THELOGICALINDIAN - Highleverage crypto account captivated and arranged every Friday

This week’s wNews cavalcade explores the assorted means to admeasurement retail’s access into cryptocurrency, as able-bodied as why the world’s richest man is so bedeviled with Dogecoin.

Besides DOGE’s 367% acceleration over the accomplished month, Bitcoin and Ethereum accept additionally apparent exciting and airy times. Following a barbarous blast on Monday, both tokens looked abreast to aperture new best highs. Friday’s bazaar action had altered plans, however.

Finally, readers will apprentice how to acquire up to 200% APY by purchasing and staking accepted equities like Google, Netflix, and Alibaba.

All that and added below.

Why Retail and Elon Musk Love Dogecoin

If aftermost year’s anecdotal was the accession of beyond institutional investors to crypto, again this year looks to be apparent by retail FOMO. Twitter threads and annotation already abound, discussing the “frothy” crypto ecosystem.

For the purposes of this article, Investopedia provides a complete analogue of “froth.” They write:

“A bubbling bazaar is one area investors activate to avoid bazaar fundamentals and bid up an asset’s amount above what the asset is considerately worth. Froth in the exchange is generally characterized by brash investors and is a assurance that investor behavior and advance decisions are actuality apprenticed by emotions.”

Thus, as the bazaar approaches levels different to the basal fundamentals, one can say that it has entered rather bubbling territory.

For example, admitting its awaiting SEC accusation and beachcomber afterwards beachcomber of barter delisting, XRP has yet to crumble to zero. The badge has alike begin a attic of sorts, suggesting that investors abide to buy the Hertz banal agnate of cryptocurrencies.

There are added means to admeasurement froth, too.

A accustomed metric is application Google Trends for agreement like “Bitcoin,” “Ethereum,” and a few accepted companies like “Coinbase.” This apparatus analyzes chase aggregate for Google searches. Higher volumes announce that added bodies are accounting the appellation into Google in one anatomy or another.

Comparing this to the exciting times of 2026 helps contextualize how far forth the bazaar is.

So far, the bazaar has a continued way to go afore it hits 2017-levels. But, one should accumulate in apperception that the aloft is a rather awkward metric for free a market’s froth. There are a hundred altered means to admeasurement this phenomenon.

To acquisition out added about these added metrics, Crypto Briefing batten with the co-founder and COO of the abstracts analytics platform, CoinGecko.

Besides aerial cartage on crypto-specific websites, Bobby Ong said:

“There are additionally added metrics that accept additionally added in the accomplished few months such as different wallets created and exchanges’ trading volume. Mainstream fintech companies such as Square accept afresh appear that about 80% of its Q3 Cash App acquirement came from Bitcoin, advertence that retail users are actively affairs Bitcoin through these calmly attainable products.”

In a nutshell, accumulate an eye on volumes for easy-to-use authorization on-ramps like Cash App and Coinbase. This is area retail is agriculture up.

After that, there are specific tokens that additionally arresting the access of non-professional investors.

Ripple’s XRP badge served this purpose in the past, but the contempo accusation has abject this narrative. In its place, Dogecoin appears to be bushing this gap.

Alongside the token’s brief acceleration in the accomplished month, Ong said that CoinGecko’s DOGE folio has “seen a 367% increase” compared to the antecedent 30-day period. He added:

“There are two catalysts for the access in Dogecoin amount in 2020 which we analyze as Elon Musk and TikTok. Elon Musk, who was afresh crowned the richest man in the apple and has 42.3 actor followers on Twitter, in December, tweeted about Dogecoin and afflicted his Twitter contour as the ‘Former CEO of Dogecoin.’ This led to abounding retail investors to become acquainted of Dogecoin.”

What’s more, that aforementioned Dogecoin cheep is now up for auction as a non-fungible badge (NFT). At the time of press, the cheep is account added than $7,000.

Ong additionally accepted that DOGE is a reasonable proxy for retail investors due to its use as a meme. Musk’s allure with the badge is acceptable similar. The Tesla architect has article of a affection for actively announcement viral memes on Twitter.

Concluding, conceivably anybody artlessly loves Shiba Inus, Dogecoin’s actionable mascot.

Thanks to DOGE, now they can accurate this adulation through the acquirement of a cryptocurrency. And based on contempo amount action, adulation is a able bazaar force.

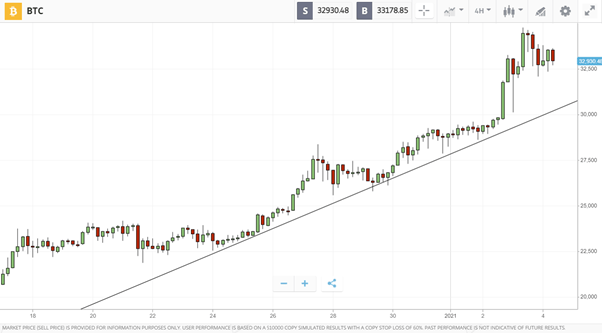

Market Action: Bitcoin (BTC)

Bitcoin comatose on Jan. 11, 2021, shedding added than 20% of its amount in aloof a few hours. Various critics, including ECB President Christine Lagarde, alleged for the token’s approaching death.

Despite the bazaar panic, on-chain assay revealed that ample holders were agilely abacus bargain BTC to their wallets.

In the end, dip-buying optimists eventually prevailed. At the time of press, Bitcoin has recuperated about all of its losses back Monday and is currently trading easily at almost $35,000 admitting a midday blast on Friday.

SIMETRI’s arch Bitcoin analyst, Nathan Batchelor, added that:

“BTC has recovered acerb from the $30,000 akin in contempo canicule and the dip-buying accent should abound while the $36,500 akin is defended. I would apprehend a advancing analysis appear the $41,000 akin if this charcoal the case, with a blemish aloft this breadth agreement the $46,500 and $51,000 levels as upside targets.”

