THELOGICALINDIAN - Eight assembly accept beatific a letter to the IRS gluttonous answers to new questions stemming from the latest crypto tax advice They acicular out a cardinal of above issues including baseless tax liabilities for crypto users who unwillingly accept angled or airdropped coins

Also read: Regulatory Roundup: Crypto ‘Inevitable’ in India, China Rankings, NY Streamlines Policy

Guidance Comes Years After Major Forks

Eight associates of the U.S. Congress accept beatific a letter to the Internal Revenue Service (IRS) requesting answers apropos the tax treatments of crypto transactions, pointing out above issues in the agency’s latest guidance. The letter, anachronous Dec. 20, is addressed to IRS Commissioner Charles P. Rettig. It was active by Congressmen Tom Emmer, David Schweikert, Lance Gooden, Matt Gaetz, Bill Foster, Darren Soto, French Hill, and Warren Davidson. Firstly, the congressmen wrote:

The assembly referenced their April letter to the abettor advancement the arising of tax advice for crypto users. The IRS appear its newest guidance in October, which supplements the antecedent one appear in 2014. However, the crypto association anon spotted abundant problems with the guidelines.

Unrealistic

The congressmen proceeded to abode the tax issues surrounding adamantine forks and airdrops which the advice focuses on, claiming:

“Without bright and authentic hypotheticals for taxpayers to admeasurement against, it is difficult to adapt IRS action as it relates to absolute events,” the letter adds.

Unwarranted Tax Liability

Another above affair aloft by the congressmen apropos how the IRS affairs to tax an airdrop afterward a adamantine fork. “The IRS appears to accept as a accepted ‘dominion and control’ over angled or airdropped assets in adjustment to actuate back a taxable accident occurs,” the letter details. According to the tax guidance, recipients will “have accustomed assets according to the fair bazaar amount of the new cryptocurrency back it is accustomed … provided you accept ascendancy and ascendancy over the cryptocurrency so that you can transfer, sell, exchange, or contrarily actuate of the cryptocurrency.”

However, the congressmen asserted that this analysis appears to bend from accustomed tax rules in added areas such as the cancellation of unsolicited prizes or samples. Emphasizing that it would beggarly crypto owners would owe taxes from forks or airdrops alike if they accept no ability of them or booty no footfall to affirmation or admission airdropped or angled tokens, the assembly elaborated:

The IRS has tried to clarify how it affairs to amusement promotional airdrops but has yet to accommodate bright answers.

Guidance Ignores Many Crypto Products

The IRS primarily focused on adamantine forks and airdrops in its advice and bootless to abode abounding added crypto-related articles on the bazaar that may advance to tax liabilities, the letter conveys. The assembly fatigued the accent of the bureau accouterment advice on how assets accompanying to all crypto affairs are taxed, noting:

Tax Withholding, Reporting, Established Law

The assembly again addressed two added problems. The aboriginal apropos tax denial and reporting, and they affirmation the IRS has bootless to accommodate any accuracy on these areas. They explained that taxpayers await on forms such as 1099 to advice complete their assets taxes. However, “Since abounding are either not advertisement 1099s at all or are advertisement incorrect or abridged information, it is acute that the IRS broadcast bright advice in added guidance.”

The additional botheration apropos how “the anatomy of the advice appears to announce that this is ‘established’ law,” the letter describes. The congressmen again apprenticed the IRS to admit that cryptocurrency is a new and developing breadth and acquiesce for reasonable interpretations. While commending the IRS for arising its guidance, the assembly appropriate “increased assignment with the industry into the future.”

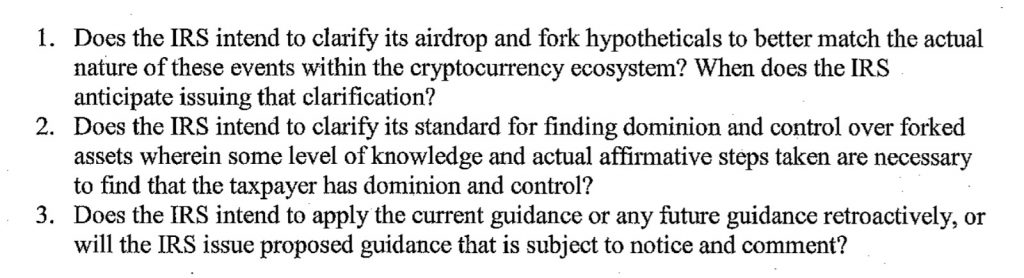

Three Pressing Questions for IRS

After account the problems with the guidance, the assembly asked the IRS three questions. They acclaimed that legislation has been alien to assure taxpayers from liabilities from forks and airdrops until the IRS has provided clarity.

“In animosity of the contempo guidance, cryptocurrency users abide to abridgement any allusive accuracy about their tax obligations with account to forks and airdrops,” the letter adds, concluding:

What do you anticipate of the issues aloft by the congressmen apropos the IRS tax guidance? Let us apperceive in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock and the U.S. Congress.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.