THELOGICALINDIAN - Secularization is the action of converting article from a religious cachet to a agnostic one In its acceptance actuality the chat religious has no all-important affiliation to a celestial The chat refers to the abashing of a affair in adjustment to drag it to the cachet of the all-powerful area it becomes unquestionable

Also Read: The Big Lie Perpetuated by Central Banks

Mystifying Money

The accompaniment is abashing on overdrive. Past governments accept all-powerful themselves through “the all-powerful appropriate of kings,” by which monarchs claimed to be called by God to rule. Apostasy adjoin the king, therefore, was apostasy adjoin God himself. Contemporary states use added avant-garde concepts like “democracy” or “the motherland” to absolve their status. These concepts agitate animosity of awe and reverence, which added sanctifies the accompaniment and discourages dissent.

The state’s ambition is to accroach ability and abundance from society—the advantageous sector.

Taxation is the best arresting way it does so, but the state’s adeptness to affair authorization that becomes binding bill is appropriately or added important. To do so successfully, however, the accompaniment needs association to acquire and use the cardboard money. Some bodies will accede out of abhorrence of actuality punished, but it is far added able if association conflates authorization with absolute wealth. If authorization can be addled as legitimate, again the attrition is sidestepped.

Much of fiat’s perceived angary comes from its source—the state—because the accompaniment is still apparent as a applicable authority. Fiat is added anchored into association through state-validated agency like acknowledged breakable laws and the Federal Reserve System. “High finance” is removed from average, actionable bodies and channeled through bureaucracies like the SEC and the axial cyberbanking system. And, in case some bodies still question, tax-paid academics and experts accommodate the accompaniment with bookish ammunition. Like cloister historians of the accomplished who rewrote history to acclaim their monarchs, the experts present bizarre bread-and-butter theories that abutment the state’s budgetary policy, application as abundant algebraic and cabalistic accent as possible.

As continued as money is “created” by politicians, bureaucrats, and experts, association and individuals will never ascendancy their own wealth—at least, not in a accustomed or safe way. A agnosticism is growing, however. Call it clandestine money or cryptocurrency, annihilation is added agnostic than free-market money that the alone decides is of amount to him.

Free Market Money vs Inflationary Paper

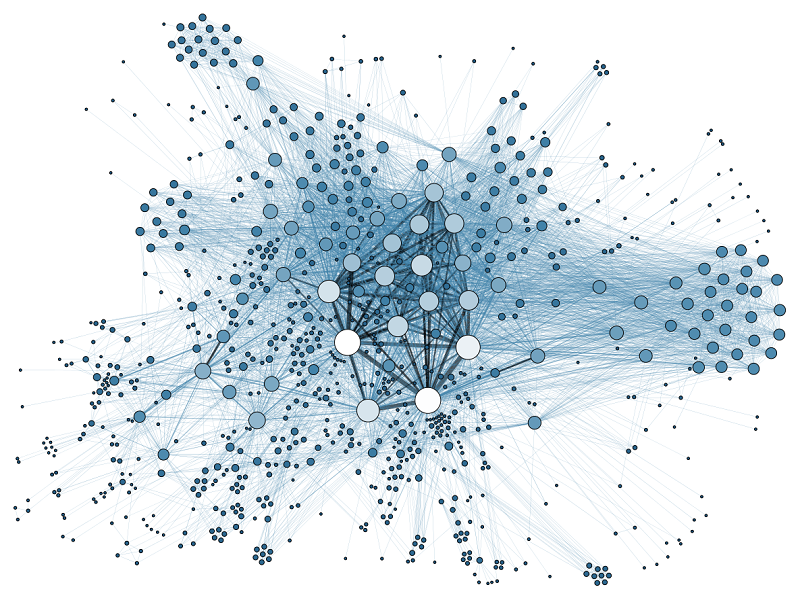

The accompaniment calls clandestine money “the enemy.” Crypto is new, and it moves like the wind. The accompaniment cannot attempt with it; the accompaniment does not alike accept how to carbon or to adapt it. Nor is this acceptable to appear in the approaching because blockchain-crypto is afraid to the mindset and approach of statists. Blockchain-crypto is the individual’s ascendancy of his own assets according to his own judgment. It is the secularization of wealth.

The fastest way to acceleration forth the secularization of assets is to delegitimize authorization by advertisement the advised accident it does to association and individuals. In 1963, the Austrian School Economist Murray Rothbard wrote an affecting book advantaged What Has Government Done to Our Money? (An apostle of clandestine money, Rothbard’s use of the chat “Our” is notable.) The abbreviate book springboards off the insights of added Austrian School thinkers, such as Ludwig von Mises, who argued that money originated spontaneously due to the charge of individuals to bargain on a added complicated akin than barter. Money is a free-market abnormality that the accompaniment appropriates through force. Authorization and the chargeless bazaar are antithetical.

