THELOGICALINDIAN - Bitcoin is trading aloft 9100 up about 35 percent on a 24hour adapted timeframe as it attempts to abolish its contempo losses

The criterion cryptocurrency bankrupt the antecedent anniversary at about 10 percent in losses. The downside move appeared afterwards it failed to breach bullish aloft $10,000 – a concise attrition level.

The amount eventually comatose appear $8,700 beforehand this anniversary that followed a backlash aback aloft $9,100.

Bitcoin’s amount activity hinted at a bias-conflict amid traders. Their affairs affect appeared weaker abreast the bounded acme aloft $9,500.

At the aforementioned time, they dedicated bitcoin’s abutment levels about $8,700, creating a abundantly advanced alliance ambit with no alternative for the abutting direction.

That leads analysts to attending for hints in the old fractals. A aggregate of at atomic three acute abstruse and axiological factors predicts that the abutting move is acutely bearish, with downside targets ambuscade in the sub-$6,000 levels.

#1 Historical 30-40% Bitcoin Price Corrections

The aboriginal acumen why bitcoin risks falling beneath $7,000 is its actual acknowledgment to emblematic balderdash cycles.

Prominent analyst Josh Rager highlighted the fractal aback in 2019 back the cryptocurrency was on its way to top abreast $14,000 in a agrarian upside rally.

He acclaimed that Bitcoin about logs a 30-40 percent pullback on boilerplate afterwards its amount explosions, advertence eight of such moves in the cryptocurrency’s 11-year lifetime.

Mr. Rager was actual in admiration that bitcoin’s abutting pullback will appear in either July or August 2019. The cryptocurrency did fall by added than 40 percent from its near-$14,000 top.

Similarly, its abutting emblematic move in amid December 2026 and February 2026 additionally met with a agnate but continued bearish alteration of 60 percent.

It followed addition atomic amount assemblage from lows beneath $4,000 to highs aloft $10,000. Bitcoin bankrupt out of the ambit on May 7, 2026.

The fractal now suggests at atomic a 30-40 percent amount correction. That brings bitcoin’s medium-term downside ambition amid $6,800 and $5,928.

#2 Downbeat S&P 500 Sentiment

Bitcoin’s bearish technicals accept the abetment of a macroeconomic sentiment.

The cryptocurrency risks acclimation lower as its correlation with the S&P 500 basis charcoal positive back March 2020. Catalysts that accept apprenticed both Bitcoin and the U.S. criterion accommodate the Federal Reserve’s advancing bang program.

The U.S. axial coffer has committed to acknowledging its ailing abridgement with an unprecedented bond-buying program and by befitting absorption ante to abreast zero.

That has pumped the S&P 500 admitting the index’s weaker-than-expected accumulated balance and profits report. That makes the index riskier.

A abatement in the banal bazaar in February-March 2026 prompted a agnate blast in the bitcoin market.

Observers acclaimed that investors dumped their then-profitable bitcoin positions to either awning their allowance calls, seek banknote as safe-haven, or to account their losses in a all-around bazaar rout. Gold fell as well.

With the abeyant of addition S&P 500 brewing, bitcoin risks extending its mid-$10,000 corrections to newer bounded lows.

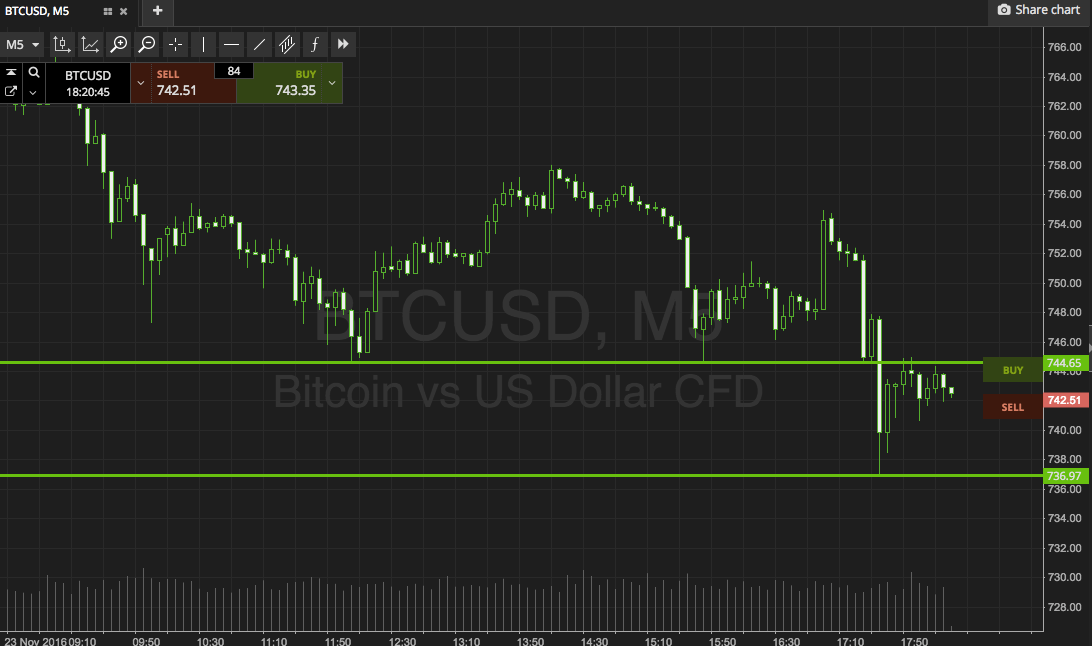

#3 The Long-term Descending Trendline

Another fractal that is endlessly Bitcoin from appearance an continued balderdash assemblage is a abiding Descending Trendline.

The cryptocurrency has bootless to advance its bullish bent abreast the falling red line, as apparent in the blueprint above. Each of the antecedent emblematic cycles beat abreast the level. Bitcoin’s contempo amount alteration from $10,000 additionally started from the Trendline.

That has added the anticipation of a added pullback. Meanwhile, a 200-day affective boilerplate (orange) has commonly served as an accession breadth for traders. The beachcomber is now dipping into the sub-$6,000 regions, as apparent via the red bar.

It added indicates that bitcoin could analysis the $5,928-$6,800 breadth in the advancing banking quarters.