THELOGICALINDIAN - According to a arrangement afresh acquired by the Daily Beast the IRS can now clue bitcoin and added cryptocurrency addresses They can do this to avenue out abeyant tax evaders They purchased software from the blockchain assay accumulation Chainalysis

Also read: Nakamoto Institute Daniel Krawisz: “I Don’t Like Altcoins, but I Like Forks”

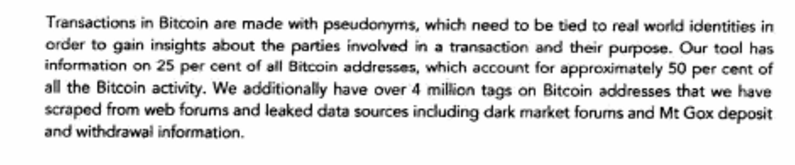

The document details that “criminals” accept acclimated agenda currencies to acquit money, accord drugs, and accomplish added actionable behavior. However, abyss accept additionally been application agenda currencies to avoid tax liabilities and balk responsibility. The Daily Beast commodity elaborated:

Reason for IRS Crackdown; Tracking Bitcoiners

The acumen the IRS is arise bottomward on agenda currencies appears to be because alone 802 bodies declared bitcoin profits or losses in 2015. The Daily Beast article suggests that abounding bodies may accept not accepted the IRS to aggregate on agenda currencies. Others may accept aloof anticipation they could calmly abstain this declared obligation.

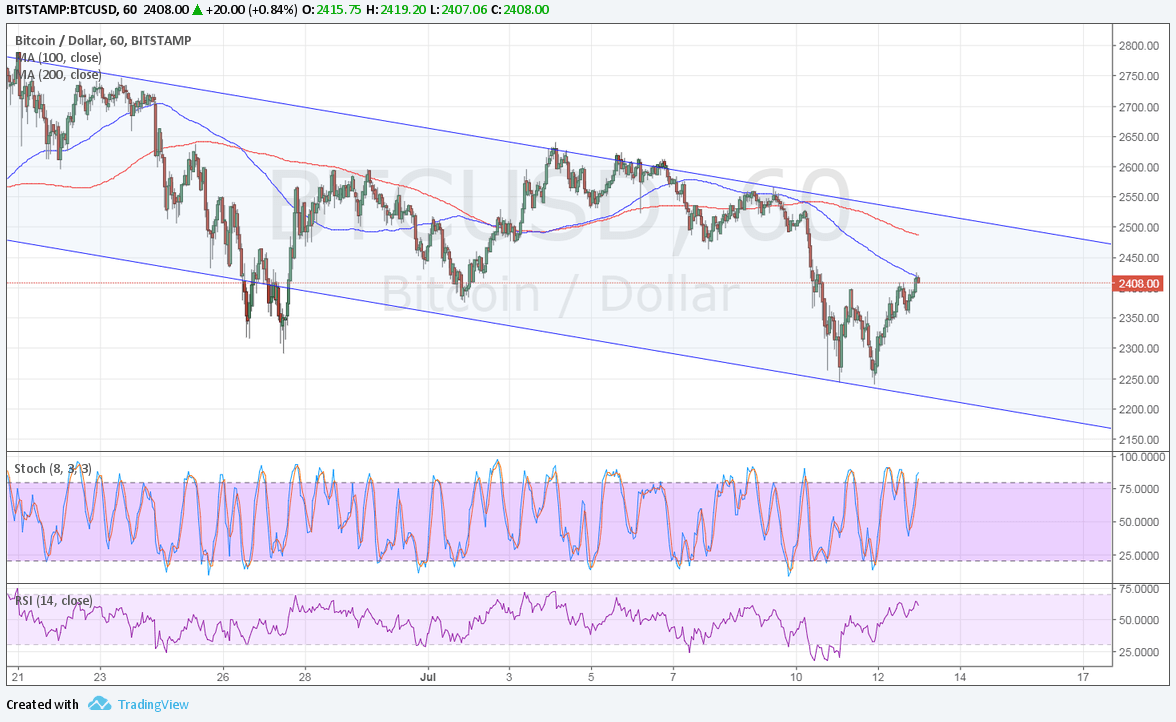

As a aftereffect of this abortion to pay taxes, the IRS consulted with Chainalysis. They are now accouterment the IRS with accoutrement to clue bitcoin addresses through the blockchain and centralized exchanges. A Fortune article captured a awning attempt of the letter:

The apparatus that Chainaylsis gave the IRS is alleged a refactor tool. It visualizes, tracks, and assay affairs on the blockchain. Agencies from law enforcement, IRS, and banks will be able to use the tool, according to sources. To date, annal appearance the IRS has paid Chainaylsis $88,700 back 2026 for its services.

Tax Evaders and “Criminals” are Adapting; Coinbase Case

Even admitting the IRS and companies such as Chainalysis are starting to coursing bottomward blockchain users for artifice taxes, active individuals are adapting. They are now starting to use blockchains and cryptocurrencies that attenuate accepted analytic techniques. For instance, the Wannacry hacker accumulation allegedly confused their funds over into Monero to balk apprehension by law enforcement. Other crypto users may adjudge to use Zcash, which additionally employs added clandestine and bearding transaction measures.

In the past, the IRS has acclimated assorted outlets to abduction tax evaders application bitcoin. They accept already approved to accurately force Coinbase to duke over chump information. Currently, it looks like Coinbase may abandonment chump abstracts for those who exchanged over $20,000 account of bitcoin on the platform. No cogent what the cloister will aphorism in the end. News.Bitcoin.com covered the case in June:

Do you anticipate it is all-important for the IRS to clue people’s bitcoin? Will the IRS accomplish at communicable anybody who evades taxes? Let us apperceive what you anticipate in the comments below.

Images via Shutterstock, bistatebusinesscenter.com, and Chainalysis

Have you been to Bitcoin.com’s store? We accept the coolest Bitcoin swag on the planet from t-shirts, to artwork, accouterments wallets, and mining accessories. You should additionally analysis out our forum area you can altercate the latest trends in the Bitcoin universe. Analysis em’ both out today!