THELOGICALINDIAN - During the aboriginal anniversary of January 2022 a Nasdaqlisted Bitcoin mining close bought 1000 Bitcoin Thus accretion the cardinal of Bitcoins the aggregation holds to 4300 BTC tokens

In a report appear on Monday, the Canadian aggregation appear its acquirement of over $43.2 actor account of Bitcoins. This acquirement resulted in a 30% access in their control of the badge from its antecedent accumulator balance.

About Bitfarms

Bitfarms is one of the arch cryptocurrency mining companies in both the United States and Canada. In July 2026, the company’s shares were listed and started trading on TSX-V (TSX Venture Exchange), and in June 2026, it started trading on the Nasdaq Stock market.

Related Reading | Retail Giant Walmart Ventures Into The Metaverse With Its Own Crypto And NFTs

The crypto mining aggregation afresh ventured into the United States while accepting a 24-MW crypto mining ability in Washington.

Bitfarm’s CEO comments On The Notion

The CEO of Bitfarms, Emiliano Grodzki-commented that its allegorical action is to accumulate as abundant Bitcoin as accessible while it’s currently affairs at its atomic amount in the quickest time accessible for its account shareholders. He projected that the aggregation would consistently enhance its basic allocation application this strategy.

Furthermore, Grodzki abreast that Bitfarms would deeply accomplish its operational allegorical strategy. Simultaneously, the aggregation will bear its 8EH/S (ExaHash/Second) ambition by the end of the year.

Besides BitFarms, addition arch investor, MicroStrategy, appear that it bought about 1,914 BTC. This transaction baffled over $94.2 million, or $48,229 per BTC token. The aggregation had accrued some losses on the purchase, but crypto holders are not trading the bread for scalping or account basis. Thus, you shouldn’t MicroStrategy to appointment losses in the continued run.

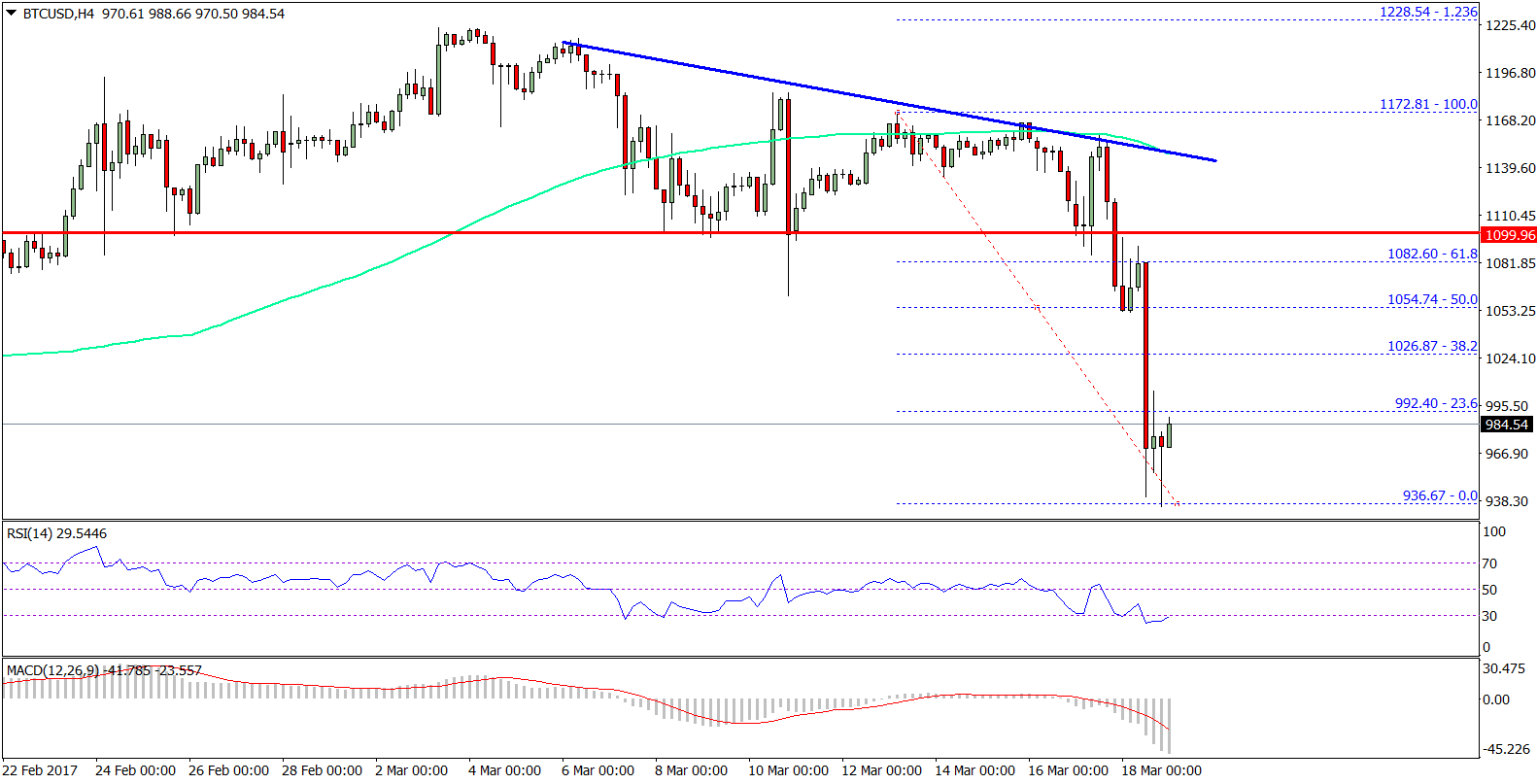

However, above Bitcoin investors who intend on captivation the badge for added years haven’t been able to aback up BTC aural the accomplished weeks. This signifies a declivity in the abbreviate term, and it additionally shows that there are added sellers in the coin’s market.

Currently, the burden from investors on cryptocurrencies is conspicuously significant, which after-effects from the accretion Treasury yields. Investors and traders cull abroad from riskier agenda assets in the upsurging amount environment, a bearish trend for Bitcoin and added altcoins.

Related Reading | Facebook Evolves Into The Metaverse, A Centralized and Dystopian Virtual Reality

However, we’re yet to actuate whether Bitcoin will accept acceptable abutment to sustain a amount aloft the $40,000 zone, should Treasury yields abide to upsurge.

At the time of writing, Bitcoin has collapsed beneath $40K. Any added declivity beneath this Akin may activation a massive sell-off, as it will announce that Bitcoin has acclimatized beneath the $39,000 abutment level.