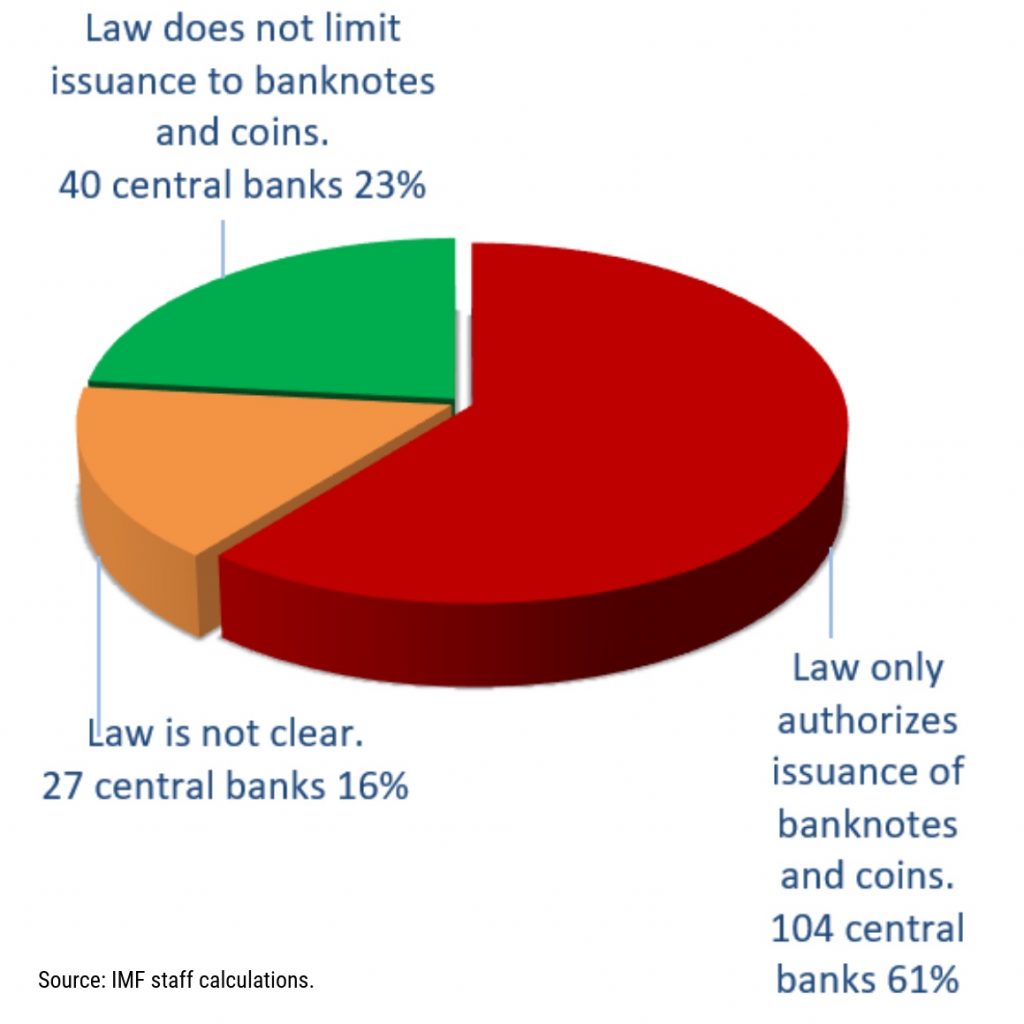

THELOGICALINDIAN - Researchers at the International Monetary Fund IMF accept advised the axial coffer laws of 174 IMF associates to acknowledgment the catechism of whether a agenda bill is absolutely money They begin that of all the axial banks advised alone about 23 or 40 axial banks are accurately accustomed to affair agenda currencies

IMF Explores if Digital Currency Is Money

The IMF appear a blog column on Thursday exploring whether agenda money is absolutely money in the acknowledged sense. The column is authored by Catalina Margulis, a consulting admonition in the IMF Acknowledged Department’s Financial and Fiscal Law unit, and Arthur Rossi, a analysis administrator in the aforementioned unit.

