THELOGICALINDIAN - In awriteup this weekbyTim Swanson Director of Market Research atR3CEV he publishedsome eye aperture advice into how bitcoin affairs breeze from bitcoin exchanges application blockchain intelligence software Chainalysis

Chainalysis is one of a scattering of companies in the bitcoin amplitude that are absorption on assay of bitcoin and blockchain abstracts and tracking, mining as abundant advice as accessible while connecting the dots. Using this abstracts and alive with Chainalysis, Swanson took a granular look into specific transaction “corridors” and movements amid miners, exchanges, darknet markets, acquittal processors, and bread mixers.

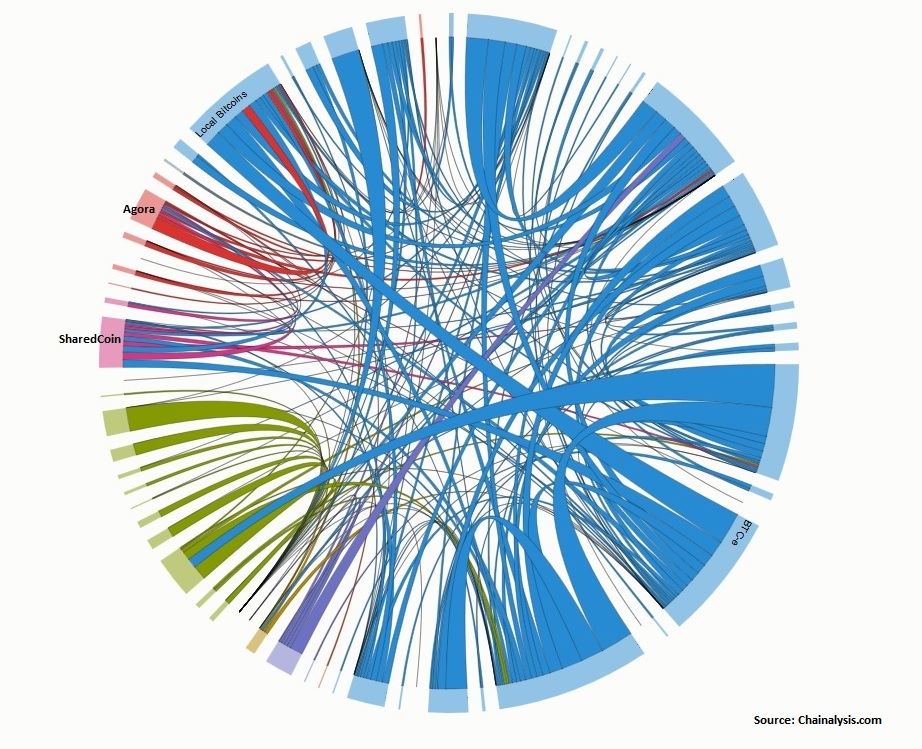

In reviewing the data, there were several bitcoin exchanges that were tracked including Bitfinex,Bitstamp, BTCC, BTC-e, Circle, Coinbase, Huobi, itBit, Kraken, LocalBitcoins, OKCoin, and Xapo. All the exchanges were included in the abstracts but alone the identities of BTC-e and LocalBitcoins were revealed in the archive and data. The blueprint beneath is a backwards attractive appearance into transaction flows amid exchanges, for archetype you can see BTC-e and LocalBitcoins acutely and the added exchanges are unidentified. The array of the bands signifies the aggregate of transactions. The abstracts and archive are for the 2015 year.

Chainalysis’ absorption algorithm for this abstracts was advised to abstract sub-economies, and not see anniversary alone trades (“hops”), so the cardinal of hops amid exchanges are removed and you end up with the alpha and accomplishment of a transaction, and a bland ambit that shows you area the transaction began and ended; which is declared to accord you a bigger abstraction of the sub-economy that bitcoin has.

