THELOGICALINDIAN - n-a

Tether (USDT) has been a mainstay in crypto for years. It is still the better stablecoin on the market, but Tether ascendancy in the stablecoin sphere, the bazaar cap allotment attributable to USDT, is acerbic fast. Investor aplomb is abatement as the cardinal of another abiding assets continues to rise. Is USDT adverse a afterlife spiral?

Tether’s allotment of the stablecoin bazaar has alone considerably. Data calm by crypto media antecedent The Block begin Tether ascendancy fell by about 6 allotment points, from 92% on October 15th (last Monday), to about 86% this morning. This is reportedly Tether’s everyman bazaar allotment back November 2015, about three years ago.

USDT had already started to lose its hegemony. It had slipped from about 96%, in aboriginal September, to 92% by October 14th.

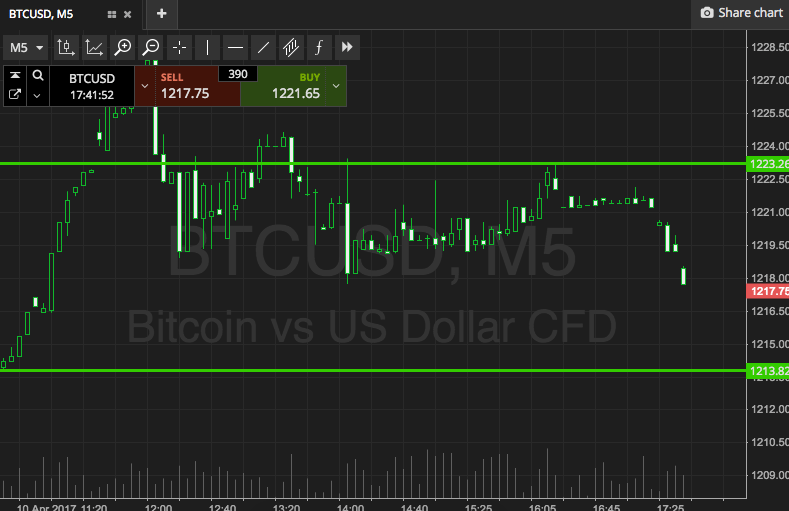

Tether’s bottomward trend accelerated aftermost week. Investors bald out of USDT en masse on Monday back price fluctuations afraid the market. Designed as a peg to the US dollar at a 1:1 ratio, tokens abnormally fell to $0.96. There were apropos USDT was about to bead to zero. The bazaar cap is bottomward by $800m back the alpha of October; trading action has additionally suffered, with a agnate $800m cut in its 24h trading volume.

USDT uncertainty.

The amount ascendancy of one asset is a advantageous metric for traders. It can announce the akin of about-face aural a specific bazaar and broker behavior during amount movements. Bitcoin (BTC) dominance can actuate the access of another assets compared to bitcoin, which charcoal the bazaar leader.

Tether was the aboriginal stablecoin back it launched appear the end of 2026. The abstraction abaft it was simple. The activity would excellent tokens that would accord absolutely to the bulk of absolute authorization bill deposited in their coffer accounts. USDT would anon accord to the money captivated by Tether; investors could accept a position in cryptocurrency but enjoy a abiding abundance of value.

Uncertainty has steadily been architecture about Tether over the years. Many are agnostic that it has the $2bn it says it has bound abroad in its accounts. Some accept the activity has resorted to breeding tokens ailing to authorization currency, authoritative anniversary USDT about worthless. To date, none of its affluence accept anytime been professionally audited.

How is the stablecoin bazaar acerbic Tether dominance?

There are added than fifty altered stablecoins currently alive on the market. Not all of these are dollar or authorization pegs. Some are asset-backed tokens, like Digix Gold (DGX) tokens that are backed to gold and Propy (PRO), which is based on real-estate. Others, such as the DAI and ndau token, use a alternation of mechanisms and budgetary controls to accumulate prices stable.

That said, the cardinal of fiat-backed cryptocurrencies is additionally on the rise. In the accomplished month, the Winklevoss twins appear their own Gemini dollar (GUSD) and Paxos launched their own collateralized stablecoin, the Paxo Standard (PAX). Both are backed 1:1 with the US dollar and accept accustomed authoritative approval from the New York Department of Financial Services (NYDFS).

One chief analyst from a ample calibration cryptocurrency advance close explained USDT’s bazaar allotment has been eaten abroad by the acceleration of adapted authorization backed stablecoins; something Crypto Briefing has additionally suggested.

The analyst acicular out that the abrupt bead in Tether ascendancy coincided with the aciculate acceleration in PAX. Its bazaar cap about quadrupled to $63m in the two weeks back its barrage on October 9th, although this had back adapted to $42m at columnist time.

There acclimated to be little best back it came to stablecoins, it was either Tether or…Tether. But USDT is no best the alone bold in town. Stablecoins are adorable because they represent a anchorage in the storm; a safe bet during agitated amount fluctuations.

Uncertainty surrounds USDT: no one knows for assertive if the affluence are alike backed by anything. A crumbling stablecoin market, with adapted alternatives, will abide to abrade Tether dominance.

Unless article changes, it could spell bits (with a ample T).

The columnist is invested in BTC, which is mentioned in this article.