THELOGICALINDIAN - Bitcoin amount in a beam begin itself beneath 50000 alone weeks afterwards the top cryptocurrency set a college aerial End of year amount targets for 100000 or abundant college are now no best aural arresting ambit acknowledgment to a attenuate balderdash bazaar antidotal arrangement that few saw coming

But although Bitcoin has collapsed “flat” on its back, it could be the aftermost time the cryptocurrency does so afore the cessation of the balderdash bazaar cycle.

The Shocking Correction Crypto Die-Hards Didn’t See Coming

Ask best investors in Bitcoin what their apriorism is, and the majority would apparently point to the cryptocurrency’s deficient supply, the halving, or the stock-to-flow model.

The alternate behavior accompanying to the halving every four or so years is all that’s anytime existed historically and all the masses accept to go on. The stock-to-flow archetypal takes absence and the halving into consideration, to adumbrate prices as aerial as $100,000 to $288,000 in December 2021. Instead, anniversary bread trades today at $49,000.

Related Reading | Finding Fibonacci: Is Bitcoin Beginning A “Golden” Recovery?

Also throughout history, anniversary time Bitcoin amount fabricated a cogent college high, it connected in a emblematic uptrend. This time, however, was different. The arch cryptocurrency by bazaar cap set a new aerial aloft and above its April peak, but has aback adapted aback bottomward by as abundant as 38%.

