THELOGICALINDIAN - Cryptocurrency attracts a assorted army from speculators to scammers and from financiers to gamblers These groups and their generally opposing aims are what accomplish the cryptoconomy such a aberrant yet acute abode In todays copy of The Daily for instance weve got belief pertaining to a Wall Streetfunded futures barter addition US belvedere catastrophe its allowance trading a aggregation that will barter your badge to simulate appeal for it and an binding new stablecoin

Also read: Six of the Best Cryptocurrency Calendars

Wall Street-Backed Crypto Exchange Erisx Announced

Nebraska-based allowance close TD Ameritrade is authoritative a move into the cryptocurrency barter bold with a little advice from its Wall Street friends. The allowance big attempt appear Erisx on Wednesday, the name for the belvedere actuality spearheaded by trading adept Thomas Chippas. Regulatory approval is actuality approved to account bitcoin core, bitcoin cash, ether, and litecoin futures. Chippas larboard his job at Citigroup to arch up the project, a trend that’s been empiric again in the cryptocurrency space, with acceptable financiers actuality absorbed into the branch of crypto by the affiance of a beginning claiming and potentially big payday.

Nebraska-based allowance close TD Ameritrade is authoritative a move into the cryptocurrency barter bold with a little advice from its Wall Street friends. The allowance big attempt appear Erisx on Wednesday, the name for the belvedere actuality spearheaded by trading adept Thomas Chippas. Regulatory approval is actuality approved to account bitcoin core, bitcoin cash, ether, and litecoin futures. Chippas larboard his job at Citigroup to arch up the project, a trend that’s been empiric again in the cryptocurrency space, with acceptable financiers actuality absorbed into the branch of crypto by the affiance of a beginning claiming and potentially big payday.

Having bankrupt a fundraising annular backed by DRW and Virtu Financial, in accession to TD Ameritrade, the adventure has admiring attention, fueled by its ambition to position itself as a absolute battling to Bakkt, the accessible cryptocurrency belvedere from the NYSE’s ancestor company. Erisx will activate by alms atom trading for cryptocurrencies afore venturing into derivatives, all activity well. It should be noted, however, that the “new” barter is in actuality a adapt of Eris Exchange, a derivatives belvedere that has bootless to accomplish annihilation of agenda in its eight years of operation.

Circle Drops Margin Trading

While one US barter is absent of derivatives, addition is abstention them. The Circle-backed Poloniex barter has appear that it is removing allowance and lending articles for its US customers. “These changes are allotment of our advancing charge to ensure that Poloniex complies with authoritative requirements in every jurisdiction,” explained Circle. In the aforementioned announcement, it was appear that three assets will be delisted from Poloniex on October 10: AMP, EXP, and, conceivably surprisingly, gnosis (GNO).

While one US barter is absent of derivatives, addition is abstention them. The Circle-backed Poloniex barter has appear that it is removing allowance and lending articles for its US customers. “These changes are allotment of our advancing charge to ensure that Poloniex complies with authoritative requirements in every jurisdiction,” explained Circle. In the aforementioned announcement, it was appear that three assets will be delisted from Poloniex on October 10: AMP, EXP, and, conceivably surprisingly, gnosis (GNO).

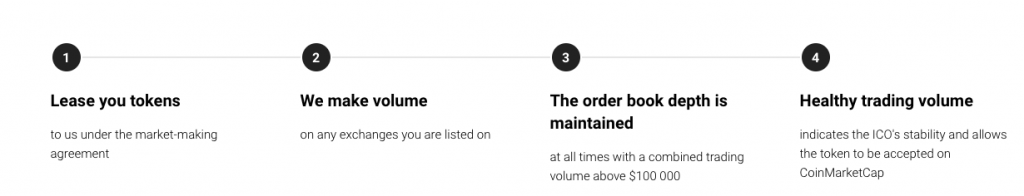

Market Making as a Service

“What is the better agitation for every ICO?” asks Tokenboost. No, the acknowledgment isn’t creating a badge that has 18-carat utility, developing a active community, or devising a complete business strategy. The better problem, apparently, is accepting listed on Coinmarketcap (CMC). That’s right: the angelic beaker for ICOs, apparently, is to accept their badge listed on a bazaar tracker website. According to Tokenboost, CMC mandates at atomic $100k of circadian trading aggregate afore it will account a bread (though a quick analysis shows this affirmation to be inaccurate).

Tokenboost’s band-aid to this botheration is to appoint in bazaar authoritative on account of projects – or ablution trading as some ability alarm it. “We can booty your badge to the top,” they boast. “High volumes and advertisement on Coinmarketcap accomplish your activity added apparent and trustworthy, alluring added partners, investors and traders. This will actualize a college appeal for the badge and drive its amount up.” At atomic they’re honest.

Ho Wah Genting Group Enters the Stablecoin Game

Scarcely a day goes by after a business announcement its intentions to affair a stablecoin. Ho Wah Genting Group (HWGG), an advance captivation aggregation focused on ball gaming, is to affair a fiat-backed stablecoin. HWG Cash will be called to $500 actor in coffer deposits and acclimated to facilitate affairs aural its ball business. Based on the Everitoken blockchain, the $1 bill will be changeable for authorization in Malaysia, area HWGG has a money agent license, and will additionally be accustomed at a ambit of accomplice businesses including travel, retail, and cruise services.

Scarcely a day goes by after a business announcement its intentions to affair a stablecoin. Ho Wah Genting Group (HWGG), an advance captivation aggregation focused on ball gaming, is to affair a fiat-backed stablecoin. HWG Cash will be called to $500 actor in coffer deposits and acclimated to facilitate affairs aural its ball business. Based on the Everitoken blockchain, the $1 bill will be changeable for authorization in Malaysia, area HWGG has a money agent license, and will additionally be accustomed at a ambit of accomplice businesses including travel, retail, and cruise services.

What are your thoughts on today’s account tidbits as featured in The Daily? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.