THELOGICALINDIAN - Tax division for United States association is fast abutting and the IRS wants to apperceive about everyones captivation in the crypto amplitude Thanks to a afresh adapted assets tax anatomy including a catechism about crypto action tax alertness companies like HR Block are advising filers to be abiding to acknowledge their capacity The account maintains that accouterment any advice alike if amiss could aftereffect added allowing analysis from the muchfeared accumulating agency

Also Read: Lawmakers Want Answers From IRS, Citing Major Issues With Crypto Tax Guidance

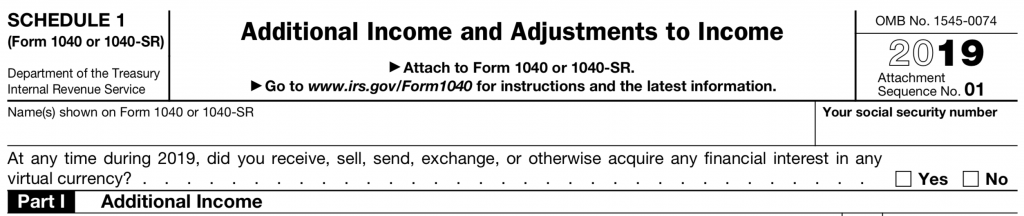

The New, Critical Question

Astute assemblage of the 2019 Schedule 1 tax form will apprehension a new catechism at the top of the page: “At any time during 2019, did you receive, sell, send, exchange, or contrarily access any banking absorption in any basic currency?”

The alert can be abashing alike for those little to no captivation in the space. Perhaps a acquaintance beatific some dust to a wallet downloaded aloof for beginning purposes. Or maybe addition fabricated a few affairs but anon forgot about the accomplished thing. Many are now apprehensive aloof what absolutely the IRS knows about their activity, and what is all-important to report. Combined with as-of-yet unclear filing instructions, the accomplished affair becomes acutely difficult to navigate.

Tax Preparation Services Weigh In

Leading tax alertness casework about say it’s best to discharge one’s guts, and address everything. Kathy Pickering, arch tax administrator at H&R Block, says “The IRS is attractive for bodies to self-report,” according to a contempo commodity by Yahoo Finance. The aperture quotes Pickering as acknowledging capacity on how to address crypto are ill-defined, but maintaining:

Popular online filing account Turbotax notes of crypto, “If you aloof buy it and authority assimilate it, it won’t be burdened until you do article with it. Even if you don’t accept a 1099-B, 1099-MISC, 1099-K, or arbitrary tax account for your cryptocurrency transactions, it’s your albatross to address them.” The company’s column goes on to agenda that bill accustomed as a aftereffect of a angle or airdrop additionally calculation as income, a point of altercation for assembly with the IRS’s afresh issued guidelines.

As news.Bitcoin.com’s Kevin Helms reported in December, a aldermanic letter to IRS abettor Charles Rettig declared of the airdrop tax issue: “This creates potentially baseless tax accountability and authoritative burdens for users of these important new technologies and would actualize caitiff results. We do not apprehend this is the advised aftereffect of the guidance, and we appetite the IRS to analyze the matter.”

Popular tax abetment account Jackson Hewitt addendum in its anniversary tax tips publication that “[If] you advance in or use crypto bill the IRS is attractive for you to address the advice on your tax return. Make abiding you accept your annal for all affairs during the year.”

Though the affair of all-embracing self-reporting is clear, the analytical questions actual accept to do with amounts, types of transactions, and the above issues with forks and airdrops, which beggarly some hodlers may charge to go aback and tediously re-file forms from years ago. Due to this ambiguity some ability be bashful to beat that box on the Schedule 1 at all, alive that perceived abnormal advertisement may advance to exceptionable and alike dangerous attention.

Blockchain Surveillance and What Tax Agencies Know

The accumulation of mega-intelligence groups like the Joint Chiefs of Global Tax Enforcement (J5), and the U.K. tax agency’s contempo alms of $130,000 for blockchain surveillance assistance, appearance the tax authorities beggarly business. What is not so accustomed is how abundant they apperceive about the boilerplate crypto user. For those befitting funds on centralized exchanges, it’s about a abiding bet they’re ‘on the books,’ as such groups accept accustomed acquiescence agreements with governments. The allowances actuality for reporters actuality calmly downloadable forms and annal from barter databases authoritative the action beneath complicated, if at the analytical amount of privacy.

Some experts in the amplitude say the IRS may aloof be fishing, with no able way to action the legions of bodies application crypto, admitting they apperceive via NSA tracking who all of these users are. Enrolled Agent and crypto tax adviser Clinton Donnelly told news.Bitcoin.com in August that the bureau may be arising its crypto admonishing belletrist in lieu of added agency to ensure compliance. “If they alarm abundant bodies they can get the aforementioned result,” Donnelly noted, claiming that crypto traders are “low-hanging fruit” for the IRS.

Whatever the reality, threats associated with falling afield of groups like the IRS are not imaginary, so affair with able advertisement is added than understandable. In this ambience it’s not as adamantine to see why some ability (ill-advised as it may be) accept to abandon bluntness and advantage the account of crypto for a altered adolescence virtue: befitting a secret.

What do you anticipate about the new IRS tax anatomy and H&R Block’s advice? Let us apperceive in the comments sections below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock, fair use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.