Expressing their own views, the authors began by celebratory that “close to 80 percent of the world’s axial banks are either not accustomed to affair a agenda bill beneath their absolute laws, or the acknowledged framework is not clear.” They continued:

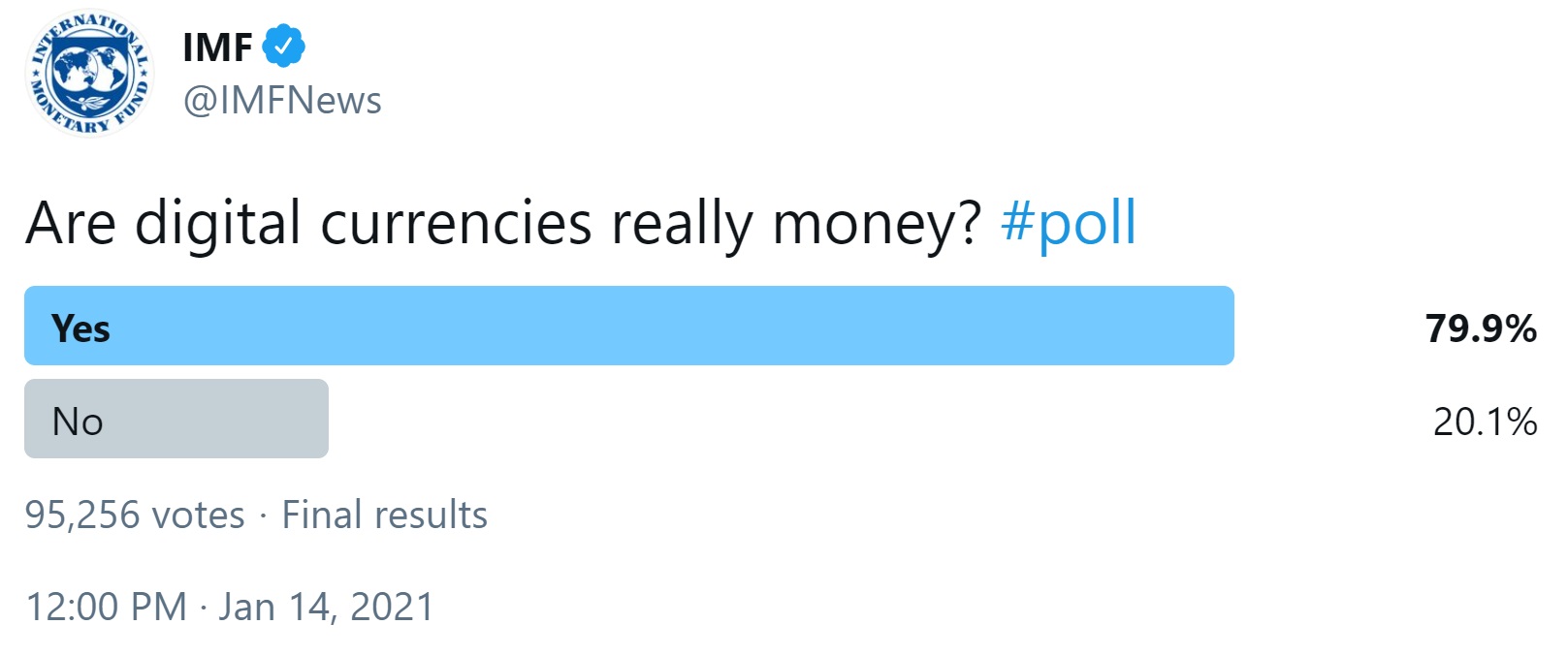

Prior to the advertisement of this blog post, the IMF set up a poll on Twitter allurement bodies to vote on whether they anticipate agenda currencies are absolutely money. Out of 95,256 votes collected, 79.9% said yes.

What Qualifies as Currency

The IMF advisers acclaimed that “To accurately authorize as currency, a agency of acquittal charge be advised as such by the country’s laws and be denominated in its official budgetary unit. A bill about enjoys acknowledged breakable status, acceptation debtors can pay their obligations by appointment it to creditors.” They detailed:

The authors acclaimed that to “use agenda currencies, agenda basement — laptops, smartphones, connectivity — charge aboriginal be in place.” However, they acicular out that “governments cannot appoint on their citizens to accept it, so acceding acknowledged breakable cachet to a axial coffer agenda apparatus ability be challenging.”

The IMF agents additionally mentioned some acknowledged issues aloft by the conception of axial coffer agenda currencies (CBDCs). Among the areas of affair are “tax, property, contracts, and defalcation laws; payments systems; aloofness and abstracts protection; best fundamentally, preventing money bed-making and agitation financing,” the IMF advisers described.

In conclusion, while acquainted that “Without the acknowledged breakable designation, accomplishing abounding bill cachet could be appropriately challenging,” the advisers emphasized:

Do you anticipate agenda currencies are money? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, IMF, Twitter