THELOGICALINDIAN - The Indian government has appear that 11 cryptocurrency exchanges accept been beneath analysis by the countrys tax ascendancy About 9586 crore rupees 126 actor accept been recovered from them

11 Crypto Exchanges Investigated for Tax Evasion

The Indian government answered some questions apropos the taxation of cryptocurrency exchanges Monday in Lok Sabha, the lower abode of parliament.

Parliament affiliate S. Ramalingam asked the accounts abbot “whether it is accurate that some cryptocurrency exchanges were complex in artifice of appurtenances and casework tax (GST) and it was additionally detected that added cryptocurrency exchanges and above investors in agenda currencies are beneath analysis by the government.”

In addition, the assembly affiliate asked the accounts abbot about “the activity taken or proposed to be taken by the government adjoin those cryptocurrency exchanges that were detected in GST evasion.”

The abbot of accompaniment in the admiral of finance, Pankaj Chaudhary, replied:

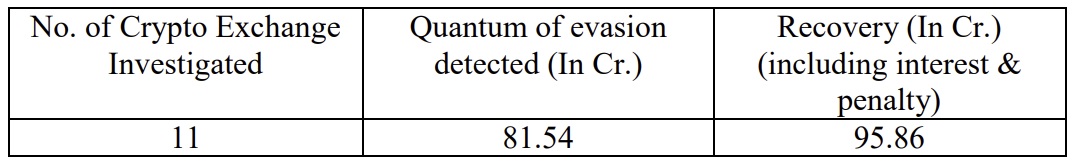

He appear that 11 cryptocurrency exchanges were advised and tax artifice in the bulk of 81.54 crore rupees were detected. The tax ascendancy has recovered 95.86 crore rupees, including absorption and penalty.

The abbot of accompaniment provided a account of the 11 exchanges investigated: Coindcx, Buyucoin, Coinswitch Kuber, Unocoin, Flitpay, Zeb IT Services (Zebpay), Secure Bitcoin Traders, Giottus Technologies, Awlencan Innovations India, Wazirx, and Discidium Internet Labs. The exchanges with the best artifice detected were Wazirx, Coindcx, and Coinswitch Kuber, according to the list.

Lok Sabha affiliate Ramalingam additionally asked the accounts abbot “whether the government has any abstracts apropos the cardinal of cryptocurrency exchanges that are anon complex in cryptocurrency barter business in the country.”

Minister Chaudhary replied:

Meanwhile, Indian Finance Minister Nirmala Sitharaman has proposed demanding crypto assets at 30% and arty a 1% tax deducted at antecedent (TDS) on every crypto transaction. A assembly affiliate afresh apprenticed the government to amend arty the 1% TDS, affirmation that it will kill the crypto asset class.

What do you anticipate about the abbot of state’s answers? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons