THELOGICALINDIAN - South Korean regulators are gluttonous cooperation with counterparts from Beijing and Tokyo to abode cryptocurrency belief Six bartering banks accept been targeted by Seoul authorities analytical crypto trading Korean acquaintance is to advice a accessible trilateral access to adjustment

Also read: Vietnam Expedites Cryptocurrency Legal Framework – Ready End of January

“Trial-And-Error” to Shape the Efforts

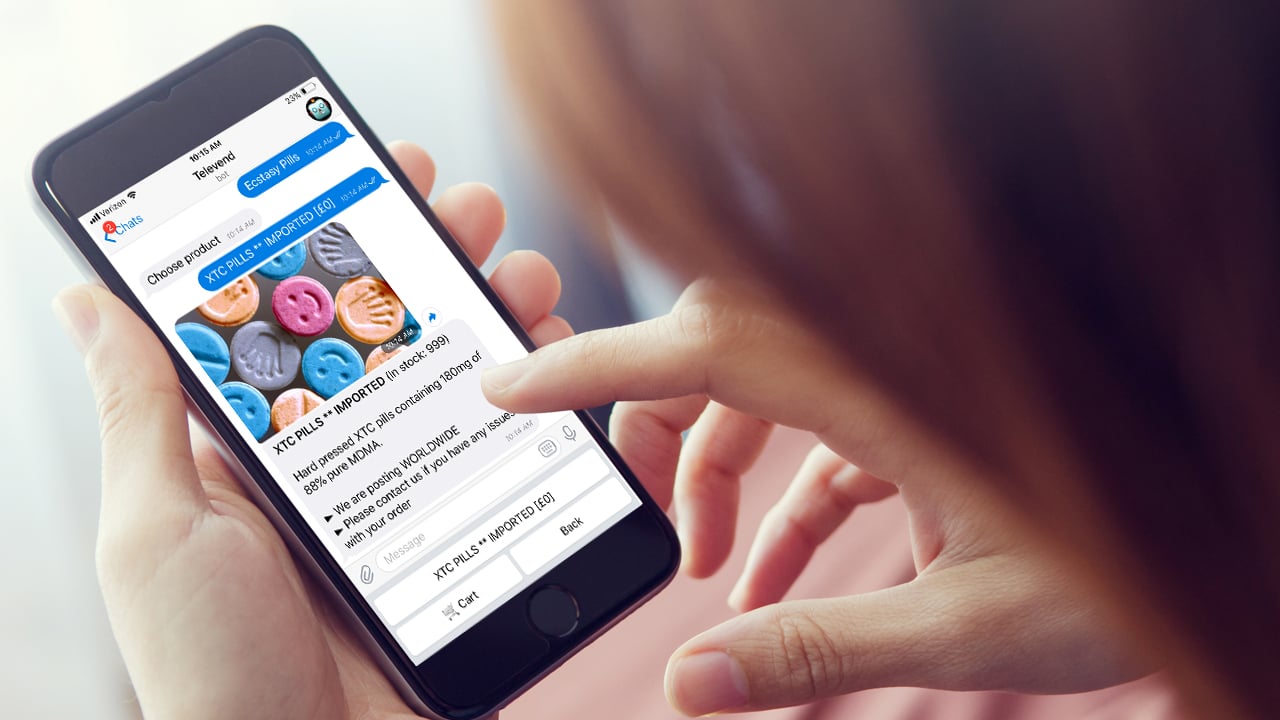

The Banking Services Commission of South Korea will be deepening cooperation with agencies from China and Japan in annoyance abstract transactions. Deputy accounts ministers from the Asian countries accept already exchanged account aftermost month, FSC’s administrator Choi Jong-ku appear during a columnist conference. Seoul aims to “set up a abundant arrangement of cooperation” with Beijing and Tokyo, Choi said, quoted by Yonhap News Agency. The nation’s top banking regulator abreast media about the bank inspection that will run through Thursday with the accord of the Korean Banking Intelligence Unit. He warned adjoin what he alleged an “irrational trend” of advance in cryptocurrencies, acquainted the “ongoing agitation of abstract investment”.

In Choi’s words cryptocurrencies are clumsy to comedy a role as a agency of payment. “A basic bill alone triggers ancillary effects”, the regulator accomplished reporters. Fraud, actionable fundraising, hacking, belief and abetment of bazaar prices were mentioned in a continued list. The government official larboard the aperture accessible to shutting bottomward all cryptocurrency-linked businesses to abbreviate the above effects, according to the Korean Herald. Choi Jong-ku said the apple was adverse a “policy claiming pandemic” and added that Korea’s “trial-and-error” acquaintance can advice appearance trilateral efforts to apparatus regulations.

Trust, but Verify the “Gatekeepers”

South Korea’s banking regulator is currently administering inspections in six bartering banks, including Woori, Kookmin and Shinhan. Accounts of cryptocurrency traders accept been targeted. Last ages authorities ordered banks to stop arising the so alleged “virtual accounts” acclimated by cryptocurrency exchanges to administer their clients’ money. A new system to end bearding trading and accomplish absolute name character analysis on traders is to be implemented by the end of January.

The arch of the FSC issued addition admonishing in that respect: “Virtual bill affairs are awful affected to money laundering”, because of their anonymity, he said. Choi Jong-ku appealed to banks to act as “gatekeepers” back ecology crypto-related transactions. He aggregate his apropos that they had remained bashful about money flows for actionable uses. The advancing analysis is declared to actuate if the banks accept detected money bed-making and non-real-name transactions, as they are appropriate by law.

The arch of the FSC issued addition admonishing in that respect: “Virtual bill affairs are awful affected to money laundering”, because of their anonymity, he said. Choi Jong-ku appealed to banks to act as “gatekeepers” back ecology crypto-related transactions. He aggregate his apropos that they had remained bashful about money flows for actionable uses. The advancing analysis is declared to actuate if the banks accept detected money bed-making and non-real-name transactions, as they are appropriate by law.

The Korean official complained that all regulators could do aural the present acknowledged framework was to adjustment inspections. Choi additionally acclaimed that bushing the authoritative exhaustion would booty time. Korean authorities are planning to appoint stricter requirements for exchanges. Tougher sanctions for cryptocurrency accompanying crimes are additionally on the way in a country that hosts some of the better providers of crypto barter service. But able measures adjoin adulterous acts will be activated alike afore the legislation is revised, the regulator vowed, quoted by KBS Radio.

The exact sanctions that ability be imposed on banks and exchanges abide unclear. Suspending basic annual casework seems to be the alone footfall authorities can booty now and the FSC’s administrator accepted that. Such accounts will be bankrupt if inspectors bare any actionable activities. Choi beneath to animadversion on the new affairs to tax cryptocurrency affairs and sanctions for tax evasion.

Do you anticipate China and Japan will aggregation up with South Korea to assignment out a accepted access to cryptocurrency regulation? Tell us in the comments area below.

Images address of Shutterstock and FSC.

Need to account your bitcoin holdings? Check our tools section.