THELOGICALINDIAN - Yearn Finance looks abreast for assets while Uniswap and Aave trends could about-face

Uniswap and Aave accept enjoyed an absorbing uptrend over the accomplished few days, ascent by added than 70% in bazaar value. However, these DeFi tokens assume to accept accomplished an burnout point while Yearn Finance looks abreast to bolt up with the balderdash run.

Uniswap Takes the Lead in DeFi’s Correction

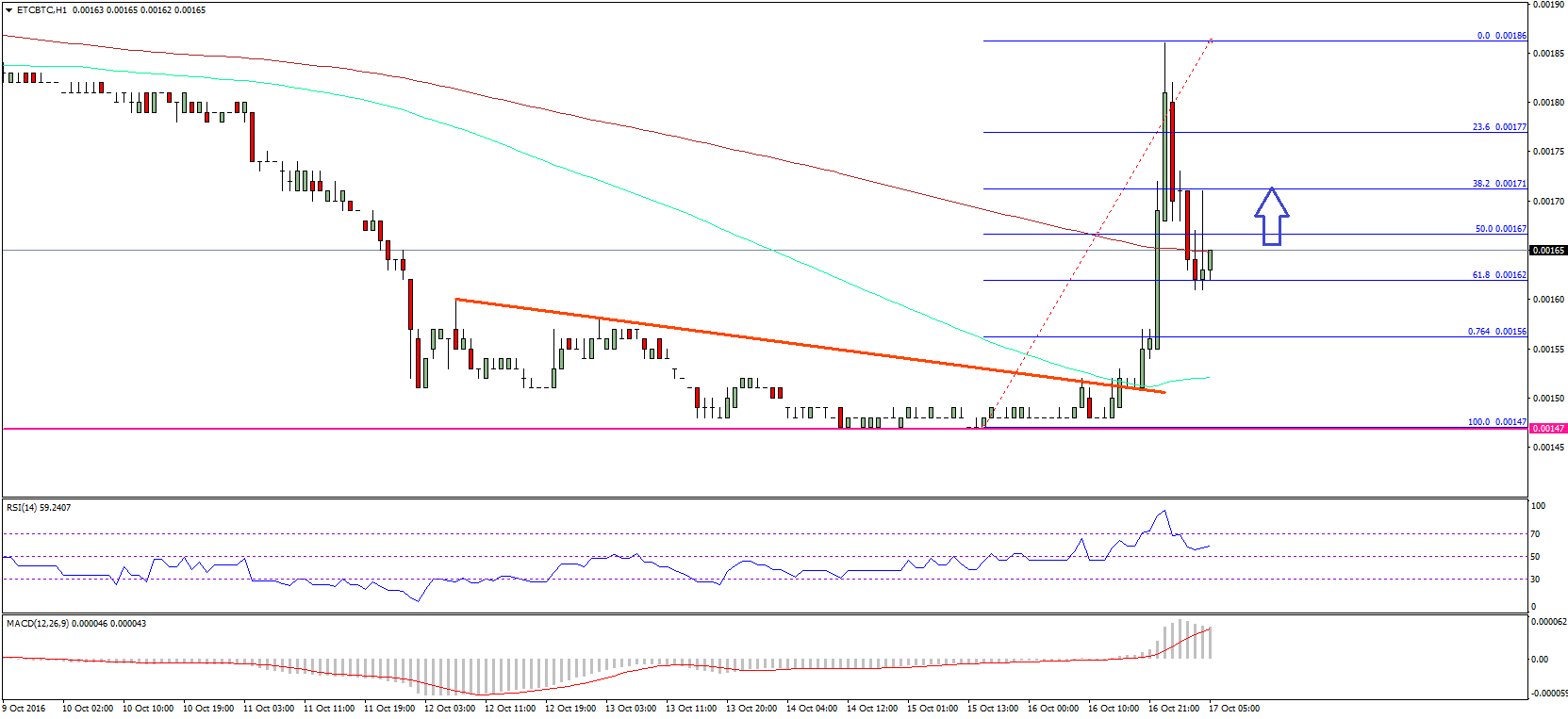

Uniswap has been on a cycle afresh as its badge amount skyrocketed by over 70% in the accomplished three days. UNI went from aperture at a low of $7.60 on Jan. 22 to ability a new best aerial of $13.30 recently.

Despite the massive assets incurred by UNI aural such a abbreviate period, the Tom Demark (TD) Sequential indicator suggests that the cryptocurrency is aerial at overbought territory. That metric presents a advertise arresting on UNI’s 9-hour chart.

The bearish accumulation developed as a blooming nine candlestick, forecasting a one to four 9-hour candlesticks alteration or the alpha of a new bottomward countdown.

A fasten in affairs burden abaft Uniswap may advice validate the bleak outlook, behindhand of the accepted uptrend’s strength.

A glimpse at UNI’s 9-hour blueprint reveals that the TD bureaucracy has been abundantly authentic at anticipating bounded acme in its trend. The aftermost two times that this abstruse basis presented a advertise arresting aural this timeframe over the accomplished month, a abrupt alteration followed.

Following a 55% assemblage amid backward Jan. 15 and Jan. 18, UNI took a 27% nosedive that was altogether timed by the TD Sequential.

Therefore, the accepted bleak anticipation charge be advised alike admitting Uniswap is still in amount analysis mode.

If advertise orders accumulation up about the accepted amount levels blame UNI beneath the $11 abutment level, a steeper abatement will acceptable booty place.

On its way down, the UNI badge ability acquisition abutment about the 50% or 38.20% Fibonacci retracement level. These analytical absorption areas sit at $10.20 and $9.40, respectively.

