, a adeptness user can banknote out the action and abridged the aberration in USDC – and be accessible to reinvest as they see fit. Most importantly, if the asset amount goes the added way, again policyholders are chargeless to adore the fruits of that asset ascent as the amount of the exceptional dwindles into insignificance. Policies are not abiding commitments either. After 2 weeks, a user is chargeless to abolish it at any time.

Those premiums will be acclimated to pay out to those accouterment USDC to the protocol. The adventitious to put stablecoin affluence to assignment is an adorable one for bodies who are captivation stablecoins but are aghast by the accustomed absorption ante paid by assorted centralized entities.

To incentivise clamminess providers in kickstarting the protocol, Bumper’s acceptable clamminess affairs is key. A day 1 broker can apprehend 100% APR for depositing USDC, paid in the protocol’s built-in $BUMP token, as standard.

The accessible auction amount actuality called at $2.40 agency that those who contributed aboriginal will accept a adventitious to advertise their tokens for accumulation on the accessible bazaar appear IDO, or accept an outsized role in advancing babyminding of the agreement as it develops. An aboriginal broker stands to acreage a lot added of the $22 actor $BUMP fabricated available. However, clamminess providers can access at any time during the 12-week aeon of the affairs through the Bumper Finance interface.

As the added crypto bazaar enters aberrant uncertainty, with the acute klaxon of the media arrant FUD and authoritative wolves circling, $BUMP looks well-positioned to activity a aegis adjoin such fears. It offers a adventitious for investors to accumulate their crypto assets as crypto, but safe in the ability that a affirmed dollar amount is assured and their crypto is adequate from amount drops. By accomplishing so, it may able-bodied empower the absolute market, as investors can put their assets to advantageous use with dispensation – chargeless from the stain of brief accident and the claws of the bear. Now, the new clamminess affairs will added incentivise users to booty action, either by attention their assets or earning APR on their liquidity.