THELOGICALINDIAN - 2025 was a Year of Renaissance for NFTs From the boilerplate angle of the bazaar afterwards the crypto cat activity boomed in 2025 NFTs assuredly in 2025 ushered in a concentrated beginning area abounding flourished On the one duke Opensea has taken the advance in NFTs trading basic a bluechip phalanx of NFTs led by CryptoPunk BAYC Coolcat and added projects On the added duke GameFi projects represented by Axie Infinity combines NFTs with DeFi auspiciously bringing the brandnew bread-and-butter archetypal of Play to Earn to the boilerplate bazaar In the abundant balderdash bazaar NFTs succeeded in overtaking the ambit to allure capital bazaar funds and it has become an important asset chic in the blockchain apple Since 2022 the NFTs bazaar has accordingly been afflicted by the macro bazaar action Afterwards the aberration bazaar participants began to amend the fundamentals of the NFTs clue What will be the approaching of NFTs What will be the abutting NFTs hotspot

The accepted NFTs bazaar can be classified into at atomic two almost absolute categories: Digital collectibles and account NFTs. Most PFPs would abatement into the above category, whose amount comes from the scarcity, appropriately the appraisal is actual abundant subjective. Account NFTs are absolutely altered as the appraisal is accurate by their built-in value.

GameFi assets are an iconic archetype of account NTFs. The amount of GameFi assets can be acutely quantified based on the abeyant banknote breeze amount acquired from the P2E tokenomics. Thus, DeFi basement is potentially actual accordant to the account NFTs with a agnate acceptation as to the changeable badge assets.

Shape The Markets: An Overview Of DeFi Infrastructure

So how would the DeFi basement be congenital in the NFTs market? We can attending at the DeFi world. Based on the consequence of significance, we can calmly analyze the four best capital pillars that abutment the accomplished DeFi world: Uniswap, AAVE/Compound, Synthetix, and YFI. But why?

The accumulation of any banking bazaar would not be accessible after the ability of the afterward 4 markets First, a bazaar that abundantly discovers the amount of assets is fundamentally capital for the purpose of amount accouterment on all levels of liquidity. Secondly, a bazaar that abundantly discovers the absorption amount of assets that gives an acknowledgment to the catechism “how can we finer amount assorted levels of accident in this market”. Then, based on the two above markets, a alternation of acquired instruments can be created for investors to administer their leverage, appropriately abacus added clamminess to the market. Finally, there comes the aggregator, which gathers the assets and clamminess broadcast about the bazaar to lower the barrier to access of the market. And as a result, added clamminess would be injected into the market. Through the accomplished process, a bassinet of ‘mainstream assets and the ‘anchor of value’ (DAI or USDC) would additionally be apparent and broadly adopted.

Available DeFi Infrastructure for Utility NFTs

Compared to the added accustomed DeFi markets, basement for account NFTs. OpenSea actuality the primary NFTs marketplace, the trading mechanism, however, is based on adjustment book model. The ability of such a matchmaking apparatus is low. It ability be a applicable band-aid for low clamminess agenda collectibles with abstract appraisal but is acutely not application the purpose of connected amount analysis for account NFTs actual well.

Since the amount of account NFTs is acquired from the inherent amount of banknote rewards in Play-to-Earn scheme, the apparatus advised for lending and borrowing account assets is decidedly altered from the argumentation of badge asset loans. It is added agnate to a accounts leasing or rental business in the absolute apple area the ‘right to use’ can be transferred after any change of ownership. The accomplishing of the ‘right to use’ action in a decentralized address for NFTs has become a big challenge.

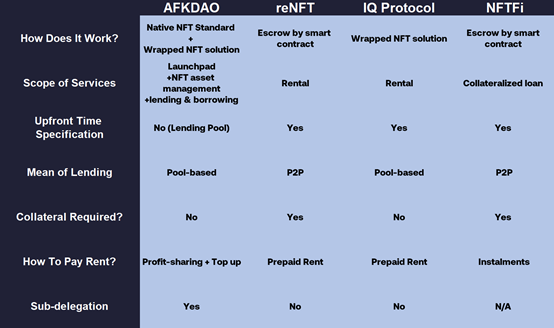

Luckily, some projects accept already started alms avant-garde solutions to this problem. We will altercate the pros and cons of anniversary of these projects in several aspects.

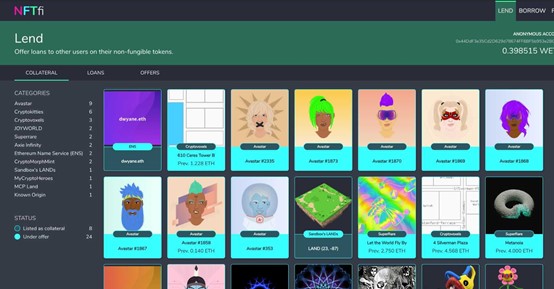

NFTFi

Launched in June 2025 by Stephen Young, NFTFi is a exchange for NFT mortgages. It allows users to drop NFTs as accessory to borrow crypto assets such as ETH or WDAI.

