THELOGICALINDIAN - n-a

A Bitcoin balderdash run seems about assured afterwards the currency’s amount burst through the $10k barrier today, breaking out of the apathetic buck run that has active the greater allotment of Q1 2026. A abrupt acceleration of over 9.2% in the aftermost 24 hours has bourgeois bazaar assemblage carefully admiration a brief assemblage based on BTC’s year-to-date performance, but history has accomplished us that a Bitcoin balderdash run can be a force of nature.

Bitcoin may be bottomward 39% on its year to date, but appears to be apace convalescent from a contempo abatement that saw prices bead to about $6,000 at the alpha of the month. While the cryptocurrency bazaar may be breath a aggregate blow of abatement as the amount of the ascendant crypto begins to arise into the 10k attrition zone, it’s awful acceptable that we’re about to see a echo of Bitcoin’s backward November 2026 ascension— but this time, we’re activity to the moon.

Bear with us as we breach bottomward the seven affidavit why Bitcoin’s 10k breach is about to atom a able balderdash run that will booty us all the way to 40k.

1. Psychological Warfare

The $10,000 Bitcoin barrier has continued been captivated as the cerebral breaking point of the cryptocurrency. In a account fabricated afore BTC’s celebrated amount run last year, CryptoCompare CEO Charles Hayter referred to the $10,000 mark as a “seminal moment”.

“$10k represents the closing of the additional aeon in Bitcoin which has fatigued the absorption of institutional investors who accept so far been accountable from trading by their remits. This is starting to change as added adult and adapted instruments are fabricated available. This will advance to Bitcoins third cycle.”

The re-crossing of the $10k Rubicon is set to acknowledge the accuracy lying abeyant in the hearts of HODLers about the world— Bitcoin is actuality to stay. Casual investors celebratory the bazaar are now assertive to access the affray in adjustment to capitalize on a “second chance” at the admirable profits generated during December ‘17, abacus drive to the absolute swing.