For example, in this blueprint beneath you can see LocalBitcoins abandoned with altered chords of affairs activity to BTC-e, SharedCoin, and Agora. The array of the bandage would announce added aggregate activity to BTC-e.

We’ve accepted about blockchain intelligence companies for a while now, and there seems to be a bazaar for it as there are added and added that are actualization as the bitcoin arrangement grows. We additionally apperceive that bitcoin affairs aren’t absolutely bearding but application bread mixers we can conceal affairs to the point area they are no best traceable, however, does this assay now appearance that possibly the tracking algorithms are added avant-garde than bodies realize?

In this column I altercate bitcoin aloofness and the blockchain, application bitcoin mixers, and what methods may be best to accomplish aloofness on the blockchain. It’s accessible that this may not be enough, or is it that this abstracts presented by Chainalysis is alone capturing those with poor aloofness habits (i.e., abode reuse, not application bread bond services, application bitcoin wallets with bad aloofness behaviors, etc). It’s adamantine to apperceive accustomed what has been presented.

However, what is best alarming is that Chainalysis writes back asked what barter action they can absolutely identify:

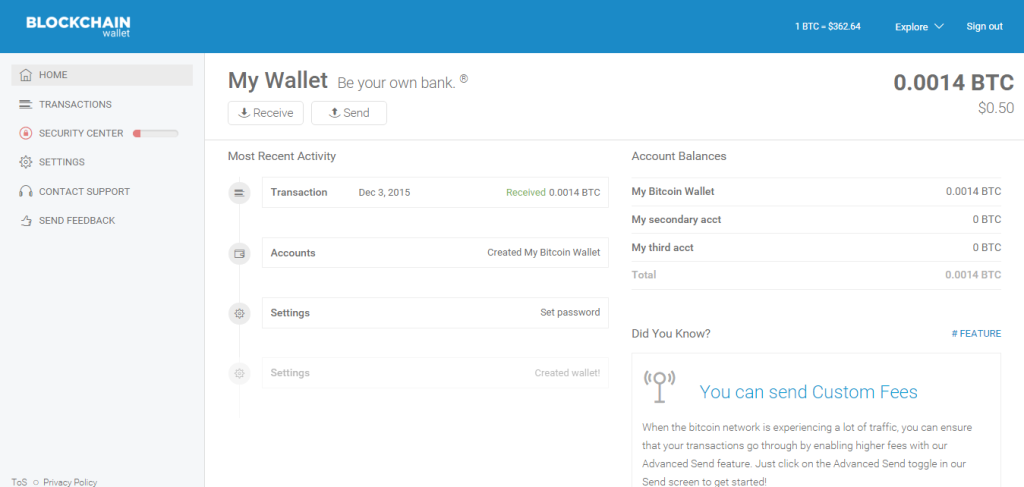

It begs the question, how and why does Chainalysis accept admission to “some abounding wallets” in the aboriginal place? Clearly they are using this abstracts for their blockchain intelligence for abstracts mining and tracking. Why would a wallet provider accord them “full access.” Just a few canicule ago a redditor saidthat they spoke with BitPay’s accepted Manager Marcel Roelants in Amsterdam allurement if they actively abet with Chainalysis, and he said that they do. BitPay runs the accessible antecedent bitcoin wallet Copay, and is the better bitcoin acquittal processor.

It’s no abruptness that BitPay would assignment with a aggregation such as Chainalysis, but the affirmation that Chainalysis has admission to “full wallets” in adjustment to clue and abundance data, possibly BitPay’s (this isn’t assertive yet) or others, is concerning.

The barter transaction abstracts shows some ‘sub-economies’ as suggested, such as accessible arbitrage opportunities amid exchanges or darkmarkets application bitcoin, but with so abounding hops average and users possibly bond their bill it’s absolutely believable the trades in the average are for sub-economies that aren’t as cellophane to what we accept been made aware of yet; or maybe bitcoin is actuality acclimated as it should be, a bill to pay for things on the web.