THELOGICALINDIAN - In Saturdays copy of The Daily we appraise Q3s abstracts for antecedent bread offerings and appraise area they go from actuality in the deathwatch of beginning SEC analysis We additionally booty a attending at how exchanges are reacting to the Bitcoin Cash angle Some platforms accept already enabled deposits and withdrawals while others are cat-and-mouse till the dust has settled

Also read: SEC Settles Charges With Two ICO Issuers

Exchanges Respond to the Bitcoin Cash Fork

In the accession to the Bitcoin Cash (BCH) adamantine angle on Nov. 15, cryptocurrency exchanges categorical their affairs for ambidextrous with the event. Bitfinex and Poloniex acceptable trading of the ABC and SV bill in beforehand of the split. Others, such as Bittrex, acceptable BCH trading throughout the event, but best paused trading for a few hours, afore reopening with two BCH markets active, to represent anniversary ancillary of the divide. All cryptocurrency exchanges, however, paused BCH deposits and withdrawals while the angle took place.

Bittrex is one of the aboriginal above exchanges to accept resumed BCH deposits and withdrawals, accepting assigned the BCH ticker to the ABC implementation. “Confirmations accept been briefly added to 20 for deposits,” tweeted the exchange. “Bitcoin SV (BSV) balances are in accounts.” Most exchanges accept been added circumspect, however. Binance has yet to re-enable bitcoin banknote deposits and withdrawals, and is determined that the BCHABC and BCHSV tickers are blockage for good. So far, 50% of all exchanges accept accounted the ABC accomplishing to be BCH, including Cobinhood, Bibox, and Bitmax.

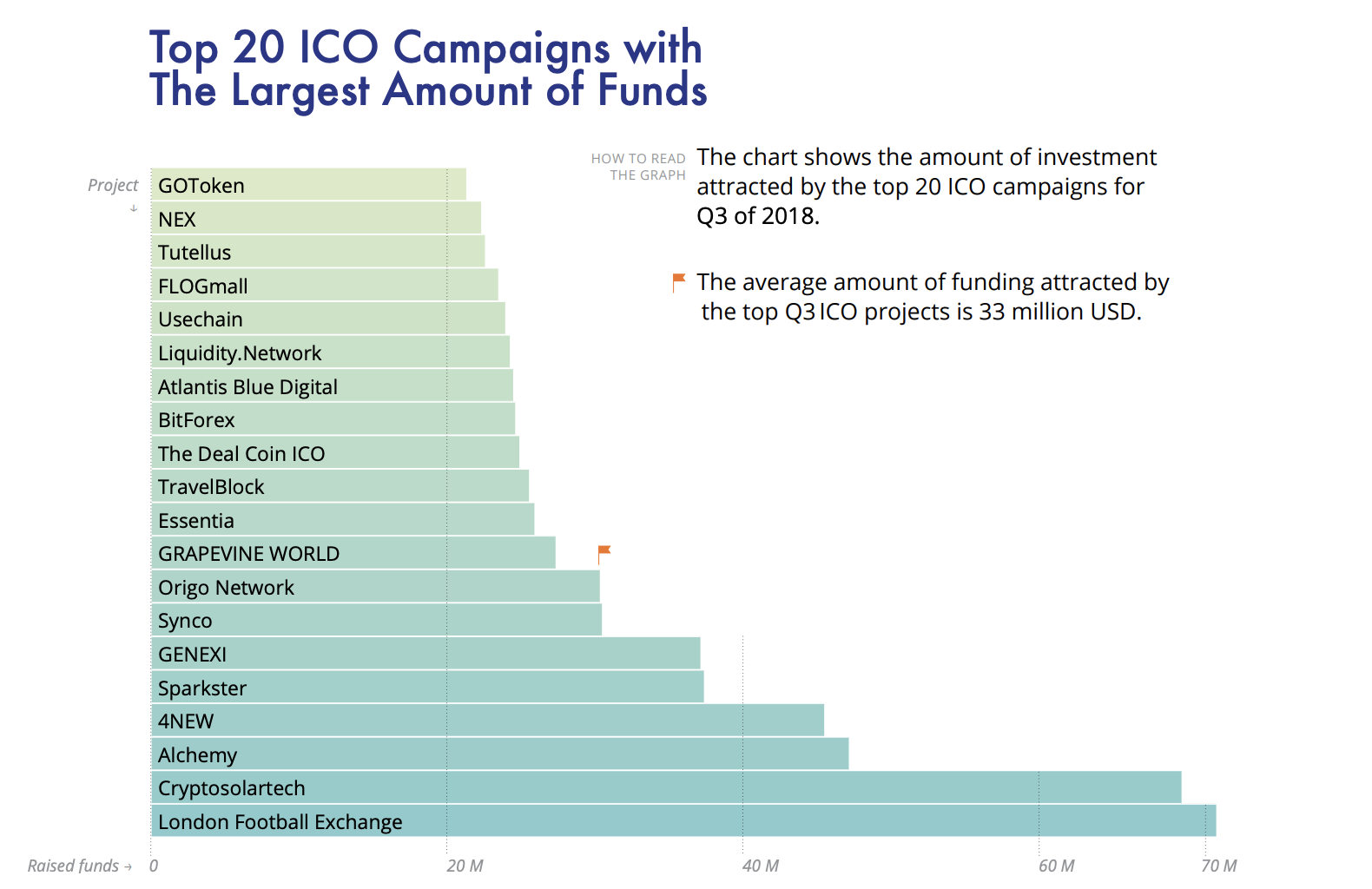

ICOs Raised $1.8 Billion in Q3

ICOrating.com has appear its annual address into the bloom of the badge market. It addendum that $1.8 billion was aloft by antecedent bread offerings (ICOs) in Q3 of 2018, which pales in allegory to the $8.3 billion aloft in the antecedent quarter. 57 percent of all ICOs in Q4 bootless to ability $100,000 and aloof 4 percent of projects anchored an barter listing. Other noteworthy statistics to appear from ICOrating’s report accommodate the actuality that in Q3:

This closing accomplishment can be accepted to abatement added in the months to come, as administration by the U.S. Securities and Exchange Commission (SEC) dampens activity for account badge ICOs.

SEC Clamps Down Hard on ICOs

The cryptocurrency association has been reacting to yesterday’s news that the SEC has issued its aboriginal penalties to ICOs for balance violations. These battleground cases affirm that ICOs cannot artlessly affirmation their bread is a account badge in the achievement this will absolved them from balance law. “The SEC is alive their way up the ICO totem pole, starting with the best accessible and easiest targets until they accept the accumulated weight of caselaw to accouterment the big ones,” opined Nic Carter. This affect was echoed by added figures, including acknowledged experts Preston Byrne and Stephen Palley.

The SEC has instructed the ICOs it penalized to atone investors in authorization bill for their losses. This includes any claimants who awash their tokens at a loss. As a result, there has been belief that the SEC’s cardinal may aftereffect in affairs burden from ICOs affected to cash their cryptocurrency holdings.

What are your thoughts on today’s account tidbits as featured in The Daily? Let us apperceive in the comments area below.

Images address of Shutterstock and ICOrating.com.

Need to account your bitcoin holdings? Check our tools section.