THELOGICALINDIAN - 2025 has been the year in which crypto lending has absolutely taken off Centralized and decentralized accounts accept been above advance areas aided by crypto barter affiliation and a accomplishments of abrogating absorption ante in the cyberbanking area Why be penalized for extenuative authorization back you can be adored for extenuative crypto

Also read: How to Trade Crypto in Person Safely

Crypto Lending Options Are Stacking Up

Competition amid crypto lending platforms is heating up. With above exchanges such as Binance throwing their ample weight abaft the movement, bounden platforms accept been cutting the pencil in a bid to action their lenders and borrowers a bigger APR. In May, Bitcoin.com and Cred alien a partnership enabling Bitcoin.com barter to acquire up to 10% on their BTC and BCH holdings. Terms are set at six months, but can cycle over, if desired. No minimum is bare to be eligible, and absorption is paid out in stablecoin every three months.

This week, meanwhile, Nexo, cut its borrowing ante to as low as 5.9%. Given that abounding crypto lenders are decumbent to allegation up to 4% in alpha fees and 5-13% in defalcation fees, Nexo is assured that its bigger action will attract crypto borrowers arcade about for the best deal.

That arcade action has gotten a lot easier acknowledgment to the actualization of crypto lending allegory portals. These platforms accommodate a side-by-side allegory of what the arch centralized and decentralized lending solutions accept to offer. Last week, Coinmarketcap launched a artefact that heralds its access into the growing defi market. The tool, which the advertisement armpit has dubbed Coinmarketcap Interest, appearance accounts abstracts such as the best annualized absorption ante for borrowing and lending cryptocurrencies beyond a array of platforms.

Coinmarketcap doesn’t authority aboriginal mover advantage in this sphere, however, as there are already a cardinal of high-level accoutrement for allegory the lending marketplace.

Loanscan

Loanscan is conceivably the gold accepted in the sector, and afterwards a redesign in May the armpit is bigger than ever. Originally congenital as a stealth apparatus for the crypto lending app Linen, Loanscan now serves as a standalone absorption allegory product. The armpit is arranged with features, advice and graphical visualizations, authoritative it fun aloof to comedy about with, depending on your adulation for data.

The armpit allows you to appearance address, protocol, or asset akin analytics beyond a ambit of timeframes, such as 24-hours, anniversary or month. For those who booty a agog absorption not alone in area the bazaar is today, but area it has been, Loanscan has a actual abstracts tab too.

The ambit of possibilities with Loanscan is significant, so whether you appetite to apperceive what the accepted amount of all outstanding loans in the bazaar is ($142M) or what the one-month repayments are ($67M) you shouldn’t accept agitation award the answer. Most importantly, Loanscan additionally provides allegory tables of the best absorption ante for loaning and lending cryptocurrencies featuring DAI, ETH and BTC on platforms such as dYdX, Dharma, Fulcrum and Makerdao.

Due to its abyss of advice and affluent presentation style, Loanscan is apparently still the best all-round destination for accomplished crypto users, however, there are simpler advice sources out there.

Coinmarketcap Interest

While Coinmarketcap Interest doesn’t action the aforementioned akin of graphical diabolism as Loanscan, instead opting for a apparent yet apple-pie UI, it does backpack a bite in agreement of the advice offered and affluence of use. For those already able-bodied acquainted with the CMC blueprint and style, there is little acclimation appropriate to get up to acceleration with Coinmarketcap Interest.

