THELOGICALINDIAN - Deribit continues to allure retail investors and baby funds But as institutional absorption picks up CME could accomplish up the absent ground

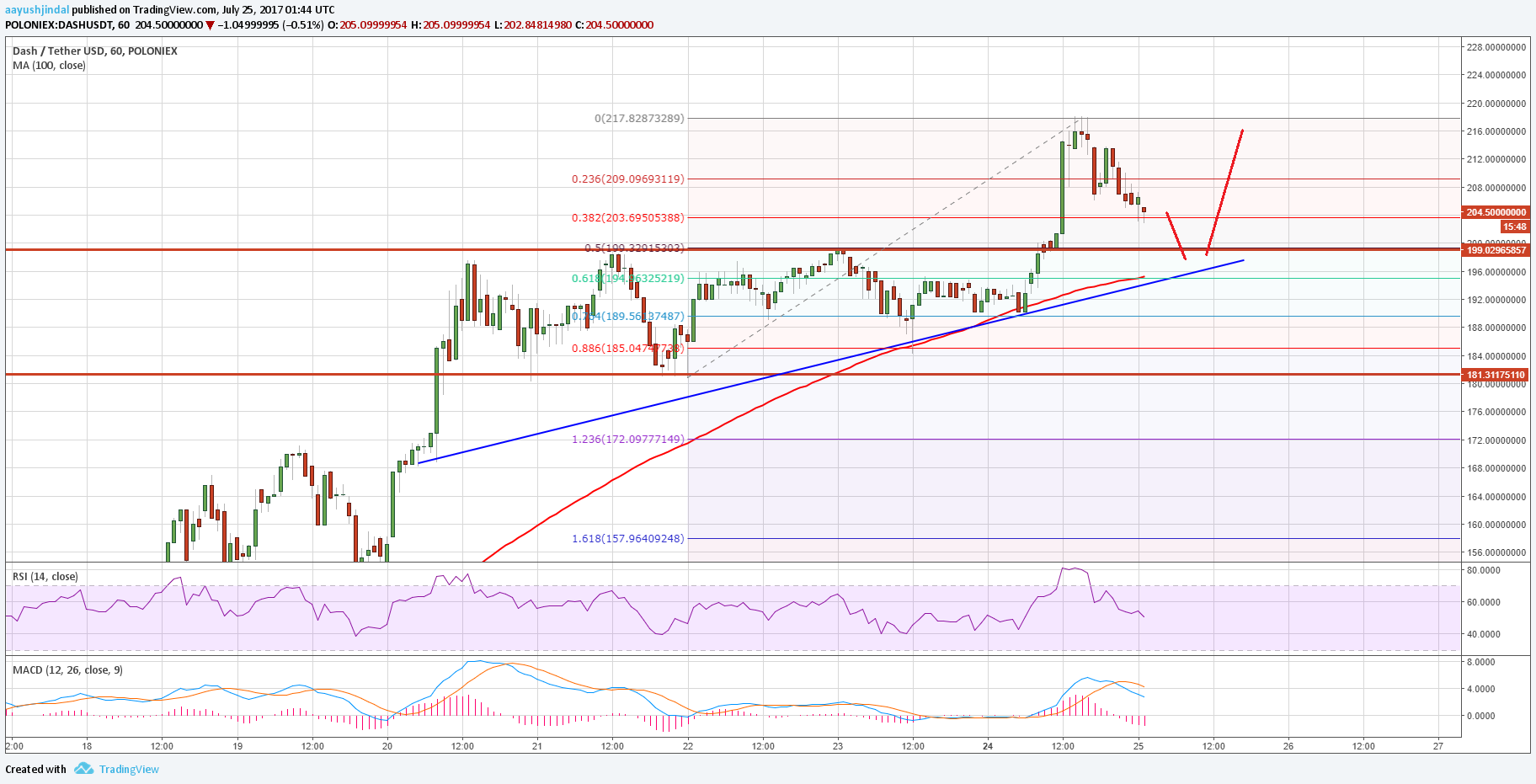

Deribit’s Bitcoin options surged accomplished 100,000 BTC of accessible interest. But as CME catches up, recording a 13x access in accessible absorption during May 2020, is Deribit’s position as the bazaar baton in danger?

The Crypto Options Race

Deribit is the best liquid options market in all of crypto, alluring both retail and institutional investors.

Yesterday, the barter beyond the 100,000 BTC beginning in accessible absorption with over 10,000 BTC in circadian trading volume.

The ascendancy of Deribit in the crypto options bazaar has been longstanding. Still, the exchange’s abode as the area of best for institutions could be imperiled as CME’s accessible absorption added from $13 actor to $175 actor this month.

Significant barrier funds like Rentech and Tudor Advance Corp that added Bitcoin derivatives to their advance mandates chose CME for the platform’s reputation.

Retail investors are the boyhood in the Bitcoin options market. If CME options abide to accretion traction, Deribit could lose cogent bazaar allotment as institutions move to the former.

Deribit’s extenuative adroitness in this attention is the arduous basic claim to barter CME’s Bitcoin options.

Each advantage arrangement on Deribit represents one BTC, while anniversary CME contract is bristles BTC or about $50,000 at the time of press.

According to Su Zhu and Hasu, authors of Deribit Insights, one charge accept an antecedent allowance of 40% to barter CME options. This is basic inefficient as it requires the banker to accumulate a ample allocation of their trading annual dormant.

Further, trading is alone accessible from Monday to Friday, as against to Deribit, which is accessible 24×7.

Institutional clamminess in options may be rising, but CME is the belvedere of best alone for ample funds. Smaller barrier funds and traders, however, will acquisition the basic ability and accessibility to be Deribit’s trump agenda over CME.

Transaction fees on Bitcoin accept added than angled back the best contempo halving event. But what users accord up in costs, they accomplish up in security.

Transaction fees on Bitcoin accept added by abutting to 250% back the network’s third block accolade halving on May 11. If this is the alpha of a abiding fee market, the absolute appulse on the network’s aegis outweighs the negatives for users.

Bitcoin Makes up for Lost Earnings

Since the halving occurred, the boilerplate fee appropriate to transact over the Bitcoin arrangement has risen from $2.5 to $6.4.

Bitcoin’s boilerplate transaction fee hasn’t beyond the $2 beginning back August 2025.

The aftermost time boilerplate fees hit $6 was in July 2025, which was the alpha of a multi-month declivity for BTC. If this is any indicator, the college transaction fees could be the aftereffect of investors affective their bill to exchanges to sell.

Bitcoin miners accept calm 1,176 BTC in transaction fees over this aforementioned period. To put this in perspective, miners becoming aloof 818 BTC in fees during April and 1,251 BTC in March, per CoinMetrics.

Moreover, this halving may be the catalyst bare for Bitcoin to apprehend its approaching as a fee market.

With the halving abbreviation miner acquirement from block rewards by 50%, transaction fees charge to aces up the baggy to abide accouterment miners with able near-term incentives.

Bitcoin’s abrupt access in transaction fees may be a damage to users, but the allurement it provides is a vital force in befitting the arrangement secure.

Whether this is a abiding access in transaction fees or artlessly a blitz to advertise BTC will be accepted in a few days.