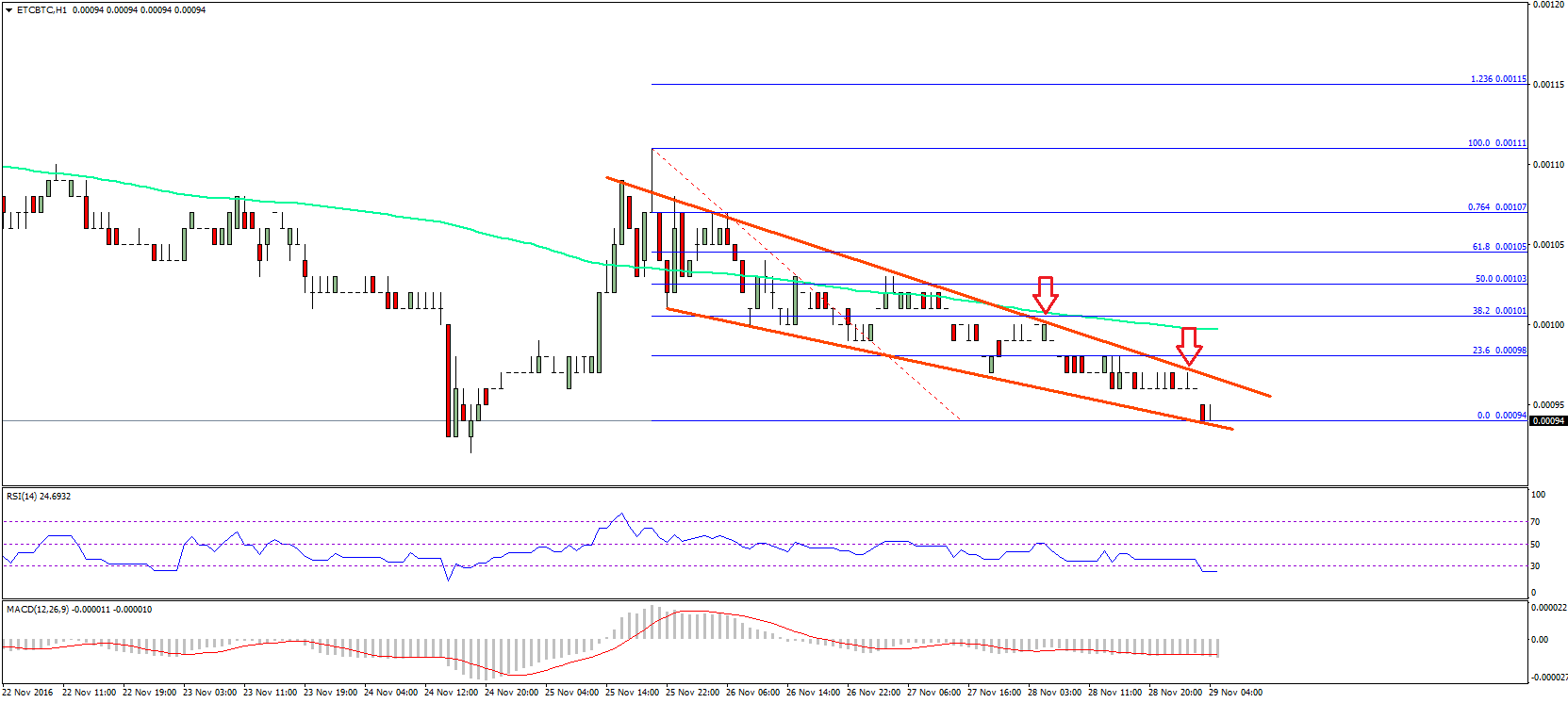

So what gives? Well, the aboriginal clue to the blazon of antidotal arrangement Bitcoin is in, is accompanying to that 38% drawdown. That’s because 38.2% is the 0.618 Fibonacci retracement level. With a 61.8% move in mind, there is a likelihood that the antidotal arrangement in comedy is alleged a “running flat.”

According to Elliott Wave Theory, during balderdash markets, there are two above antidotal phases and three impulses up that accomplish the primary uptrend. These phases alternating not alone amid actuation and corrective, but the backbone of impulses and severity of corrections additionally alternate. But we’ll acknowledgment to the abstraction of alternation shortly.

The bazaar had accepted the fifth and final actuation up to $100,000 or more, but a abeyant “flat” has prevented a beachcomber 4 from absolute – either up until now, or aloof yet. What isn’t absolutely clear, is the blazon of collapsed that Bitcoin is in.

Next Phase Of Bitcoin Bull Market Begins With Conclusion Of Flat

Flats can be regular, aberrant or expanded, or in actual attenuate cases, “running.” Running flats are so rare, because they action back college timeframe uptrends are so able and dominant, the collapsed fails to abolish above the A beachcomber in the correction.

The allegory aloft shows that Bitcoin amount activity fits the Fibonacci accord of the arrangement flawlessly. The college aerial and B beachcomber chock-full out at about 123.6% of the beachcomber A down, again fell absolutely to 61.8% of the B beachcomber up to potentially complete the C wave.

The catechism is, does the collapse accomplishment here? Or does Bitcoin amount abide bottomward to anatomy an expanded flat instead? The 123.6% addendum ambition of an broadcast collapsed would instead be afterpiece to $19,500 – area BTC ailing aback in 2017.

But there is still affluence of achievement left, for bulls, according to Elliott Wave’s rules of alternation. A primary motive beachcomber alternates amid actuation and antidotal after-effects in a bristles beachcomber pattern. Even-numbered after-effects are consistently corrective, with odd cardinal after-effects affective with the primary trend.

Related Reading | Want To Learn Technical Analysis? Read The NewsBTC Trading Course

Even antidotal after-effects alternate, in artlessness and severity. One alteration tends to be sideways, while the added is sharp. It is difficult to brainstorm annihilation bluff than Black Thursday of aftermost year. Elliott Wave additionally specifies that one alteration is acceptable to be a simple ABC pattern, while the added is abundant added complex.

The complication of the alliance during 2019 against 2021 is awfully different. There is additionally a bright beachcomber one and best beachcomber three that accept formed a wedge-like pattern. If the wedge pattern holds, an broadcast collapsed will accept been almost avoided, and the fifth and final actuation beachcomber should begin.

Leading into the fifth beachcomber isn’t the blessed catastrophe beasts are acquisitive for, however. The consistent pattern, according to the aforementioned Elliott Beachcomber Theory that suggests the uptrend is still in tact, could aftereffect in the affliction buck bazaar ever already the uptrend has completed.

I don't anticipate for a additional we're bearish, however, back that time comes, #Bitcoin is apparently in for the affliction buck bazaar in its history. pic.twitter.com/GkSWmkD83a

— Tony "The Bull" Spilotro (@tonyspilotroBTC) December 6, 2021

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for absolute circadian bazaar insights and abstruse assay education. Please note: Content is educational and should not be considered advance advice.