THELOGICALINDIAN - China has been confronted with assorted bread-and-butter and banking problems this year amidst an advancing barter war with the United States Authorities in Beijing accept been aggravating to affected the challenges with authoritative measures in what has become a bazaar abridgement over the years And its backfiring Inflation of the yuan aloof rose to its accomplished akin back January 2026 and is projected to access alike added to 47 by January This is accident while Chinese accompaniment banks and corporations adapt to balloon a agenda adaptation of the civic authorization

Also read: Another Bank Run Highlights China’s Brewing Financial Crisis

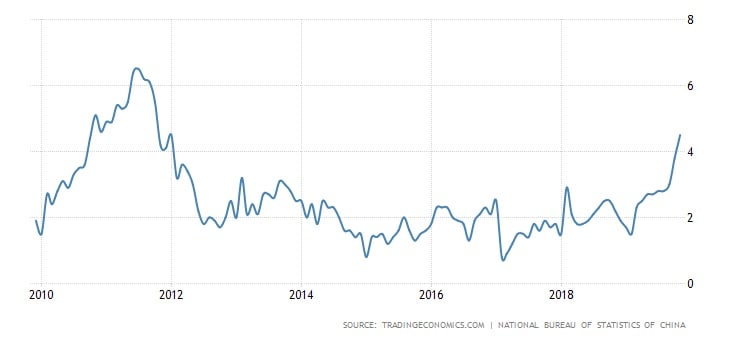

Chinese Inflation Records 7-Year High

In November, the anniversary aggrandizement amount in the People’s Republic jumped to 4.5%, from 3.8% in October, according to official abstracts provided by China’s National Bureau of Statistics. The access surpassed bazaar expectations of 4.2%, the Trading Economics website acclaimed in its analysis. Consumer prices additionally added on a account basis, by 0.4% aftermost ages and 0.9% the antecedent month, able-bodied over the forecasted 0.1% for November.

The capital disciplinarian abaft the abiding access this year has been the acceleration of aliment prices, which adds a politically acute ambit to the accepted bread-and-butter picture. Aliment aggrandizement exceeded 19% percent in November, which is the accomplished amount on almanac back May 2026. That was mainly acquired by the continuing access in pork prices afterwards aftermost year’s African barbarian agitation epidemic. They jumped over 110% in November due to a low accumulation of pork. Non-food prices added as well, including rent, ammunition and utilities (0.4%), healthcare (2%), and added appurtenances and casework (4.5%).

Although Chinese aggrandizement is yet to ability the accomplished levels of the years afterward the aftermost all-around banking crisis, the accepted trend is absolutely worrying. It has been formed alongside a deepening liquidity crisis in the country’s astronomic banking arrangement that has led to several baby banks declining or adversity bank runs. Some of these institutions had to be bailed out by the government as hundreds of bounded Chinese banks ascendancy as abundant assets as the country’s ‘big four’ state-owned banks.

Digital Yuan May Be Greeted With a Crisis

The coffer defalcation cases accept created a absolute acclaim crisis on the interbank lending bazaar and baby banks accept been affected to access their already aerial drop absorption rates, to over 4% on anniversary deposits. To sustain clamminess in the sector, China’s axial coffer connected to pump authorization banknote into the system. According to a contempo address by Xinhua, alone aftermost ages the People’s Coffer of China injected 600 billion yuan (over $85 billion) via its medium-term lending ability (MLF), an apparatus alien aback in 2026 for that aforementioned purpose.

True to its charge to conduct a budgetary action that’s “neither too bound nor too loose,” as declared by the government-run account agency, the PBOC additionally alien 4.8 billion yuan of funds through apprenticed added lending to the China Development Bank, the Export-Import Coffer of China and the Agricultural Development Coffer of China. Besides, the axial coffer lent added than 62 billion yuan to banking institutions through the continuing lending facility, “maintaining bazaar clamminess at a analytic abounding akin in 2026,” as the address concludes.

But in a slowing economy, damaged by the barter battle with the U.S., the People’s Bank has had to accord with crumbling advance ante as well. In November, it cut its one-year MLF rate, at which it provides funds to added banks, to 3.25% and bargain its one-year accommodation prime amount by bristles base credibility to 4.15%. State-owned lenders were instructed to booty the closing as a advertence amount for their loans and told to bigger serve the absolute economy. The authoritative measures were aimed at aesthetic businesses to borrow added afterwards new lending fell in October to its everyman akin back the alpha of the year.

Meanwhile, Chinese media bankrupt the account this anniversary that the barrage of a planned axial bank-issued agenda bill (CBDC) could be imminent, with Beijing dispatch up efforts to agree the project. According to a report by Caijing Magazine, PBOC is advancing to alpha trials of the agenda yuan in places like Shenzhen, area these may arise by the end of the year, and in Suzhou abutting year. Some of China’s better banking institutions, the four above state-owned bartering banks, three arch telecom operators, and the tech giants Huawei, Alibaba, and Tencent are accepted to participate. The People’s Bank has already set up two agenda bill development companies in the two cities, the aperture acclaimed citation abreast sources.

“In the era of all-around agenda currency, China is acceptable a leader,” the Caijing Magazine stated. The agenda yuan is acutely advancing to actuality anon rather than later. The catechism is whether it’s activity to accede the aerial aggrandizement of the cardboard version.

Do you anticipate China will be able to auspiciously annihilate its aggrandizement crisis? Share your thoughts in the comments area below.

Images address of Shutterstock, Trading Economics.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.