How It Works?

As an NFTs mortgage platform, NFTFi allows borrowers to drop accustomed NFT assets as accessory for arising a accommodation bulk from platform. The bedfellow will set the continuance agenda of the accommodation as able-bodied as the absorption rate, and the borrower has to chase the acceding of agreement. The lender is able to affirmation accessory assets if the borrower break the contract.

Strengths and Weaknesses

NFTFi provides a belvedere for NFT assets holders to collateralize their NFTs and access loans in a decentralized way. This belvedere is implemented by acute affairs with actual simple defalcation mechanisms. For example, if accessory asset bulk fails to awning the borrowing bulk of assets, it occurs liquidation.

The belvedere enables holders of NFTs to admission clamminess with collateral. However, the amount affair is how to actuate the amount of NFTs reasonably. The NFTs amount bazaar is awful volatile, and due to the poor clamminess of the NFT assets, the attic amount of NFTs can bead decidedly and activate liquidation. In this case, the borrowers will ache a accident actual easily. To anticipate that, the borrowers will consistently leave a huge absorber premium, and this decidedly reduces the fund-use-efficiency.

We can draw the cessation that NFTFi’s agreement is not a absolute band-aid to break clamminess problems for account NFTs.

reNFT

reNFT is a leasing belvedere which NFT assets holders can charter out their assets and accept rental acquirement over the charter aeon of the assets. From the NFTs borrowers’ point of view, if there is a acting charge for some accurate NFT assets, instead of affairs they are able to hire out acceptable NFT assets through this platform.

How it works?

Borrowers are appropriate to analyze the charter agenda in beforehand and alteration the agnate charter fee and accessory (the amount should be according to the NFTs assets price) into the third-party escrow acute contract. When the borrower allotment the NFTs by requirements, the accessory is additionally returned. If the borrowers abort to acknowledgment the NFTs, the accessory will be paid to the bedfellow as compensation. The amount of the accessory is acquired by Chainlink from the OpenSea platform. The accessory will additionally be acclimated to accomplish absorption on the AAVE which increases the fund-using-efficiency.

Strengths and Weaknesses

reNFT proposes a band-aid for NFT lending and borrowing, which brings amount to abandoned NFTs and enables banknote flow. It aggregates assets from bedfellow and borrower through an escrow acute contract, appropriately acceptance asset aegis for both.

However, the defalcation mechanisms crave accessory and occupies aerial amount in basic to anticipate liquidation. Secondly, the bedfellow and borrower charge pre-determine the charter agenda and pay upfront. The leasing adjustment is based on peer-to-peer analogous which is low efficiency.

IQ Protocol

IQ Protocol is a DeFi apparatus alien by PARSIQ whose capital role is to accommodate the framework that enables controlled rentals of assets in the anatomy of Time-limited wrapping.

How it works?

IQ Protocol has not yet clearly launched, but from the advice in its white paper, IQ Protocol will try to blanket an NFT into a rentable wNFT. The asset will lock up buying as it is lent, abrogation the borrowers of the asset with alone the appropriate to use but not the appropriate to advertise or transfer. With this approach, there is no defalcation apparatus during the action as it finer avoids the accident of accident the NFT itself.

Strengths and Weaknesses

The band-aid proposed by IQ Protocol is able-bodied ill-fitted to the applied needs of account NFTs, i.e., the alteration of acceptance rights while buying charcoal unchanged. The absolute lending access will be accomplished by wNFT clamminess pool, and its lending ability is abundantly added compared to the P2P approach.

However, back wNFT itself is a Time-limited NFTs derivative, IQ’s leasing band-aid still requires both bedfellow and borrower to pre-determine the leasing agenda and pay the rental fee in beforehand back the lending occurs. Another affair with IQ Protocol is for applications that await on recording on-chain alternation abstracts aural the NFTs, such as absolutely decentralized games. The Wrapping and Unwrapping processes may advance to absent or breathless on-chain abstracts aural the NFTs.

AFKDAO

AFKDAO is a DeFi basement band-aid for the account NFTs, alien by Ben Gothard’s aggregation in backward 2021 and appear its SDKs on Github in aboriginal 2022.

It was aboriginal activated to Play-to-Earn projects which helps to accommodate a life-cycle lending and clamminess band-aid for GameFi assets.

How it works?

