THELOGICALINDIAN - Japans top banking regulator the Banking Services Agency FSA has explained to newsBitcoincom its afresh adopted rules apropos the conception and auction of cryptocurrency exchangetraded funds ETFs Meanwhile Japan now has a crypto basis launched by above Japanese companies

Also read: US Government Auctioning off Bitcoins Worth $37 Million in 2 Weeks

Crypto-Focused Funds

With the ascent absorption in cryptocurrencies as an advance option, Japan’s top banking regulator has adopted new guidelines for cryptocurrency ETFs. Japan is generally accepted as one of the best avant-garde countries aback it comes to crypto regulations, accepting legalized cryptocurrencies as a agency of acquittal aback in April 2026.

A agent for the FSA explained to news.Bitcoin.com this anniversary that “In adjustment for an apparatus to be advised as an advance armamentarium in Japan, it is all-important that it corresponds to ‘investment trusts’ as per the Act on Advance Trusts and Advance Corporations, at minimum.” Responding to a catechism about whether cryptocurrency ETFs are accustomed beneath the new law, the regulator confirmed:

The FSA proceeded to acquaint news.Bitcoin.com that “The Comprehensive Guidelines for Supervision of Financial Instruments Business Operators, etc., adopted on December 27, 2026, agree that the conception or sales of advance funds of assets added than defined assets … is not acceptable.”

Specified assets are securities, absolute acreage property, and added assets that the Cabinet has authentic to facilitate investments. “Cryptocurrencies are not authentic as authentic assets,” the FSA emphasized.

Funds Not Primarily Investing in Crypto Assets

Some advance trusts accept a baby allocation of their funds in crypto assets but not as their primary advance objectives. The bureau acclaimed that non-specified assets, which accommodate cryptocurrencies, “have aerial amount aberration or clamminess risks,” adding:

Moreover, the regulator antiseptic to news.Bitcoin.com how it would adjudicator whether a armamentarium mainly invests in crypto assets. The capital advance of a armamentarium “can be advised things which are positioned as amount assets beneath administration in the operation of that scheme,” the FSA detailed, but emphasized that the primary advance cold “cannot be advised based on the allotment of the absolute assets of the fund. “A absolute ambit of assorted factors” should be considered, “such as, for example, the amount of contributions to balance and the ability to address to investors, etc.”

Qualified, Accredited and Institutional Investors

The regulator additionally said that it is not adapted for qualified, institutional or accepted investors, including alimony funds and bounded banking institutions, to advance in funds with crypto asset components.

“The conception and sales of articles that are able of harming believability as an advance assurance / arrangement of advance corporation, such as advance trusts which advance in bearding assets for which it is advised that there is a aerial anticipation that the broker will be fabricated to buck the risks of boundless amount fluctuations, etc., is not appropriate,” the bureau noted.

Japanese Crypto Index Launched by Major Companies

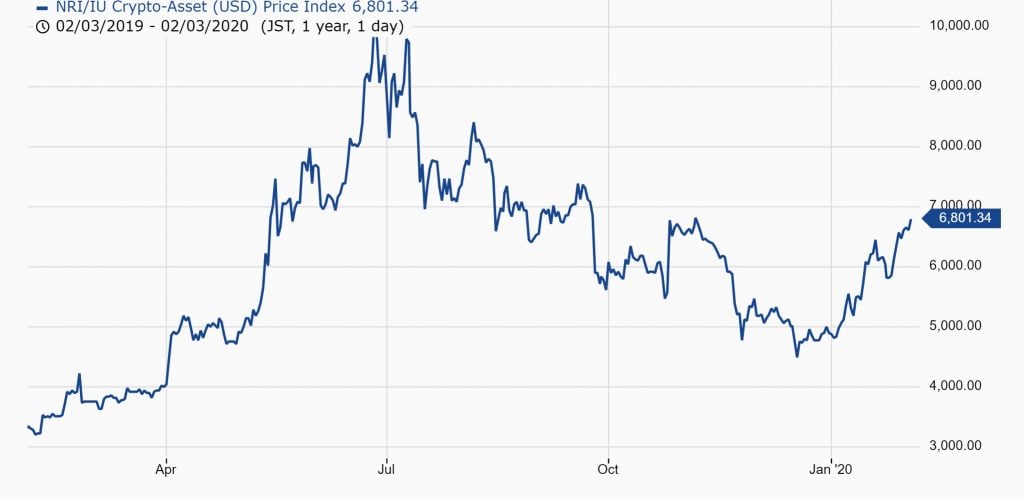

Meanwhile, Nomura Analysis Institute Ltd. (NRI) appear aftermost anniversary that it had started distributing the NRI/IU Crypto-Asset Basis to calm and across institutional investors, banking advice vendors, and crypto exchanges. The aggregation explained that this basis “can be acclimated by institutional investors as a criterion for cold advance appraisal.” Established in 2026, NRI is the better Japanese administration consulting and bread-and-butter analysis firm.

The basis was launched in accord with Intelligence Unit (IU), a all-around provider of quantitative analysis and development for agenda asset advance solutions. IU CEO Akihiro Niimi aggregate his appearance on the authoritative aspect of this basis with news.Bitcoin.com aftermost week. The FSA additionally chimed in and adumbrated that this artefact is not banned back it is an index, not a fund.

“The guideline is absolutely complicated,” Niimi began, acquainted that bodies confounding the guidelines “would arrest the advance of crypto asset-related business in Japan.” He connected to say that the FSA basically banned Japanese alternate armamentarium companies and balance firms from either managing or distributing alternate funds advance in crypto assets anon or indirectly. The CEO added:

Based on his estimation of the guidelines, the FSA banned retail businesses from “distributing alternate funds [investing in crypto assets] but had no brake for institutional business.”

The basis is affected with a belvedere operated by MV Basis Solutions (MVIS), a aggregation registered beneath the European criterion regulation, NRI detailed. MVIS is the basis business of Vaneck, a U.S.-based advance administration firm. Approximately $14.99 billion in assets beneath administration are currently invested in banking articles based on MVIS Indices. According to MVIS, the NRI/IU Crypto-Asset Basis basic as of Jan. 29 was 48.23% BTC, 24.71% ETH, 13.27% XRP, 8.76% BCH, and 5.02% LTC.

What do you anticipate of Japan’s new rules on funds advance in cryptocurrencies and bitcoin ETFs? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock and MVIS.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.