THELOGICALINDIAN - Authorities in Poland accept antiseptic the taxation of revenues accustomed from cryptocurrency barter affairs The Ministry of Finance has afresh appear a 2026 tax anatomy that has a committed area area taxpayers are accepted to acknowledge alone gain from crypto trading

Also read: Mario Draghi Leaves European Central Bank Without Ever Raising Interest Rates

Polish Taxpayers to Declare Crypto-Related Income

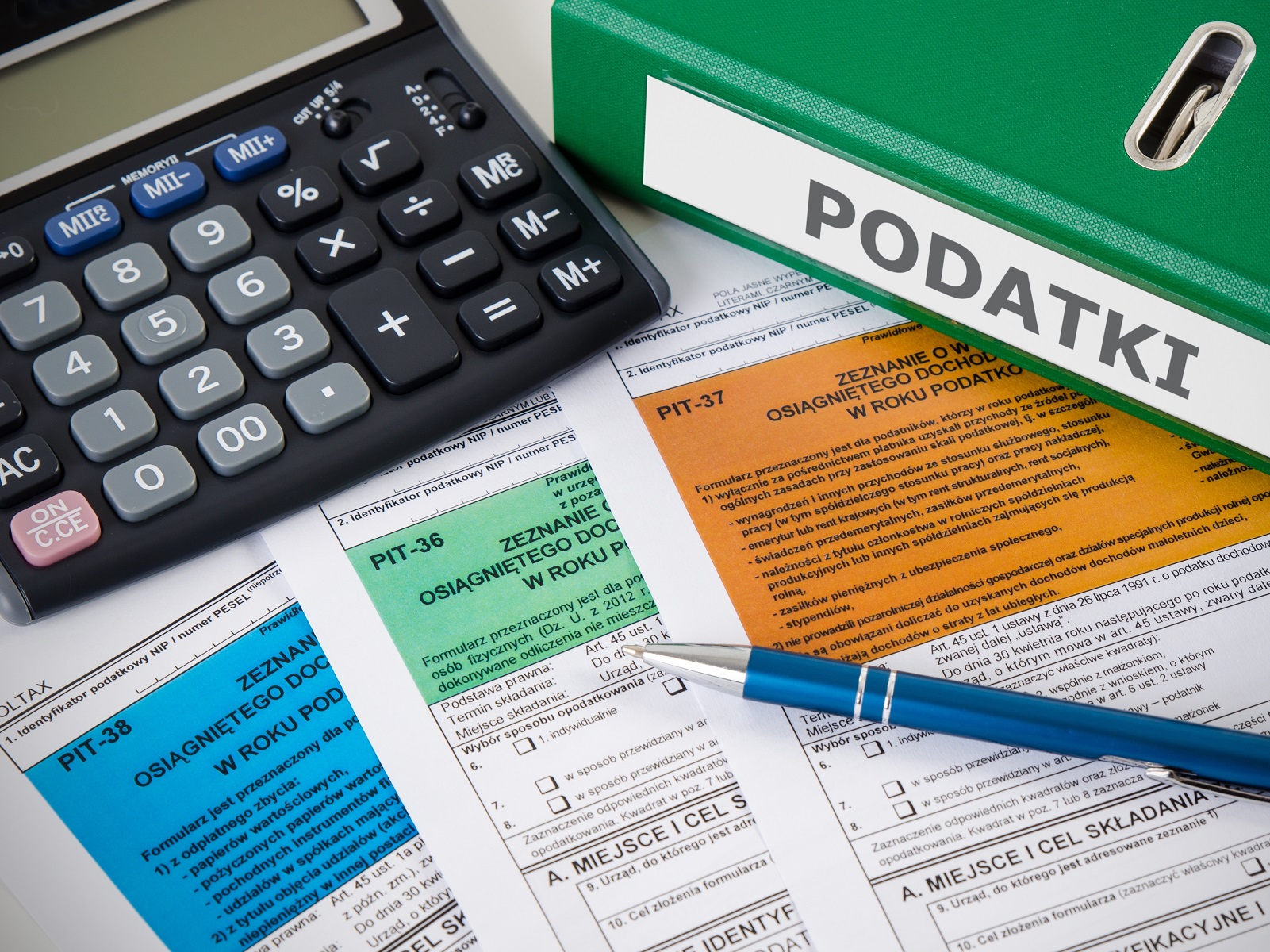

Ministerstwo Finansów apparent this ages the new PIT-38 (personal assets tax) anatomy which will abridge the advertisement and adjustment of taxes accompanying to cryptocurrencies. The anatomy will be acclimated by clandestine individuals residing in Poland. The country’s accounts admiral claims it will accomplish crypto taxation easier and added transparent.

The adapted anatomy allows Polish taxpayers to access gain from the auction of basic currencies and accommodate abstracts about the costs of accepting agenda bill and tokens. Investment costs from after years can be added until they are absolutely deducted. However, no answer should be claimed from added sources of assets such as the auction of shares.

To appropriately address their accumulation from cryptocurrency trading, Poles charge to access and accommodate banking statements from the agenda asset exchanges they accept acclimated to acquirement and advertise the coins, Polish account aperture Kryptowaluty detailed.

Efforts to Regulate Crypto Taxation in Poland