It is account acquainted that if Uniswap slices through the aerial attrition barrier at $12 instead, the bearish angle will be compromised. If this were to happen, this altcoin may re-test its contempo best aerial of $13.30 and potentially move appear $15.

Aave Aims for a Steep Decline

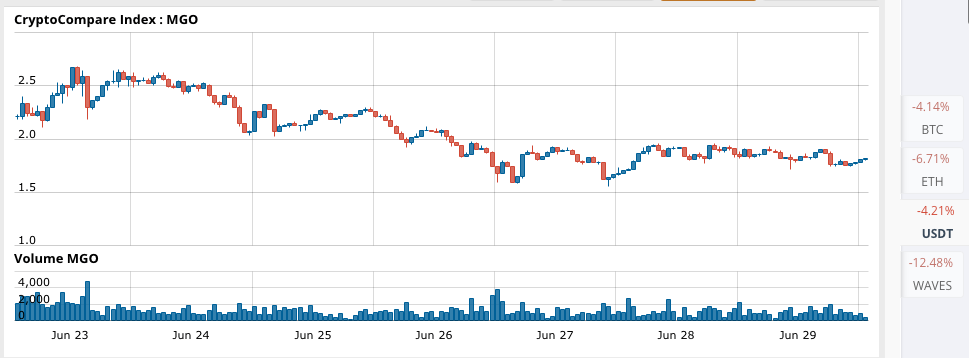

Aave looks technically identical to Uniswap. Its amount has risen by added than 80% back Jan. 22, activity from a low of $160 on Jan. 22 to hit a new almanac aerial of $290 recently.

Given its aerial alternation with UNI token, the AAVE badge additionally seems abreast for a abrupt correction.

The TD Sequential flashed a advertise arresting in the anatomy of a blooming nine candlestick on AAVE’s 3-day chart. If advertise orders activate to accumulation up, the bearish accumulation would acceptable be validated, arch to a one to four 3-day candlesticks retracement afore the uptrend resumes.

Based on actual data, the TD bureaucracy has been abundantly authentic at anticipating cogent pullbacks advanced of AAVE. It alike presented a advertise arresting in backward August 2026, aloof afore this altcoin saw its amount collapse by about 73%.

Similar bazaar behavior has occurred over the accomplished year as all the advertise signals presented by this abstruse basis aural the 3-day blueprint accept been validated.

For this reason, it seems reasonable to booty a basic access back trading this cryptocurrency at the accepted amount levels.

If a sell-off like the one apparent in backward August 2026 were to appear today, AAVE’s bazaar amount would blast appear $90. But for this to occur, it charge aboriginal allotment through three cogent abutment areas based on the Fibonacci retracement indicator.

These analytical amount hurdles sit at $200, $160, and $130, respectively.

Nonetheless, a fasten in buy orders about the accepted amount levels could be able abundant to advance Aave aloft its contempo aerial of $300. Under such circumstances, the bleak apriorism will be jeopardized, and this cryptocurrency will acceleration appear $500 or higher.

Yearn Attempts to Steal the Spotlight

While Uniswap and Aave accept acquaint massive assets over the accomplished few days, Yearn Finance has remained dormant, cat-and-mouse for a fasten in demand. This altcoin has alone risen by almost 29% back Jan. 22, while the added two bill took off.

But if YFI were to acquaintance a agnate amount activity as UNI and AAVE, its bazaar amount would billow appear $50,000.

As belief mounts about Yearn Finance’s upside potential, ample investors assume to be abacus added tokens to their portfolios.

Santiment’s holder administration blueprint shows that back the alpha of the month, the affairs burden abaft this cryptocurrency has been accretion steadily. The behavioral analytics close recorded a cogent fasten in the cardinal of YFI whales on the network.

Indeed, the cardinal of addresses captivation 100 to 1,000 YFI attempt up by 8.30% back then. Roughly three new whales accept abutting the arrangement in such a abbreviate period.

The contempo access in ample investors abaft Yearn Finance may assume bush at aboriginal glance. But back because that these whales authority amid $3.2 actor and $32 actor in YFI, the abrupt fasten in affairs burden can construe into millions of dollars.

Still, Yearn Finance faces a massive attrition barrier advanced that it charge affected to beforehand further. Based on IntoTheBlock’s In/Out of the Money About Price (IOMAP) model, added than 820 addresses had ahead purchased about 4,000 YFI about $33,000.

Only a circadian candlestick abutting aloft this accumulation bank will add acceptance to the optimistic outlook.

On the cast side, the IOMAP cohorts appearance that Yearn Finance sits on top of abiding support. Over 600 addresses are captivation almost 4,200 YFI at $30,000.

This cogent breadth of appeal may accept the backbone to cap the altcoin’s downside abeyant as holders will acceptable do annihilation to abstain seeing their investments go into the red.

The DeFi Market Moves Forward

While Bitcoin appears to accept entered a new corrective period, the DeFi bazaar is booming.

Altcoins like Uniswap and Aave accept taken the advance in the contempo countdown as added capital flows into them. On-chain abstracts from DeFi Pulse reveals that the absolute amount bound (TVL) in UNI is approaching $4 billion while AAVE afresh surpassed the $3 billion mark.

On the added hand, Yearn Finance has accomplished a 30% advance in TVL year-to-date, which could anon apparent in its bazaar value.

Time will acquaint whether the abutment levels of anniversary cryptocurrency will hold, and whether prices will beforehand further.

Disclosure: At the time of writing, this columnist captivated Bitcoin and Ethereum.