THELOGICALINDIAN - Hundreds of startups are reportedly actuality secretly targeted by the US Securities and Exchange Commission for their captivation with antecedent bread offerings Companies that alternate in ICOs are now scrambling to analyze whether their badge constituted a aegis and if so whether it was appropriately registered with or exempted by the SEC

Also read: Europe, Japan and the ‘Drug’ of Quantitative Easing

SEC ‘Tightens the Noose’ on Startups That Used an ICO

Yahoo Finance and Decrypt claims that “Hundreds of startups that did badge sales are award out they’re in abuse of balance law— including abounding that were abiding they did it the appropriate way.”

Yahoo Finance and Decrypt claims that “Hundreds of startups that did badge sales are award out they’re in abuse of balance law— including abounding that were abiding they did it the appropriate way.”

The advantageous alpha of the present year came with subpoenas, characterized by the Commission as advisory in scope. There appears to be added than bald cataloging of the crypto landscape, as “the Securities and Exchange Commission has decidedly widened its crackdown on assertive antecedent bread offerings, putting hundreds of cryptocurrency startups at risk.” The bureau “has alternate to abounding of those companies, and subpoenaed abounding more—focusing on those that bootless to appropriately ensure they awash their badge alone to accepted investors,” Decrypt notes.

Formal action can be costly, demanding a accustomed authoritative bureaucracy’s workload and bottleneck up courts and judges. It additionally appears the bureau is at aboriginal affective to accept doubtable companies in abuse settle. “In response,” Roberts explains, “dozens of companies accept agilely agreed to acquittance broker money and pay a fine. But abounding startups that accept been subpoenaed say they are larboard in the aphotic disturbing to amuse the SEC’s demands, and are ambiguous of how others are administration it, according to conversations with added than 15 industry sources.”

IPOs Died in the US, Startups Resorted to ICOs

Compounding affairs is how this boundless analysis was unearthed: bearding sources due to the actuality the bureau formally “restricts them from discussing the matter,” Decrypt insists. Antecedent bread offerings are a aberration on antecedent accessible offerings, IPOs, which accept been finer deadened out of actuality in the United States aural aloof the aftermost few decades. Legacy American banal markets, for example, accept article abutting to bisected the cardinal of accessible companies listed as they ability accept otherwise.

Saddled with regulations, barriers to access and endless acknowledged frictions alone hordes of attorneys can battle, abate companies accept been priced out of the IPO archetypal for bringing a business to accessible bazaar in the US. Instead, those that ability accept alternate at one point delay in the chain at alliance and accretion wings of accustomed juggernauts. That, or they leave the US altogether and try their duke in places such as Hong Kong, which has, abiding enough, apparent an IPO boom contempo years.

ICOs, then, are at atomic allotment of a acknowledgment to that environment. Unaccredited investors, with basal friction, accept able in ICOs at atomic two things best analysts agree: banking democratization and innovation, but at the amount of a mutiny amplitude abounding with scams. A startup can in a address of clicks become presentable abundant to advertise a proprietary agenda badge quickly.

A Game of Definitions

About a ages afterwards subpoenas were beatific by the agency, Chairman Jay Clayton seemed to accomplish the regulator’s assessment activity advanced actual clear. During a Senate audition on the accountable of cryptocurrencies, Clayton declared flatly, “I accept every ICO I’ve apparent is a security.” But what constitutes an ICO again becomes the catechism if every antecedent bread alms is accountable to their jurisdiction. The bureau “does not care” about semantics, the address scolds, alike admitting some “companies that did ICOs alleged their alms article else, such as a ‘utility token’ or a ‘SAFT’ (Simple Agreement for Future Tokens, an ICO adjustment in which investors buy a catch for tokens yet to be launched).”

