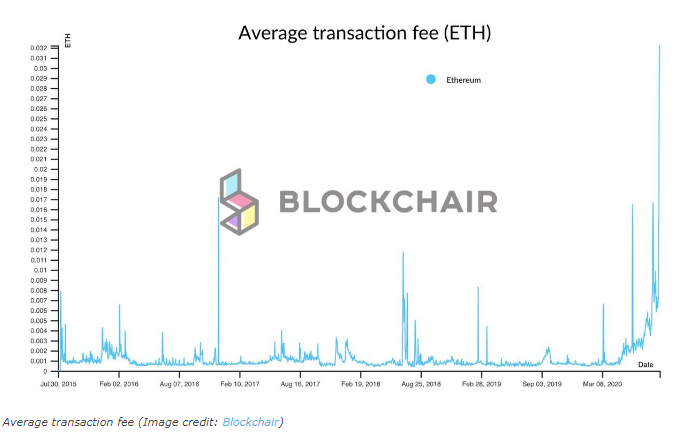

THELOGICALINDIAN - Growing Ethereum arrangement transaction fees which affected new highs afresh are a absolute aftereffect of the accretion cardinal of defi projects and crop agriculture Crop farmers charge to pay ETH for affairs like affective funds in and out of pools The added cardinal of crop farmers leads to added affairs and slower confirmations authoritative college fees assured

Such aerial fees are now aggressive the activity of some acute affairs and decentralized accounts (defi) applications.

According to a newsletter produced by Boxmining, the defi boom, like the ICO balloon of 2017, has helped to atom antagonism amid altered protocols. The newsletter singles out one project, Sushiswap, which is alone about one anniversary old, yet it is believed to be abaft “the fasten in boilerplate transaction fees on September 1, 2020.” As of September 2, the boilerplate transaction fee on the arrangement was USD$15.13.

Sushiswap, which is “a angle from Uniswap” already had “$1.2 billion on funds beneath lock” afterwards aloof bristles days. In addition, it is already “hugely accepted in China area it is dubbed ‘Uniswap’s better rival.'” It is this affectionate of animosity amid altered Defi protocols that is causing a “gas war.”

In the meantime, the college fees ability be good news to ether miners still, they are adopting apropos “about the sustainability of the network.” As the newsletter goes on to advance that “many are adage that the aerial transaction fees beggarly that they are ‘priced out’ of activities on defi platforms.”

The newsletter opines that college fees “may alike beggarly that some acute affairs become around unusable, thereby bringing the catechism of Ethereum actuality a acute arrangement belvedere in the aboriginal abode into question.”

Already, some organizations accept been affected to append affairs as they adjournment for the gas fees to acknowledgment to accustomed levels. For instance, on September 1, Publish0x, a belvedere that tips its accidental writers with ETH based tokens, announced the “payouts adjournment due to acutely aerial ETH gas fees.”

The administrator explains how the fees accept developed and how this is affecting business:

“When we aboriginal started Publish0x, gas prices were 6 gwei. It amount us $10-20 to pay out 2026 people. Today gas prices hit an best aerial of over 460 gwei, about 100x the cost. We’re attractive at $2,000 amount for a payout at accepted gas prices. This is acutely not economically viable.”

Just like others analogously affected, Publish0x says it is accessible to the achievability of application non-ETH based tokens for angled in the future.

Meanwhile, the Boxmining newsletter suggests that the “answer to this can be Ethereum 2.0, but its mainnet barrage is months away.”

In his contempo comments about the levels of gas fees, Vitalik Buterin suggests the additional band band-aid will affected the aerial fee challenge.

What are your thoughts about the appulse of Defi projects on ETH gas fees? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Blockchair,