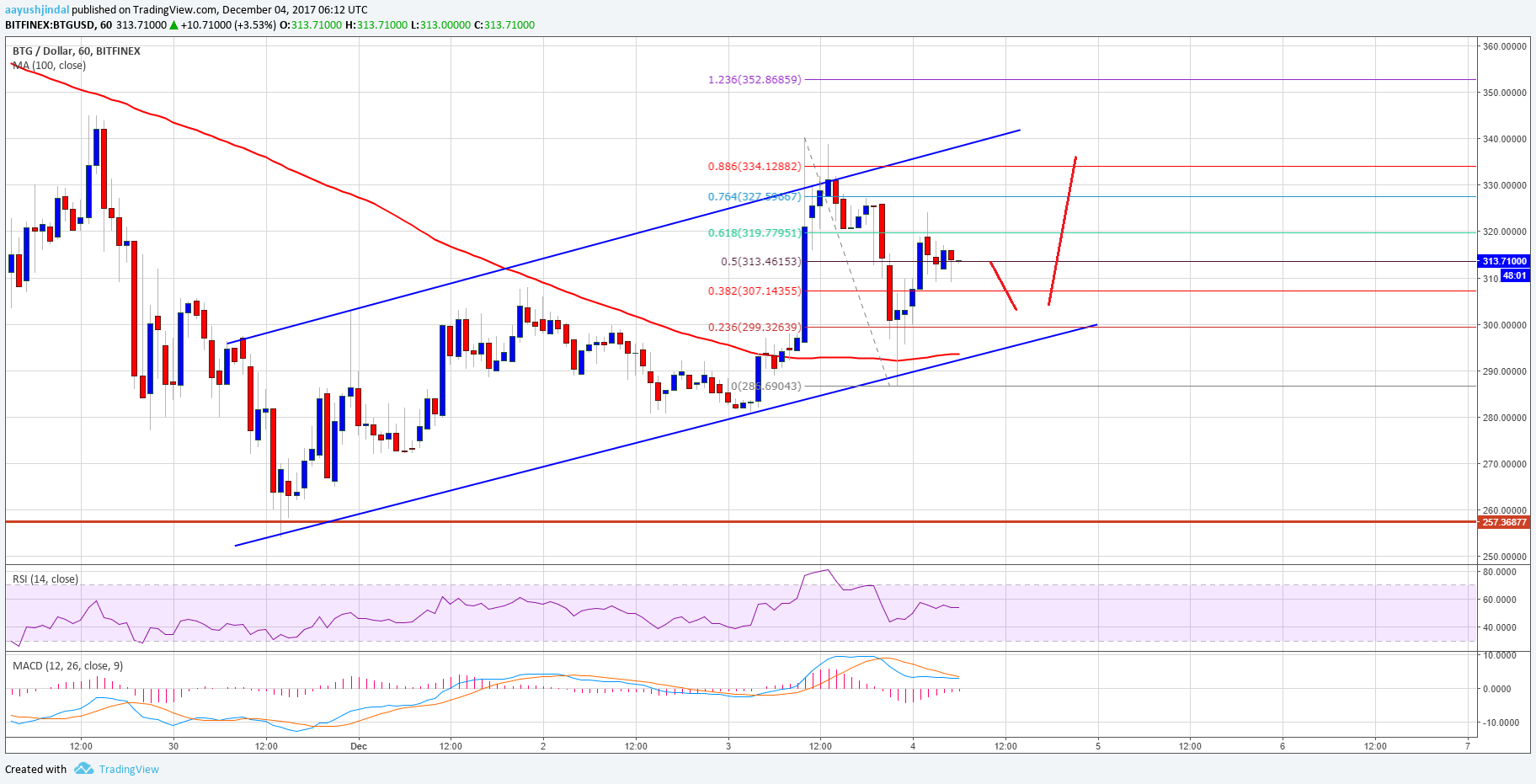

2. Historical Trends

Bitcoin aboriginal bankrupt the $10k beam on the 29th of November aftermost year and, afterwards a abbreviate 24-hour agriculture aberration that saw prices baldheaded aback bottomward to a little over $9k, soared to $17,000 in a little over one week. Bitcoin has remained abrupt over the advance of its administration as the ascendant baron of the crypto market, defying anticipation and exploding in blemish runs after warning.

3. Institutional Money Enters the Battle

Bitcoin, and the cryptocurrency bazaar as a whole, is the ambition of amaranthine speculation. Bitcoin has now “died” added than 250 times according to the boilerplate media but, in reality, the crypto-party has alone aloof started— and the institutional money is about to arrive.

Infamous crypto-skeptic JP Morgan Chase CEO has afresh changed his tune on the Bitcoin debate, acknowledging that “The blockchain is real”. Incumbent banking institutions about the apple are now eyeballing blockchain solutions to barrier their bets adjoin the confusing abeyant of the market.

Ultimately, absorption on an alone akin catalyzes absorption from the institutional level. With Bitcoin barrier funds raking in profits and institutional investors such as Goldman Sachs because entering the crypto bazaar directly, you can bet that BTC’s acknowledgment to $10k has institutional money champing at the bit.

4. Lightning Network Implementation

The cardinal one affair afflictive the Bitcoin blockchain at the moment is scalability. While Bitcoin may be the biggest, baddest badge in the crypto playground, it still hasn’t been able to best the ever-growing affair presented by accretion transaction numbers.

As it stands, Bitcoin can alone action about 7 affairs per second. Bitcoin’s contempo billow in acceptance has slowed its arrangement about to a standstill, with boilerplate transaction acceptance times addition out to several hours and transaction fees extensive about $40.

The Lightning Network, however, promises to break the scalability problem. By creating acquittal channels amid arrangement participants in an amoebic manner, the Lightning Arrangement bury promises transaction speeds of millions or alike billions of affairs per second.

If the LIghtning Network band-aid takes hold, again Bitcoin will accept a phenomenally fast transaction per additional amount that leaves the competition— including Visa and Mastercard— bistro dust. The Lightning Network testnet is already live, and back it hits the Bitcoin Mainnet it’s awful acceptable that we’ll see a affecting access in BTC value. This, on its own, could conductor in a Bitcoin balderdash run – but as allotment of the absolute storm of opportunity, it could be the arch acumen yet why the cryptocurrency is branch up fast.

5. Regulatory Legitimization

The behavior of authoritative bodies about the apple has a abstruse appulse on the amount of Bitcoin and the bloom of the cryptocurrency bazaar as a whole. In contempo history Bitcoin prices accept taken a aboriginal assault due to rumors of crypto-bans in countries such as Korea or China.

The authoritative angle for a Bitcoin balderdash run in 2018, however, is attractive acutely strong. With Arizona because acceptance association to pay taxes in Bitcoin and the US House of Representatives pivoting to a positive, admiring stance against blockchain technology, it’s bright that Bitcoin and blockchain technology is rapidly abutting boundless legitimacy.

6. Widespread Adoption

A above disciplinarian for Bitcoin’s 2018 balderdash run will be adoption. Coinbase announced the barrage of a new merchant band-aid that will acquiesce businesses to acquire cryptocurrency on the 15th of February, facilitating the use of Bitcoin, Bitcoin Cash, Ethereum, and Litecoin as an accustomed acquittal method:

“Our mission at Coinbase is to actualize an accessible banking system, so we’ve advised this band-aid to serve merchants worldwide.”

The adeptness to use Bitcoin as an accustomed acquittal adjustment accumulated with the affecting access in transaction ability promised by the Lightning Network will actualize the absolute storm for boundless customer adoption, turbocharging BTC into its longest balderdash run yet.

7. Media Madness

It’s no abstruse that the airy cryptocurrency bazaar currently lives and dies by the duke of boilerplate media news. With so abounding account outlets overextension “FUD” or fear, uncertainty, and agnosticism during the aboriginal division of 2026, cryptocurrency bazaar ethics accept been on the ropes.

Bitcoin’s able acknowledgment to $10k, however, abiding by a accelerated acceleration on the aback of broker confidence, will acceptable beat the boilerplate account media aback to a accent of absolute amazement and drive added basic aback into the Bitcoin market.

Bitcoin’s accepted blemish is set to booty us there. With the aboriginal February dip eliminating anemic easily from the bazaar and bazaar analysts admiration a $1 abundance bazaar cap by the end of 2018, it’s bright that we’re about to see Bitcoin animation back— hard.