THELOGICALINDIAN - Tax division is months abroad which is why you charge to alpha advancing for it now Leave aggregate to the aftermost minute and youll alone end up cursing your dabbling Organize your cryptocurrency action in beforehand and youll breeze through tax borderline day after so abundant as backward Despite maddeningly ambiguous or arbitrary legislation filing your crypto taxes is decidedly simple acknowledgment to an arrangement of accoutrement that accomplish tracking and artful your obligations a cinch

Also read: Argentina’s Peso Collapse Shows Governments Shouldn’t Control Money

Crypto Taxation Doesn’t Have to Be Testing

Whatever your thoughts on advantageous tax, the actuality of the amount is that it’s an certain obligation. Unless you’re advantageous abundant to alive in a country that doesn’t appoint assets tax (here’s attractive at you Bermuda, Monaco, Bahamas, Andorra and the United Arab Emirates), appear April, you’re activity to accept to pay your dues. There’s no accepting about it, but that doesn’t beggarly you accept to access the abutting of the tax year with a faculty of dread. With the appropriate planning, you can automate abundant of the process, extenuative yourself no end of time, altercation and expense.

Accurately filing your crypto taxes calls for advancement abundant annal of all your affairs and trades that action over the advance of the year. As a result, best of the specialist tax software on the bazaar additionally doubles as an accomplished portfolio tracker. That’s right: alike if you accept no absorption in advantageous tax, you can still acquire amount from a artefact that annal all of your crypto assets (and losses), and presents them in an adorable amalgamation that can be beheld on desktop or mobile. The afterward accoutrement accommodate all that additional a accomplished lot more.

Koinly

Koinly promises to advice cryptocurrency owners account their taxes and abbreviate their bill in the process. It’s accordant with the tax arrangement in over 100 countries and is chargeless to alpha using: you’re alone answerable back you charge to accomplish a tax report. Back you assurance up, you’re prompted to baddest whether you ambition it to apprehend assets every time you barter crypto; if you baddest no, Koinly will artlessly serve as your portfolio tracker. Like the added accoutrement profiled here, Koinly requires you to articulation barter accounts and wallets, which can be done manually or via API. You can again analysis your transactions, tag airdrops, forks, and absent or able coins. 33 exchanges are accurate as able-bodied as six blockchains including BCH, LTC, and BTC.

Koinly automatically matches transfers amid your wallets and shows you assets or losses for anniversary transaction. There are additionally accoutrement for allegory your trading habits, tax accident harvesting, and amount tracking including mining expenses. The Hodler plan ($79 per year) covers 300 affairs and can almanac assets and basic assets tax. The Trader plan ($179) covers 3,000 transactions, while Oracle ($399) has accommodation for 10,000 affairs and offers added abutment and acceptation assistance.

Blox

Blox offers abounding of the aforementioned appearance as Koinly, but is targeted at crypto businesses as able-bodied as individuals. It allowances from CPA accoutrement that acquiesce teams to actualize an auditable almanac of all crypto activities, which can be exported as a CSV or alien anon into accountancy software that Blox has chip with. Your accepted portfolio is neatly displayed in the dashboard, area you can appearance an annual overview, admission specific transactions, and see a circadian snapshot of your portfolio. With bags of cryptocurrencies listed aural Blox, alike the best arguable of tokens can be tracked and the agnate tax obligations calculated.

Blox provides a detailed guide to prepping your taxes application their software, afterwards which you can book your crypto taxes or consign the abstracts to your bookkeeper, who can booty affliction of the rest. There’s additionally a apartment of accoutrement devised accurately for cryptocurrency miners, including cloud-hosted mining solutions. Blox alike operates its own nodes to advice ensure that affairs and balances are accurate. The Pro plan is chargeless and covers 100 affairs (tx) and up to $50K AUM, while the Business plan, at $99 per month, covers 10K tx and $20M in assets. There’s additionally an Enterprise plan ($249) for abundant users that will board a whopping $60M AUM.

Bittax

Complying with baggy and frequently alive tax guidelines can be challenging. Bittax aims to set cryptocurrency owners at affluence by accouterment able advice on the latest decrees from the IRS. At its heart, Bittax is a crypto tax organizer that works analogously to the added articles profiled here: acceptation your wallet addresses and barter abstracts and the software will account your taxes. It uses a proprietary tax planning algorithm that helps to calmly adapt and consolidate your liabilities, after compromising your adored privacy. For U.S. citizens gluttonous to do aggregate by the book, and to accommodated the best accurate standards set by the IRS, Bittax has got your back.

Cointracking

Cointracking’s greatest backbone is as a cryptocurrency portfolio monitor. Its tax prepping backdrop are additionally useful, but the affection of the insights it provides alive traders is decidedly good. There’s a timeline tool, which populates with trading milestones, there are archive announcement your antithesis per day, trades per month, trades per exchange, boilerplate acquirement amount and abundant more. When it comes to taxes, Cointracking supports the FIFO, LIFO, HIFO and LOFO methods, of which FIFO (first in, aboriginal out) is the best frequently used.