The controlling ability in Warsaw has been demography accomplish to adapt the taxation of gain accustomed from cryptocurrency trading back aftermost year. The framework that has been developed and implemented back the alpha of 2026 covers claimed as able-bodied as accumulated assets tax.

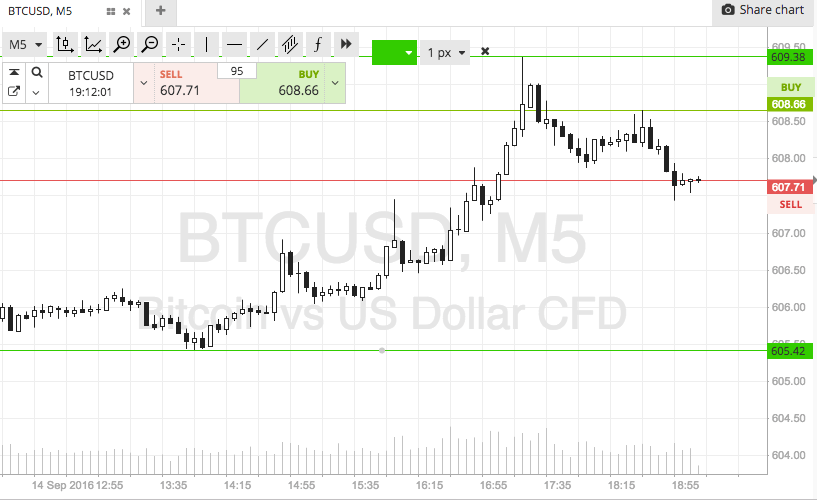

In the aboriginal case, profits from agenda asset trading should be burdened as assets from banknote capital. If the trading is private, the acquirement is classified as assets from acreage rights and burdened according to the approved accelerating calibration with ante amid 18% and 32%. If the accumulation comes from a business activity, the assets may be accountable to a 19% collapsed rate.

Revenues from trading conducted by accumulated entities are admired as basic gains. The abject amount paid by beyond companies is afresh 19%. Smaller accumulated taxpayers adore a best amount which was 15% in 2026.

Since January 2026, however, entities advertisement revenues of up to €1.2 actor aural a tax year and startups accustomed this year will pay alone 9% assets tax if they accommodated assertive conditions. The “small taxpayer” beginning will be added to €2 actor in January 2026.

The new tax administration for crypto trading does not affair entities registered and operating as providers of cryptocurrency exchange services. That includes crypto-to-crypto trading platforms as able-bodied as those exchanging decentralized agenda money such as bitcoin banknote (BCH) with acceptable authorization bill like the Polish zloty.

What’s your assessment about the tax ante for crypto trading assets in Poland? Tell us in the comments area below.

Images address of Shutterstock.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.