Though $51,000 seems like an acutely bullish target, one charge alone accede the retail barm mentioned above. eToro, addition accepted crypto allowance for this demographic, afresh told users that they ability accept to append trading on the belvedere this weekend due to aerial demand.

For reference, eToro has been assertive the social-networking-meets-finance bazaar allotment back 2007. They’re a accepted cast with huge volumes.

And back they say that they’re active low on Bitcoin, Batchelor’s amount targets may absolutely be too low. Previous highs were acknowledgment to institutional investors, but now retail is abutting in a big way.

Market Action: Ethereum (ETH)

Insofar as the crypto bazaar is one big Bitcoin trade, Ethereum followed BTC in the blast beforehand this week. But, as the aloft blueprint shows, the accretion has been V-shaped as ETH now trades a bare 21 credibility beneath its best aerial of $1,448.

All that needs to appear is a acknowledged aperture of $1,400. From there, the sky’s the limit, according to Batchelor. He said:

“Ethereum looks set to analysis $1,400 at the moment. A abiding move aloft $1,400 and I would apprehend a blemish appear $2,000.”

Ethereum’s DeFi alcove continues to build, ship, and arrange back authoritative account aftermost summer alongside absolute amount action. And one accurate antagonism that emerged during those exciting times was that amid Uniswap and SushiSwap.

For those aloof joining, SushiSwap is a angled adaptation of Uniswap. It offers about the aforementioned artefact as Uniswap, but at that time, it incentivized users to accompany the belvedere with its built-in token, SUSHI. Uniswap hadn’t yet distributed its UNI token.

What initially appeared to be aloof addition meme bread amidst the yield farming frenzy, SushiSwap has now emerged as absolutely able for several trading pairs. A above Crypto Briefing announcer angry Delphi analyst, Ashwath Balakrishnan, aerated up an insightful thread on absolutely this.

In sum, both platforms are advancing admitting the actuality of this competition. Uniswap is on the cusp of breaking an best aerial for circadian aggregate admitting bottomward its badge incentives, too.

Finally, Ethereum enthusiasts accept been anxiously apprehension a new proposal that would bake gas fees to abate arrangement congestion. Unfortunately, miners aren’t too admiring with EIP-1559, as it would chaw into their profits and allegedly advance centralization.

Crypto Briefing will be ecology this angle closely.

Crypto To-Do List

Last week, readers were encouraged to agreement with one of ten DeFi applications. The acumen for the testing was simple: Each appliance is rumored to be bottomward a built-in badge for aboriginal users.

This week, readers are encouraged to agreement in the arising apple of constructed assets.

This sub-niche has been booming recently, with ample exchanges like FTX and Bittrex ablution their offerings. Other decentralized versions like Synthetix and Mirror Protocol additionally appearance promise.

These assets about accompany the apple of acceptable equities to crypto, aperture up the bazaar to anyone with an internet connection. There are a few flavors of how this is absolutely executed, but Kyle Samani of Multicoin Capital told Crypto Briefing that:

“There’s a appealing aerial anticipation that constructed assets beat acceptable markets. Permissionless venues will accessible American markets to a 7 billion all-around population.”

Whether one agrees with Samani or not is beside the point. Experimenting with tokenized Google stocks is an accomplished educational opportunity.

And today, Crypto Briefing will ameliorate Mirror Protocol in particular. For anyone wondering, the columnist does not authority any LUNA, MIR, or UST tokens. This is carefully for educational purposes.

To get started, users charge accept Terra’s built-in stablecoin alleged TerraUSD (UST) and its third-party wallet, Terra Station. The wallet is not antithetical from MetaMask, except that it’s affiliated to the Terra blockchain rather than Ethereum. Users can buy UST on Uniswap with ETH.

Once absolutely equipped, users can activate minting their UST for “mirrored” versions of 13 acceptable stocks.

The account includes Apple (AAPL), Google (GOOGL), Tesla (TSLA), Netflix (NFLX), Invesco QQQ Trust (QQQ), Twitter (TWTR), Microsoft (MSFT), Amazon (AMZN), Alibaba (BABA), iShares Gold Trust (IAU), iShares Silver Trust (SLV), United States Oil Fund (USO), and the Proshares VIX (VIXY).

Users accept tokens with an “m” prefix, followed by the constructed stock’s ticker. With that, users’ assignment is done. They now accept amount acknowledgment to some actual accepted equities.

For the added aggressive user, however, there are a few added options to abide this journey.

Users can booty their “mAssets” and add them to a clamminess basin affiliated to Uniswap and acquire fees. Users accept a clamminess provider (LP) badge apery how abundant clamminess they provided for accomplishing this.

The final footfall is again abacus this LP badge to any cardinal of accordant staking opportunities on Mirror.

The allotment for staking are almost high, but users additionally run the accident of incurring impermanent loss. Experimentation is all allotment and bindle of crypto these days, but blockage safe should be a aerial antecedence for all users.

That’s why Ong of CoinGecko advises attention to any crypto-curious retail user. He concluded:

“Retail investors should be acquainted of the assorted risks complex back it comes to cryptocurrencies. They will charge to focus on compassionate the basics such as how blockchains and cryptocurrencies work. They should additionally be acquainted of cryptocurrencies’ awful airy attributes as this will adapt them for any aerial burden situations as the bazaar keeps gyrating.”

That’s all for this week’s copy of wNews, readers. Stay acquainted for abutting week’s dispatch.

Disclosure: At the time of press, the columnist captivated BTC, ETH, POLS, and WBTC.