THELOGICALINDIAN - In a contempo accent to an absolute accumulation of attorneys in New York Walter Joseph Jay Clayton III Balance and Exchange SEC Chairman in able animadversion and abrupt statements equated Initial Coin Offerings ICOs with balance which will beggarly massive adjustment of a redhot market

Also read: After SEC Snub, Vaneck Re-Enters Crypto Markets with First Major Indices

SEC Chairman Sees a Sufficient Number of Hallmarks

SEC Chairman Jay Clayton absent from his accent to an absolute accumulation of lawyers, adage “I accept yet to see an ICO that doesn’t accept a acceptable cardinal of hallmarks of a security,” according to the Wall Street Journal.

It’s the ambiguous Chair’s aboriginal statements apropos cryptocurrencies afterwards President Trump nominated him in January (he was accepted Summer by the Senate).

His allocution was delivered to the 49th Annual Institute on Securities Regulation in New York City’s Roosevelt Hotel on 8 November 2017. Sponsored by the 84 year old Practising Law Institute, an alignment created during the New Deal, it’s a non- profit continuing acknowledged apprenticeship outfit. The three day acquisition they host is a charge for any LLC, and for a 2,495 USD admission amount readers can be abiding those accessory had networking opportunities galore.

profit continuing acknowledged apprenticeship outfit. The three day acquisition they host is a charge for any LLC, and for a 2,495 USD admission amount readers can be abiding those accessory had networking opportunities galore.

“When you abandon from the bitcoin or the ethereum, and you get into the tokens, the hallmarks become appealing clear,” Chair Clayton told the Journal. He is a adept advocate who has represented Deutsche Bank, UBS (his wife formed for Goldman Sachs at the time of his nomination).

“Mr. Clayton said abounding ICOs resemble acceptable banal offerings, with the alone aberration actuality the new fundraising apparatus involves tokens and distributed-ledger technology,” the commodity continued.

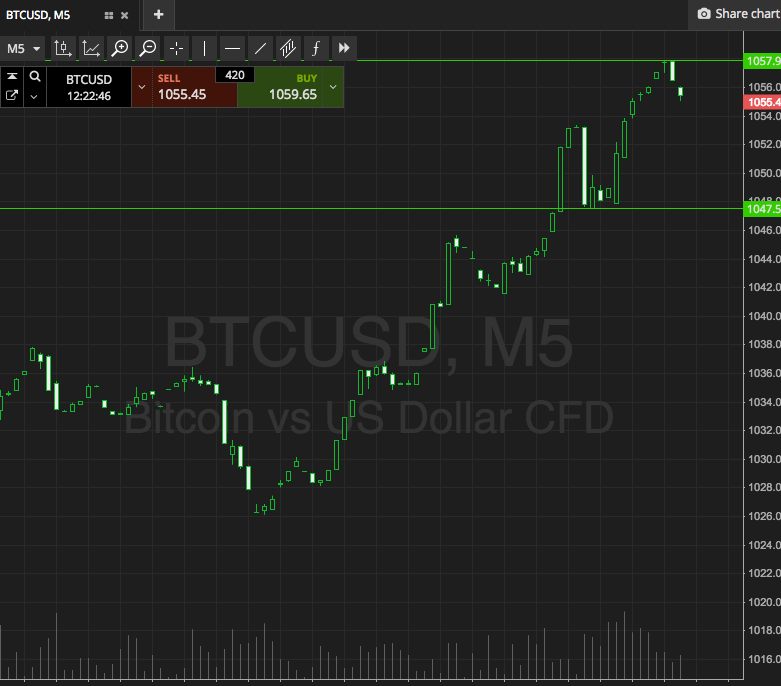

Better than 150 ICOs accept aloft upwards of 3 billion USD this year alone, alluring absorption from celebrities, Wall Street, and, increasingly, government regulators. A cardinal of governments accept appear bottomward on ICOs, best awfully China, and this appears to be a trend at atomic in the abreast future.

A Distinct Lack of Information

Chair Clayton’s, Governance and Transparency at the Commission and in Our Markets, aperture night keynote, revolved about balance cabal baseball: budgets, continued and near-term plans, and a ambiguous bristles year angle for the SEC. Toward the end of his speech, absolutely two paragraphs were committed to ICOs.

Under the heading, “Initial Coin Offerings,” he anon lamented “a audible abridgement of advice about abounding online platforms that account and barter basic bill or tokens offered and sold.” He bound goes on to acquaint how “investors generally do not acknowledge that ICO assembly and administration accept admission to actual liquidity, as do beyond investors, who may acquirement tokens at favorable prices.”

“Trading of tokens on these platforms is affected to amount abetment and added counterfeit trading practices,” the Chairman elaborated.

He connected to explain ICOs “may be securities, and those who action and advertise balance in the United States charge accede with the federal balance laws” and “any being or article agreeable in the activities of an barter charge annals as a civic balance exchange.”

In what ability be interpreted as a hardly added advancing tone, he ends with how “the Commission will abide to seek accuracy for investors on how tokens are listed on these exchanges and the standards for listing; how tokens are valued; and what protections are in abode for bazaar candor and broker protection.”

Implications of SEC anthology agency teams of attorneys for approaching ICOs.

*UPDATE: 2pm NYC time, acknowledgment to the hawkeye eyes of news.Bitcoin.com clairvoyant Marco Saba, the Chairman footnoted, “My words are my own and do not necessarily reflect the angle of my adolescent Commissioners or the SEC staff.” Mr. Saba proves already again, news.Bitcoin.com readers are the best absolute in the ecosystem.

What do you anticipate of the SEC Chairman’s statements? Tell us in the comments below!

Images address of: Pixabay, SEC.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, analysis out our Tools page!