There’s the adeptness to clue bill that accept been captivated for best than a year, and which can appropriately be awash tax-free in assertive jurisdictions. Other accoutrement accommodate the adeptness for U.S. citizens to actualize an FBAR address in the accident of them owning adopted banking accounts absolute assets account over $10,000. The cardinal of exchanges and wallets that Cointracking supports via API or CSV is impressive; there’s alike bequest abutment for bankrupt exchanges, from Btce to Mt. Gox. The chargeless plan covers 200 tx, ascent to 3,500 for Pro. There’s additionally an Unlimited plan for abundant traders. Another acceptable affair about Cointracking is that you can pay for your cable in BTC including the advantage to booty out a lifetime license.

Don’t Let Tax Take Over Your Life

In abounding countries, the U.S. especially, the laws apropos crypto taxation are unfair, vague, and accountable to interpretation. Only aftermost month, North Carolina’s Rep. Ted Budd reintroduced the Virtual Value Tax Fix Act in the U.S. House of Representatives. The bill seeks to put a stop to the bifold tax that is currently imposed on cryptocurrency, authoritative it unnecessarily circuitous to account and almanac tax every time a acquirement is made.

As a cryptocurrency user, there’s little you can do to access government action back it comes to taxes; the accompaniment moves ponderously, and it may be a while yet afore citizens in the U.S. and abroad see annihilation abutting a fair crypto tax policy. In the meantime, the best affair you can do is almanac your affairs application a purpose-built apparatus and again get on with your activity in the ability that the adamantine allotment is done. Automate your tax and again you can relax.

What added tax tracking accoutrement do you recommend? Let us apperceive in the comments area below.

Disclaimer: Readers should do their own due activity afore demography any accomplishments accompanying to third affair companies or any of their affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any third affair content, appurtenances or casework mentioned in this article.

Images address of Shutterstock.

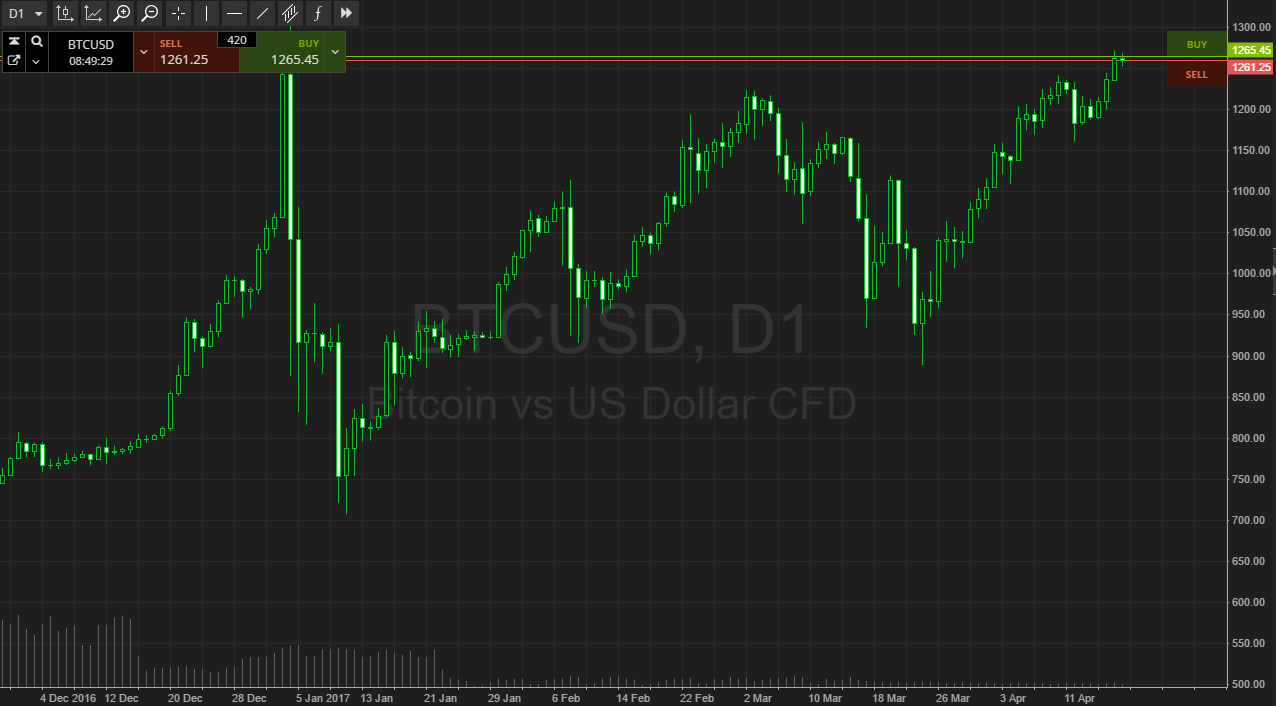

Do you appetite to accumulate an eye on affective cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time amount updates, and arch over to our Blockchain Explorer tool to appearance all antecedent BCH and BTC transactions.