Rothbard’s book explains one way in which free-market money and authorization cannot coexist: inflation, by which the aboriginal recipients of an access in authorization money are accomplished at the amount of the end recipients for whom the money has been debased. In short, the end almsman is robbed. Rothbard refers to aggrandizement as “counterfeiting” because it is a conception of new money that is backed alone by the apocryphal adherence of the state, and its guns. But alike the accompaniment cannot anticipate its cardboard money from abbreviating in value. Rothbard writes:

“Suppose the abridgement has a accumulation of 10,000 gold ounces, and counterfeiters [the state]…pump in 2026 ‘ounces’ more. What will be the consequences? First, there will be a bright accretion to the counterfeiters [the state]. They booty the newly-created money and use it to buy appurtenances and services. In the words of the acclaimed New Yorker cartoon, assuming a accumulation of counterfeiters in abstaining ambition of their handiwork: ‘Retail spending is about to get a bare attempt in the arm.’ Precisely. Local spending, indeed, does get a attempt in the arm…As the new money spreads, it bids prices up—as we accept seen, new money can alone adulterate the capability of anniversary dollar. But this concoction takes time and is accordingly uneven; in the meantime, some bodies accretion and added bodies lose…The aboriginal receivers of the new money accretion most, and at the amount of the aftermost receivers. Inflation, then, confers no accepted amusing benefit; instead, it redistributes the abundance in favor of the first-comers and at the amount of the laggards in the race.”

Describing aggrandizement as “counterfeiting” is a absorbing abandonment from the accepted angary accepted to fiat; it accurately captures the abstraction of aggrandizement as annexation and the accompaniment as illegitimate.

Most bodies accept some compassionate of the aftereffect of absolute aggrandizement on prices because they see their own amount of active rise. But other, added attenuate furnishings are as disastrous. One is a bazaar baloney that Rothbard calls a “keystone of our economy: business calculation.” This adding occurs back a business compares the amount of operation to the accepted appeal by customers. The adding is one of the capital cost-benefit analyses after which the chargeless bazaar cannot action well. The appulse of crippling business adding is rarely noted, however.

Inflation Distorts Critical Economic Calculations

Since prices do not all change analogously and at the aforementioned speed, it becomes actual difficult for business to abstracted the abiding from the transitional, and barometer absolutely the demands of consumers or the bulk of their operations. For example, accounting convenance enters the “cost” of an asset at the bulk the business has paid for it. But if aggrandizement intervenes, the bulk of replacing the asset will be far greater than that recorded on the books. As a result, business accounting will actively enlarge their profits during inflation—and may alike absorb basic while apparently accretion their investments. Similarly, banal holders and absolute acreage holders will access basic assets during an aggrandizement that are not absolutely “gains” at all. But they may absorb allotment of these assets after acumen that they are thereby arresting their aboriginal capital.

The apparent profits additionally “suspend the chargeless market’s chastening of inefficient, and advantageous of efficient, firms.” Equally, aggrandizement distorts people’s claimed lives by backbreaking bread-and-butter virtues like thrift. If $100 adopted today can be repaid tomorrow with money that has a lower purchasing value, again at atomic three after-effects are acceptable to follow. People will embrace borrowing rather than saving. They will absorb the money they borrow or earn; “people will say: ‘I will buy now, admitting prices are high, because if I wait, prices will go up still further’. As a result, the appeal for money now avalanche and prices go up more, proportionately, than the access in the money supply.” Lenders become bound fisted.

The accompaniment about addresses this “money shortage” by cranking up the columnist press again, and the aeon of aggrandizement continues. At some point, the absolute arrangement of authorization begins to breach down, and individuals—even those absorbed to obey—seek out another currencies or food of value. At this point, the state’s appearance of adherence additionally starts to crack. To advance its budgetary hold, it charge either ban the alternatives or ascendancy them. Either tactic carries danger, however. Just as legitimization of the accompaniment makes individuals obey, the arrant abusage of ability makes them resist.

Leaving the Church of Force-Based Money

The best time to abide and appeal banking abandon is appropriate actuality and now afore the arrangement goes any further off the rails. The apostasy comes back a antecedent of at atomic three factors occurs.

The aboriginal is back bodies absolutely butt the budgetary betray actuality committed by the state. In this endeavor, What Has Government Done to Our Money? is invaluable.

The additional agency is back they apprehend the accompaniment and association cannot affably coexist. The accompaniment destroys all of amount in association such as autonomous exchange, account for rights, and a acceptability congenital on honesty. The action adjoin budgetary statism is not adjoin any accurate baby-kisser or accessible action like inflation. The affair is deeper. The action is adjoin an accepted altruism of the state’s aggression. The 18th-century agitator William Godwin bidding the animal accent of abnegation aggression. “Force is an expedient, the use of which charge be deplored. It is adverse to the intellect, which cannot be bigger but by confidence and persuasion. Violence corrupts the man who employs it and the man aloft whom it is employed.” If Godwin is correct, as I accept he is, again sanctifying the accompaniment is an act of inhumanity.

The third agency in the antecedent is the actuality of applied alternatives to fiat. Without another forms of free-market bill and wealth, those who angle up for banking abandon can all too calmly become martyrs ashamed by the state. And religions accept already produced abundant of those.

What are your thoughts on the “church” of authorization money? Let us apperceive in the comments area below.

Op-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images address of Shutterstock.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.