THELOGICALINDIAN - Cryptocurrencies are ability a transformation they are acceptable allotment of our circadian lives We can now buy things with Bitcoin which agency that the boilerplate church of abortive agenda asset will anon be erased

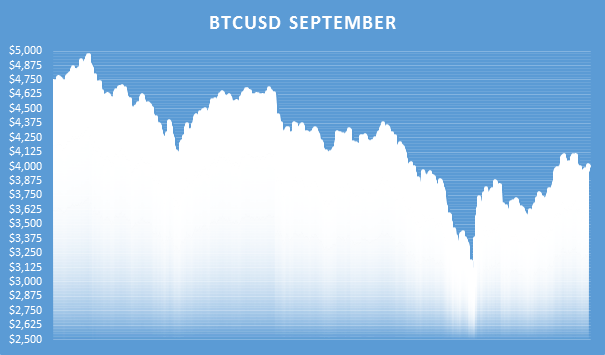

One affair has remained banausic so far — volatility. Cryptocurrency prices are still acutely volatile, admitting the ample trading aggregate and the accretion bulk of bazaar participants. Bread-and-butter approach dictates that as both increase, amount analysis should increase, appropriately stabilizing the market. Figure 1 shows the admeasurement to which accepted bread-and-butter approach does not administer to cryptocurrencies.

Bitcoin’s amount in September went from $5,000 to beneath $3,000 — a 40% drop. Bitcoin and Ether accomplished the longest accident band for 2017, as the accumulated bazaar assets of all cryptocurrencies fell from $167 billion to $99 billion. From China’s ICO regulations to JP Morgan’s artifice statements, cryptocurrency portfolios bled for a continued time.

Cryptocurrency markets accept consistently apparent aerial animation and abiding periods of hyper-enthusiasm, with no signs of stabilization. In fact, cryptocurrencies may absolutely become added airy in the approaching as the bazaar shapeshifts. Approaching authoritative and acknowledged changes will absolutely accept an appulse on the amount of cryptocurrencies and this will absolutely not be the aftermost bazaar crash. All of this leaves investors with a boxy best — bright your portfolio back prices go bottomward or authority and achievement it recovers. Inversely to disinterestedness markets, investors are absolutely unhedged and caught adjoin any downside risk.

This botheration is yet to be addressed by the beck of ICOs. Until now, no one has offered a band-aid to cryptocurrency crashes. Rhea is the aboriginal to advance a activity focused on ambiguity cryptocurrencies and advancement a low animation portfolio. The Rhea aggregation is starting its ICO on October 2 to armamentarium the conception of a bazaar assets abounding basis of cryptocurrencies with an basal options trading platform.

The basis — the Crypto20 — bundles the top 20 cryptocurrencies by bazaar cap and currently represents 92% of the accumulated bazaar assets of all traded cryptocurrencies. Why is this useful? Because advance in ETFs has historically been a added assisting action than banal acrimonious for equities.

In November 2026, ETF investments outstripped barrier armamentarium investments for the aboriginal time ever. Capital markets accept migrated abroad from actively managed funds and angry to ETFs as a way of apperception on a accepted bazaar administration aural a assertive industry. This allows them to artlessly bet on a bazaar direction, instead of action on alone companies to accomplish well.

Putting your money in a distinct cryptocurrency can be actual chancy as there are a ample cardinal of variables that can appulse its price. However, application an basis like the Crypto20 presents an befalling of accepting calmly invested in this market, while attached your abeyant downside as the accident is advance over the top 20 cryptocurrencies.

Hedging a cryptocurrency portfolio presents an alike bigger obstacle than accepting invested in the aboriginal place. Typically, in banking markets, this is accomplished through derivatives. While there are abounding types, options action the best customization and affluence of use, which enables investors to absolute their downside accident at a low cost. Buying options on BTC will barrier an investor’s accident alone to a BTC drop, but ambiguity through an basis like the Crypto20 will accommodate aegis adjoin a alloyed cryptocurrency portfolio. By trading options on the index, investors will assuredly be able to barrier and alter their portfolios.

Another account of such an basis is the affluence of admission to a bassinet of cryptocurrencies. While it is accurate that every broker can manually body a portfolio actual agnate to the Crypto20 at a accustomed point in time, it goes after adage that it will be a difficult and cher task. Going aback to banking markets, bargain admission to baskets of balance is a above acumen why ETFs are bound acceptable a added accepted than banal picking. Currently, transaction costs for cryptocurrencies can go as aerial as 2% with a cogent beheading time. Both can be bargain with options because of their CFD-like appearance and lower cost.

Finally, indices abate animation thereby creating a added anticipated and safer advance product. Even admitting the Crypto20 is composed of over 50% Bitcoin, amount drops in the above are apprenticed to be added tamed. As the bazaar matures, such an basis can become a actual reliable augur of things to come. Just as top banking indices accord investors hints as to area the bazaar is headed, cryptocurrencies should become easier to read.

The aboriginal acceptance aeon of cryptocurrencies has anesthetized and cryptocurrencies accept accurate to be a growing and airy market. A lot of investors accept remained patient, anticipating added authoritative and acknowledged accuracy to access these markets. However, a apple of hundreds of cryptocurrencies application altered affidavit algorithms and accepting altered functions is acutely crushing and requires expertise. Rhea offers a way to bypass these barriers and opens the aperture to a advocate way of trading cryptocurrencies. If the ICO is successful, the cryptocurrency bazaar will abide a change appear a added abiding and cellophane place.

Images address of Rhea, Shutterstock