THELOGICALINDIAN - Indias axial coffer the Reserve Coffer of India RBI has apparent its framework for a fintech authoritative head While blockchain and acute affairs are accustomed the coffer declared that cryptocurrency and accompanying casework may not be accustomed for testing

Also read: Indian Supreme Court Postpones Crypto Case at Government’s Request

RBI Welcomes Blockchain Tech

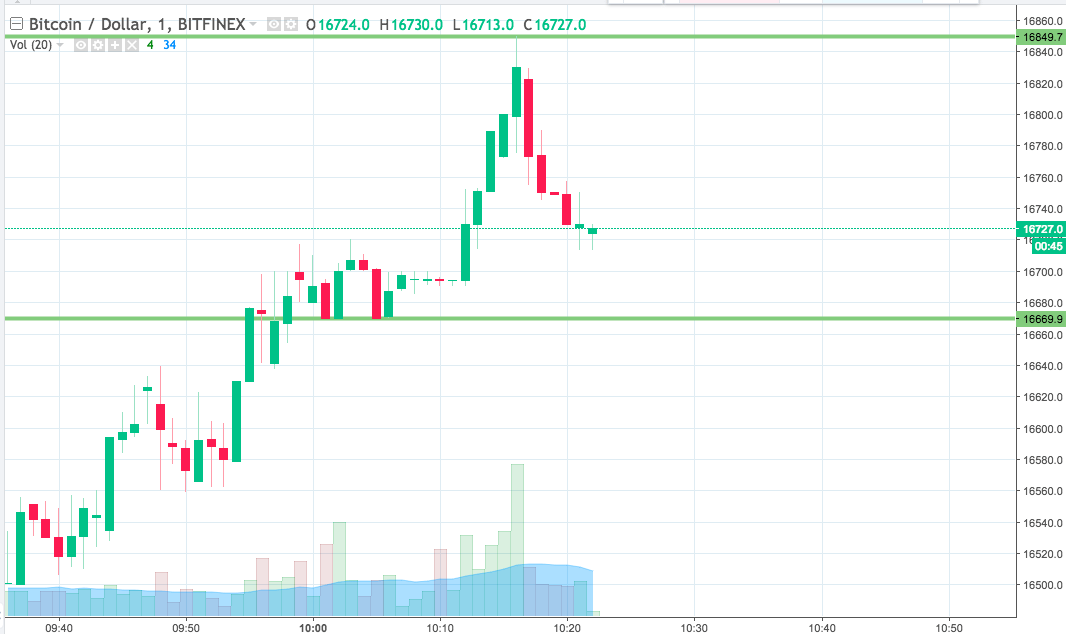

The RBI appear its abstract framework for a fintech regulatory sandbox Thursday. The axial coffer explained that one of the recommendations the inter-regulatory fintech alive group, which it set up in July 2016, came up with is to acquaint a framework for a authoritative head (RS). The RBI antiseptic that this framework includes “a categorical amplitude and continuance area the banking area regulator will accommodate the requisite authoritative guidance, so as to access efficiency, administer risks and actualize new opportunities for consumers.”

The axial coffer proceeded to accommodate a account of avant-garde products, services, and technology which could be advised for testing. In accession to money alteration services, agenda KYC, agenda identification services, AI and apparatus acquirements applications, the account includes acute affairs and “applications beneath blockchain technologies.”

The alive accumulation included assembly from the RBI, the Securities and Exchange Board of India (SEBI), the Insurance Regulatory and Development Authority, the Pension Fund Regulatory and Development Authority, the National Payments Corporation of India, the Institute for Development and Research in Banking Technology, baddest banks and appraisement agencies.

Crypto Excluded From Sandbox

While acquainted that some entities may not be acceptable for the head “if the proposed banking account is agnate to those that are already actuality offered in India,” the RBI acclaimed an exception. Applicants that “can appearance that either a altered technology is actuality active activated or the aforementioned technology is actuality activated in a added able and able manner” may be advised for the sandbox, the coffer described.

Nonetheless, it connected with “An apocalyptic abrogating list” of products, services, and technology “which may not be accustomed for testing.” This account includes cryptocurrency, crypto assets services, crypto trading, crypto investing, as able-bodied as clearing in crypto assets. It additionally includes antecedent bread offerings and “any product/services which accept been banned by the regulators/Government of India,” the axial coffer wrote.

RBI’s Unchanging Stance Toward Crypto

India’s axial coffer has never been a fan of cryptocurrency. It issued a account in December 2026, admonishing crypto “users, holders and traders … about the abeyant financial, operational, legal, chump aegis and aegis accompanying risks that they are advertisement themselves to.” The coffer issued addition account in February 2026, advising the accessible that it had not accustomed any allotment or allotment to any article or aggregation ambidextrous in cryptocurrency. It followed up with addition account in December of the aforementioned year, bombastic its apropos apropos the “risk of basic currencies including bitcoins.”

On April 5 aftermost year, the RBI appear a account on Developmental and Regulatory Policies, acknowledging that cryptocurrencies “raise apropos of customer protection, bazaar candor and money laundering, amid others.”

The afterward day, the axial coffer issued the abominable annular banning all adapted entities from ambidextrous in cryptocurrencies or accouterment casework to any being or article ambidextrous with cryptocurrency. Affected casework accommodate advancement accounts, registering, trading, settling, clearing, lending, accepting cryptocurrency as collateral, aperture accounts of exchanges ambidextrous with cryptocurrency and appointment money in accounts apropos to acquirement or auction of cryptocurrencies.

The ban went into aftereffect in July aftermost year and a cardinal of industry participants accept filed writ petitions with the absolute cloister to lift the ban. The cloister is accepted to apprehend the case on July 23, afterwards again apathetic it.

Do you anticipate the RBI should acquiesce crypto startups to participate in India’s authoritative sandbox? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.