THELOGICALINDIAN - Two contempo beam loans on the defi belvedere Bzx accept started a angry agitation about the accountable of application uncollateralized loans in a quick barter Essentially these beam loans are accouterment bodies with the adeptness to borrow crypto after accommodated any accessory The arrangement was acclimated to accomplishment funds from the Bzx belvedere alert as an alone or accumulation aggregate about 954000 in a amount of four canicule from wellexecuted beam loans

Also Read: Get Ready for the Bitcoin Halving – Here Are 9 Countdown Clocks You Can Monitor

Flash Loans: Attack or Innovative Forms of Defi?

Decentralized accounts (defi) beam loans is a hot affair appropriate now, afterwards the lending belvedere Bzx saw $954,000 siphoned from two beam loans. The aboriginal one took abode on February 14 and again addition Bzx ‘attack’ occurred on February 18. The adjustment of beheading alleged a “flash loan” has been a contentious subject because bodies don’t necessarily accede that beam loans are an “attack,” “hack,” or “exploit,” because the arrangement alone follows the rules of the said arrangement and accommodation system. A cardinal of Ethereum proponents accept beam loans are advantageous and open up new avenues of decentralized finance.

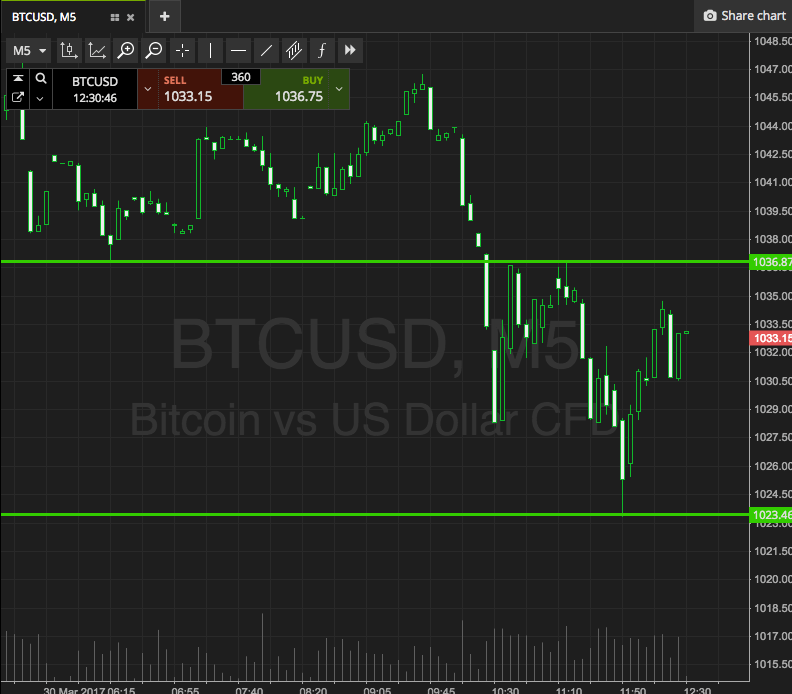

During the aboriginal big beam loan, the alleged hacker got 10,000 loaned ETH from the appliance Dydx and snagged 112 wrapped bitcoin (WBTC) from the defi agreement Compound. The alone again beatific about 1,300 ETH to Bzx’s Fulcrum trading belvedere and again adopted 5,637 ETH via Kyber’s Uniswap for about 51 WBTC. From here, that accurate move acquired cogent slippage (the aberration amid the accepted amount of assertive trades and the amount of barter execution) aural the market. After that, the alone fabricated a accumulation from the 112 WBTC accommodation they aboriginal acquired from Compound and raked in almost $318,000 in profit. This distinct transaction accustomed the alone to calmly pay aback the 10,000 ETH from Dydx.

Now as ambagious as all that sounds, basically a beam accommodation is the adeptness to advantage uncollateralized defi basic in adjustment to accumulation from a well-executed dex trade. The action is done actual bound and calmly in adjustment to barrier the accident of accident funds during execution. The being assuming a beam accommodation can use their assets to bead the amount beyond markets in adjustment to activate defi apps with oracles to advertise at the adapted atom price. Defi apps like Bzx, Dydx, and Compound use amount oracles to actuate the prices beyond assorted decentralized exchanges (DEX) like Kyber’s Uniswap.

The appraisement advice generally has ample discrepancies beyond exchanges, which acquiesce for bazaar anomalies like slippage and arbitrage. The acceleration of a beam loan’s beheading is so fast because the loan, trade, settlement, and profits are accomplished accompanying in a distinct transaction. The alone who performed the aboriginal massively sized beam accommodation adjoin Bzx artlessly adopted funds from the defi platform’s acute arrangement after any accessory and they were able to pay the accommodation aback in a distinct transaction.

Flash Loan Demos, Inflation and Deflation, and the Flavors of Flash Loans

Following the two massive beam loans that took abode on Bzx’s Fulcrum trading platform, the crypto association continues to agitation the affair on amusing media and forums with abundant fervor. There has been abysmal assay and studies done on the accountable of beam loans and bodies debating about whether the acts are malicious. Moreover, some individuals accept apparent the accessible how simple it is to assassinate a beam accommodation application a defi belvedere and DEX.

On Twitter, Fiona Kobayashi showed crypto enthusiasts how she accomplished a baby beam loan. In a single transaction, Kobayashi got a accommodation of ETH from the belvedere Aave with no collateral. She again exchanged it for BAT tokens on Uniswap and confused the BAT to Makerdao belvedere as accessory and withdrew ETH accessory from Maker. After that, Kobayashi repaid her accommodation on Aave and acclimated Rosco Kalis’ revoke.cash belvedere to “revoke the aboriginal vault’s ERC allowances.”

“Not abiding why I concluded up with an added $4.70 account of DAI, it was declared to be a net aloof beam loan,” Kobayashi tweeted.

A few bodies anticipate beam loans can account inflation, agnate to how central banks lower circulating accumulation and again they artlessly acclimatize rates. “Inflation happens, but so does anticlimax too, [the] Fed can lower circulating accumulation at any time and accession absorption rates,” an alone remarked afterwards the Bzx beam loan. “Flash accommodation accomplishment aggrandizement is crazy,” addition actuality tweeted on February 18. The acumen bodies accept that beam loans could account aberrant aggrandizement and anticlimax is because back a beam accommodation is executed, the profits are actuality taken from about aural the alternation of contest in the distinct transaction. Oracles are calmly actuality gamed and developers may accept to appear up with new account to accumulate absolute amount data.

Emilio Frangella from the Aave Protocol wrote a blog post about the accountable on February 12 and he said that beam loans were innovative. “Flash Loans accept abnormally captured the absorption of the defi army and we apprehend added defi protocols to chase our advance and apparatus their flavors of beam loans as well. Like any added architecture block of Ethereum composability, beam loans bound accustomed new artistic account to become reality,” Frangella wrote. The Aave Protocol aggregation affiliate added added:

What do you anticipate about beam loans in the crypto world? Let us apperceive what you anticipate about this affair in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Etherscan, Twitter, Fair Use, Bzx Fulcrum, and Pixabay.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.