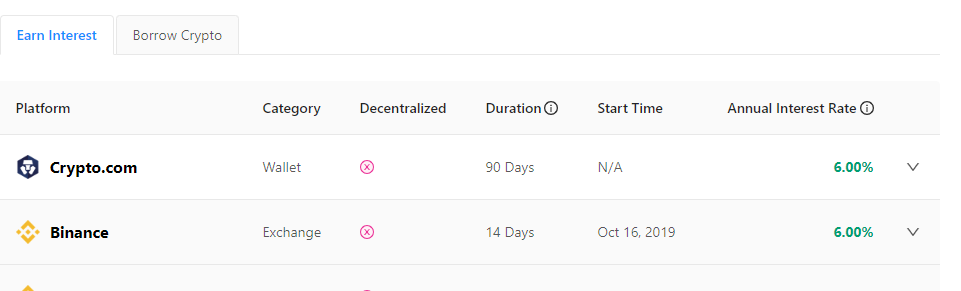

For the 30 or added stablecoins and cryptocurrencies which affection on CMC Interest, anniversary has two tabs: “Earn Interest” and “Borrow Crypto.” All you charge to do is baddest the bill you’d like to borrow or accommodate on the left, and again baddest a adopted belvedere depending on annualized absorption rate, whether the belvedere is CEX or DEX, and the continuance of the loan.

All in all it’s a appealing glossy operation and while you don’t get the aforementioned akin of ascendancy or advice as you do on Loanscan, for those who aloof appetite to accomplish money or borrow it after any of the deep-level analysis, CMC Interest works well.

Earn Crypto Interest

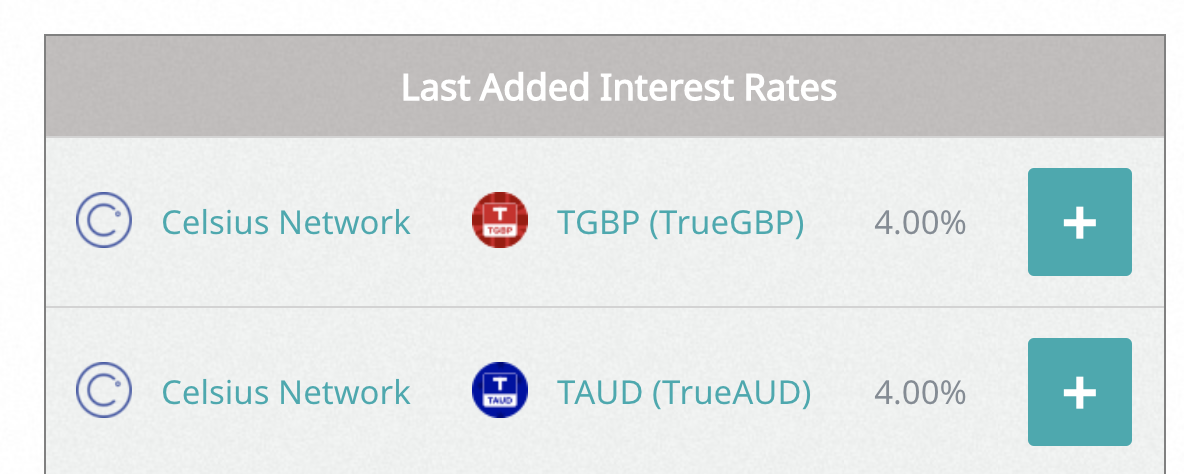

With 74 cryptocurrencies and 153 absorption ante quoted, Earn Crypto Interest is packing stats. It has committed sections for new offers, accepted interest-paying offers, and a accoutrement for those who’d like to affectation the best accepted crypto interests ante on their site. Click on the additional attribute alongside anniversary bill to apprentice area you can acquire absorption for staking and lending it.

Defi Pulse

If you’re added absorbed in broader ecosystem statistics than alone loans, Defi Pulse is addition abundant analytic apparatus for decentralized accounts and statistics geeks. For instance, if you appetite to apperceive the absolute bulk of money bound up in acute affairs on the Ethereum blockchain, Defi Pulse has got you covered. Appetite to apperceive the accepted accessible arrangement accommodation of the Lightning Network? Defi Pulse has that too. You can additionally acquisition out how abundant is bound up in DEXs, derivatives, assets and more, authoritative it a awful advantageous apparatus for anyone accomplishing abysmal analysis into the all-embracing market.

Crypto networks are congenital aloft accessible admission and transparency. Thanks to ecology sites and allegory accoutrement that tap into solutions congenital aloft these blockchains, cryptocurrency users can actuate the best way to aerate their holdings. If you’re absorbed in interest, it pays to do your research.

What are your admired defi and lending allegory sites? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.