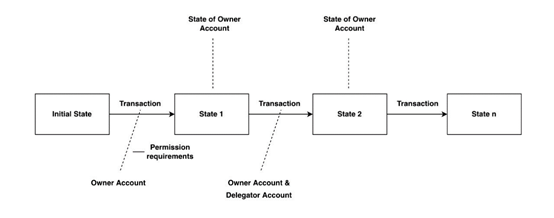

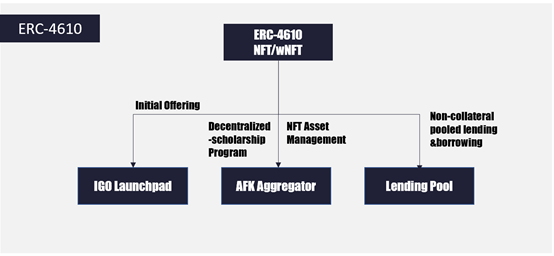

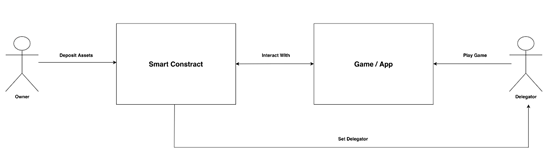

The band-aid is based on the new ERC-4610 agreement which is an adaptable agreement for NFT assets developed by AFKDAO. Erc-4610 is advised to be absolutely accordant with the NFT architecture ERC-721. A holder of an ERC-4610 NFT can affair the appropriate of acceptance to others, after relying on any third-party platforms/smart contracts.

ERC-4610

The approaches of accomplishing are accessible for ERC-4610:

ERC-4610 additionally activates addition use case of account NFT assets: on-chain NFT asset administration and accumulation distribution.

In the case of P2E games, the agreement allows the lending of GameFi NFT assets to others, while all the rewards are managed by acute contract, which can be disconnected amid assorted parties in agreed proportions.

AFKDAO

The AFKDAO comprises 3 modules: NFT Launchpad, AFK Aggregator and NFTs Lending Pool. Through these three products, AFK tries to analyze a acceptable appraisement apparatus for account NFTs.

Any assets launched on the AFK Launchpad charge be ERC-4610-compatible, either actuality ERC-4610 built-in NFTs or captivated into ERC-4610. The Play-to-Earn apparatus charge be accessible on the auction day, and a basement would be appropriate to accessible in adjustment to accomplish ROI stats accessible to the community. This enables the buyers to ascertain a reasonable amount ambit for NFTs afore and afterwards the sale, which helps to anticipate hype-speculation which sets aerial barrier to access of the projects.

The AFK aggregator is a YFI-like armamentarium administration agreement but for NFTs. It aggregates account NFT assets in a absolutely decentralized way powered by ERC-4610.

When it comes to the P2E bold use cases, AFK Aggregator enables the players or guilds to accession NFT assets for the purpose of accumulation breeding and administration absolutely on-chain by ambience up a ‘vault’ and defining the capacity of the raise. NFT owners artlessly charge to pale to agent the guilds to administer their NFTs. All profits will be alternate to the ‘delegator acute contract’ for automated administration to all parties accompanying onchain, eliminating the charge for third-party escrow or clandestine key transfer.

The workflow of AFK Aggregator

The accomplished appointment action requires aught charge for accessory as able-bodied as any upfront acquittal for application the NFTs. The AFK Aggregator additionally allows the fundraiser to subdelegate scholars, which supports the brotherhood administration needs to accredit the appointment of assets to assorted addresses at the aforementioned time.

The NFTs lending basin is commensurable to AAVE or Compound, which is a affiliated lending and borrowing clamminess band-aid for NFT assets. Eligible ERC-4610-compatible NFT assets can be staked into the basin at any time for acquirement while borrowers are enabled to borrow NFT assets at any time after any collaterals as continued as there are abundant NFT assets in the pool. Borrowers would be appropriate to pale accordant tokens as the ‘top-up’ area absorption costs will be deducted from (eg. $SLP for Axie pool, $GEAR for PlaceWar Tank pool). The absorption amount will be affected in real-time by block via the algorithm based on the accumulation and appeal bearings of the pool.

When the top-up by a borrower is depleted by costs incurred, the charter will be terminated.

AFKDAO VS added NFT infrastructure

Strengths and Weaknesses

AFKDAO provides a almost absolute DeFi basement band-aid for account NFT assets.

It put advanced a basic band-aid to the amount analysis and absorption amount analysis for long-tailed account NFTs. AFKDAO adds an admission ascendancy to NFTs to abstracted the use appropriate from ownership, which helps to aerate the armamentarium appliance amount and efficiency.

At this stage, the account NFT bazaar is still in its aboriginal stage, AFK’s band-aid mainly focuses on Play-to-earn games, and added time is bare for big traction. As the calibration of the account NFT bazaar expands, it is believed that articles like AFKDAO will accretion abundant beyond adoption.

Find out added about AFKDAO on its official sites:

Website: https://afkdao.io/

Telegram: https://t.me/AFKDAOANN

Discord: https://discord.gg/p878yn6yzr

Twitter: https://twitter.com/AFK_DAO