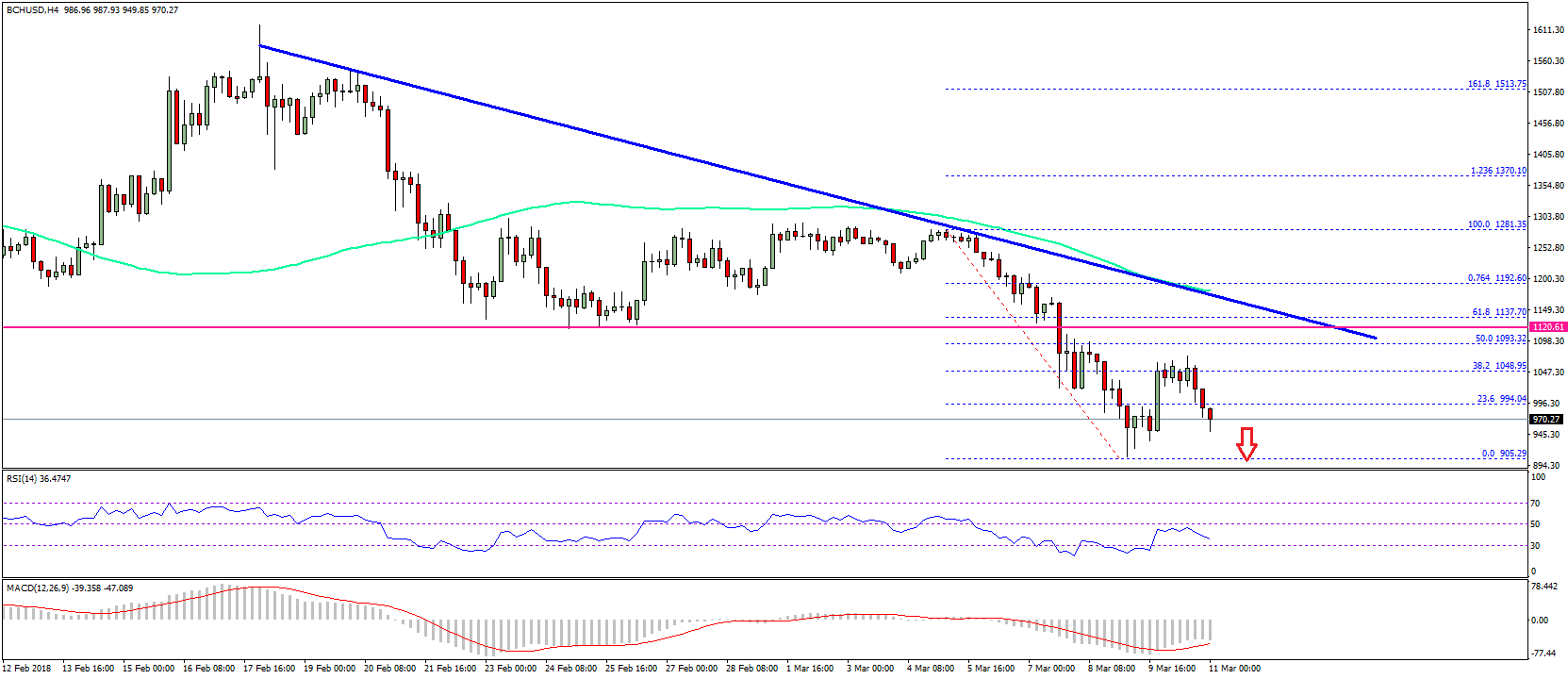

Due to the cat and abrasion attributes of the space, “It is adamantine to say absolutely how abounding ICOs occurred during the accomplished four years,” Decrypt acknowledges. Thousands for sure, and added than “$20 billion has been aloft in ICOs to date, but the ICO bang ailing in January 2018. Concerns over the amends of badge sales accept had a air-conditioned effect.”

However, it is able-bodied accepted that all US firms anywhere abreast to alms a aegis are absolute by the SEC in one anatomy or another. And the bureau does action a academic absolution which asks accord be bound to vaunted “accredited investors” who acquire added than $200,000 per year, for two years, and authority a net account of at atomic $1 actor – factors that apparently led the aggregation to seek an ICO in the aboriginal place. At that aforementioned Senate hearing, Clayton was asked how abounding had approved SEC approval. The acknowledgment came aback ominously: about none.

Will the SEC allocation out ICOs advance to a absolute aftereffect for crypto markets? Let us apperceive in the comments below.

Images address of Shutterstock.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike attending up the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.