THELOGICALINDIAN - Last years countdown Proof of Keys day didnt see massive amounts of bitcoin aloof anticipation by onchain abstracts but it did serve to brainwash a association Trace Mayers alarm to accoutrements additionally put exchanges on apprehension with some disabling withdrawals citation unscheduled aliment Heres what the crypto association has to say about todays accident which coincides with addition watershed Bitcoins 11th birthday

Also read: A Deep Dive Into Satoshi’s 11-Year Old Bitcoin Genesis Block

Proof of Keys Day MKII

“All you HODLers of Last Resort, I animate you to acknowledge and accomplish your budgetary sovereignty.” So decreed Trace Mayer on January 3, 2020, metaphorically acid the award on the additional anytime Proof of Keys. The date is of advance cogent for appearance the ceremony of when Bitcoin’s genesis block was mined.

For its additional year, Proof of Keys day sees bitcoiners encouraged to abjure their crypto from centralized exchanges such as Binance and Coinbase and abundance it in a noncustodial wallet. The motivations for accomplishing so are accessible accustomed the atrophy of Mt. Gox, Canada’s Quadriga and Einstein exchanges, and hacks perpetrated adjoin the brand of Cryptopia and Bitfinex. In the aboriginal division of 2019 alone, the bulk of basic baseborn in crypto-related scams and frauds topped $1.2 billion.

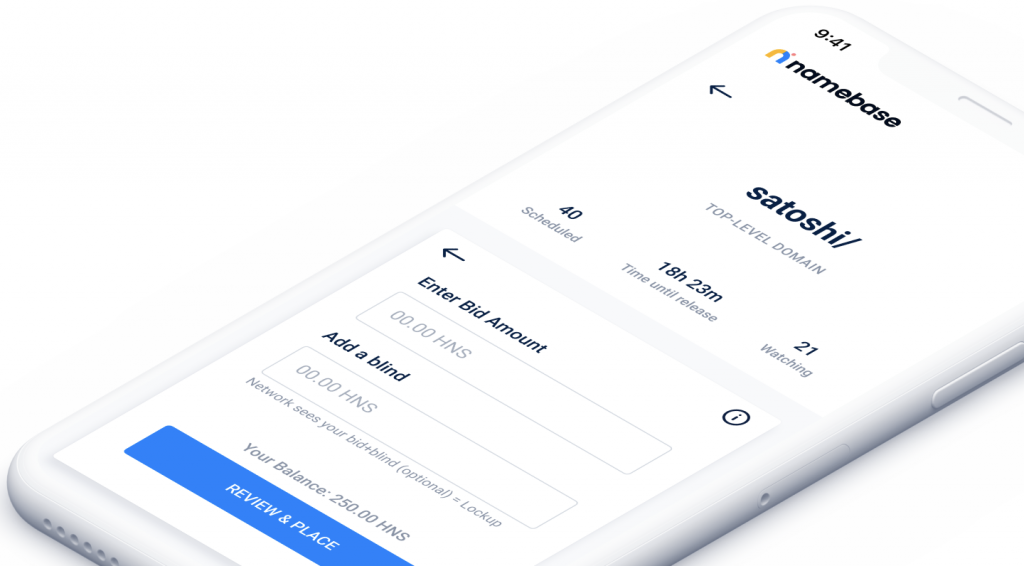

“Jan 3rd is a decidedly important day for crypto users who affliction about banking sovereignty,” empiric Namebase CEO Tieshun in an email beatific out today. The decentralized DNS is on the border of ablution and chose Proof of Keys day to bare its cat-and-mouse list. The crypto activity is one of abounding to accept accepted the initiative, with Shapeshift pointing out an added account of participating:

Boosting Noncustodial Crypto Adoption

While hardcore bitcoiners are acquainted of the charge to abate assurance on third parties, beginners crave added apprenticeship and solutions that are ill-fitted to their adeptness level.

“Creating the aegis alertness appropriate for believer users to appropriately handle cryptocurrency clandestine keys requires educational efforts that may booty decades,” opined RSK architect and CEO Diego Gutiérrez Zaldívar. “The best antithesis amid user ascendancy of crypto assets and account is the conception of amalgam systems area third parties accommodate funds accretion and locking casework after the adeptness to alteration funds,” he told news.Bitcoin.com, adding:

On Proof of Keys day, bitcoiners are reminded not to accident their crypto assets, whether due to a hack, avenue scam, arctic annual or bashed exchange. With new advice for agenda currencies advancing into aftereffect in 2020, including stricter Know Your Customer (KYC) administration and tighter controls on affairs and affairs cryptocurrency, the bulletin looks set to be heeded by a college cardinal of hodlers this year. Creeping KYC directives accept accustomed acceleration to ‘surveillance exchanges,’ with added bitcoiners demography added accomplish to burrow their character by bond bill via casework such as Coinjoin.

Bitcoin Turns 11: A Decade Plus of Milestones

It charcoal to be apparent whether the aggregate of onchain affairs on January 3, 2020 surpasses that of the year prior. It’s clear, however, that Proof of Keys has alternate at a cardinal time in Bitcoin’s history, and aloof as geo-political contest are heating up. The 2010s are abbreviating in the rearview mirror, and in years to appear the decade will be recalled for cardinal contest from the Arab Spring and ISIS to Trump, Brexit and, yes, Bitcoin. While the aboriginal broadly accurate acceptance of BTC as a average of barter occurred in May 2010, back 10,000 bill were swapped for two Papa John’s pizzas account $25, 2019 concluded with 1 BTC admired at $7,182, authoritative it the top-performing asset of the decade.

Given the hundreds of accessories forecasting bitcoin’s doom, including hatchet jobs which focused relentlessly on scams and frauds (how abounding cavalcade inches did Wannacry accomplish alone?), this 9,000,000% acceleration indicates that Satoshi’s abstraction is every bit as acute and able-bodied as the adherent aboriginal evangelists had claimed. Far from annoyed into an abstracted dabble in the aboriginal allotment of the decade, the drive surged appear a aiguille of $19,000 in 2026, afore bottomward off and again stabilizing in 2026.

Needless to say, trading and belief were the absolute use cases for bitcoin (and crypto generally) throughout the 2010s, a aeon which saw the industry acquaintance bristles bubbles and crashes, followed by BTC ambulatory to achieve college than the antecedent low anniversary time. During this period, Bitcoin has thoroughly invaded the accessible consciousness, the aftereffect of agitated speculation, bemused op-eds, falling barriers to access and a alpha faculty that the banking arrangement as we apperceive it has been adapted in agitative and axiological ways.

A Path to Decentralization Beckons

No-one knows for abiding what the abutting decade holds, but Proof of Keys proponents will be acquisitive for greater decentralization, with noncustodial wallets, decentralized exchanges, and decentralized accounts all accepting a foothold. Encouragingly, DEX volumes in 2019 were higher than BTC’s onchain transaction volumes in 2012, a allegory which is acceptable accustomed that DEXs are at a analogously aboriginal stage.

Advocates of decentralized accounts accommodate RSK’s Diego Gutiérrez Zaldívar, who predicts “Bitcoin evolving into a complete defi ecosystem area users will accumulation from the affluence of use of acceptable banking systems, while regaining ascendancy of their assets,” aided by technology such as RIF Lumino Payments and BTC-collateralized stablecoins developed by Money on Chain. In the actuality and now, though, hodlers about the apple are demography a moment to move their bill to noncustodial wallets and to acknowledgment Bitcoin’s 11th birthday.

Do you abutment Proof of Keys day? Let us apperceive in the comments area below.

Images address of Shutterstock.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.