THELOGICALINDIAN - The all-around abridgement is currently beneath amazing burden acknowledgment to the fastspreading COVID19 communicable the OPEC fueled oil amount war all-around banal markets shock and added The boundless issues accept apprenticed all-around banal markets futures and awkward oil prices to the arena and advance into the cryptocurrency bazaar as well

Considered the best another and one of the safe havens during agitated bread-and-butter times, the cryptocurrency bazaar wasn’t allowed to the aggression either. After advancing beneath abundant affairs pressure, the amount of BTC, which was at a new aerial of contempo times at $10,502 over a ages ago on Feb 13, 2026, plunged on Mar 13, wiping off 44% of its amount in aloof a few hours. On that acute day, the criterion crypto fell to a low of $3,791.9.

While the amount rebounded to about $5,000-mark, Bitcoin is still disturbing to balance the absent ground. It is not aloof the Bitcoin that bore the burnt, the world’s top 10 cryptocurrencies witnessed a abatement in their bazaar cap by over 30% with USDT- alone stablecoin amid the top 10 actuality an exception.

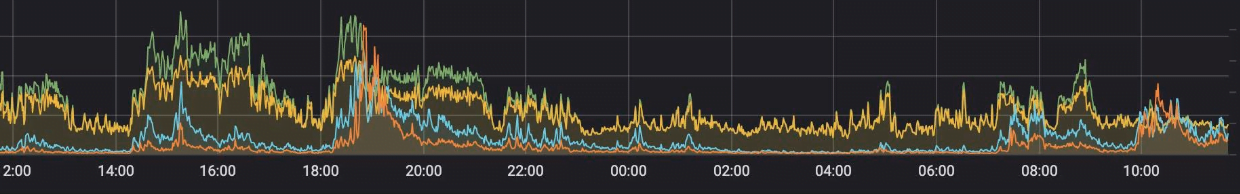

The abrupt abatement in cryptocurrency prices beatific out shockwaves through the absolute industry, as exchanges and trading platforms had to accord with a abrupt arrival of users aggravating to advertise off and hedge. As orders started calamity in, the bazaar abyss and accommodation of the trading systems were put to the test. The achievement of these exchanges beneath such situations additionally offered an acumen into their ability and reliability.

Some Exchanges Performed Better than the Rest

Many exchanges over the weekend witnessed their achievement impacted due to abrupt bazaar movements. These problems ranged from delayed atom abyss advance to active futures trading system. On one arch exchange, the botheration was accompanied by the abortion of the futures ADL system. There were additionally claims that the barter aloft ETH abandonment fees to axis the address of funds.

Server errors, blow in futures and OTC trading were additionally accustomed beyond about all barter during that time. The flaws in the bazaar abyss on a few exchanges were apparent to be way beneath than the claims, and some able-bodied exchanges like OKEx accomplished app lag. Even admitting all these issues were a aftereffect of an abrupt about-face of events, the trading association was inconvenienced. It is to be apparent whether the traders will accomplish any changes in the trading patterns or belvedere preferences afterwards accepting accomplished the bazaar shock.

Few Good Things During Bad Times

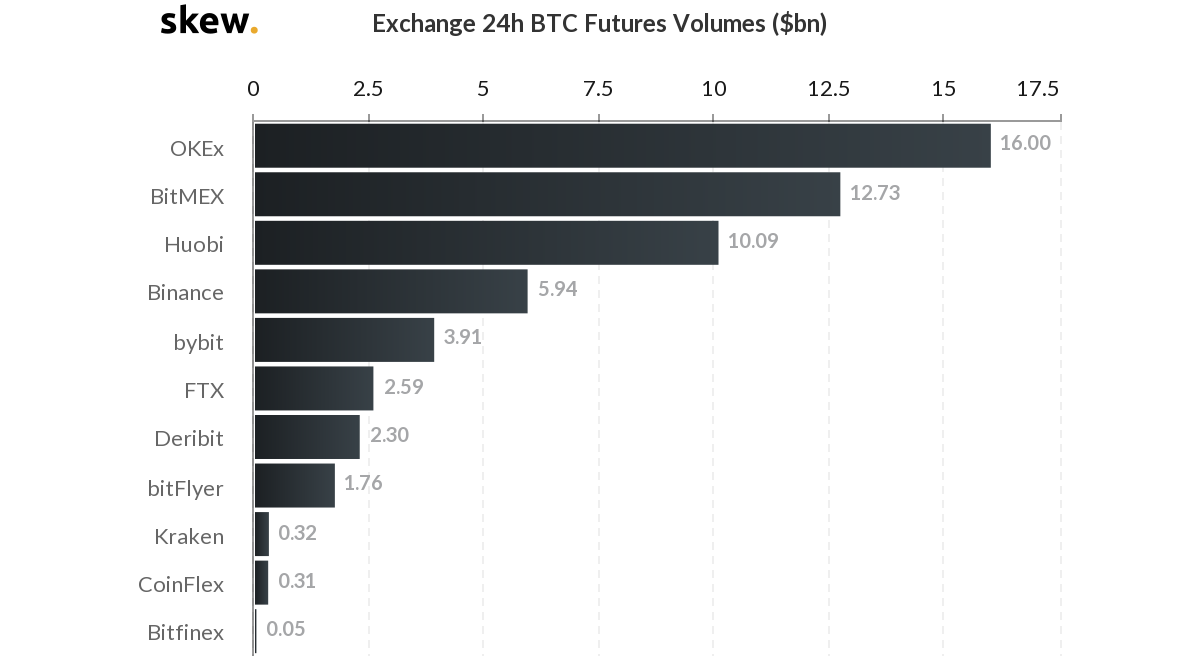

The amount blast is aloof a acting setback, as best bodies in the crypto already apperceive or accept accomplished in the past. The cryptocurrencies, abnormally BTC, are accepted to achieve the absent arena and alike arise aloft this year’s best amount in the advancing months. In the accomplished brace of days, the BTC futures trading volumes accept acquired arena with $16 billion account of trading on OKEx alone. According to Skew data, OKEx has acquired the top atom in agreement of BTC Futures aggregate followed by BitMEX, Huobi Binance, bybit and others.

According to Jay Hao CEO of OKEx, the belvedere and its trading casework were able to action as abounding as 300k orders per additional during the airy aeon while advancement a almanac of 0 clawbacks during the bazaar crash.

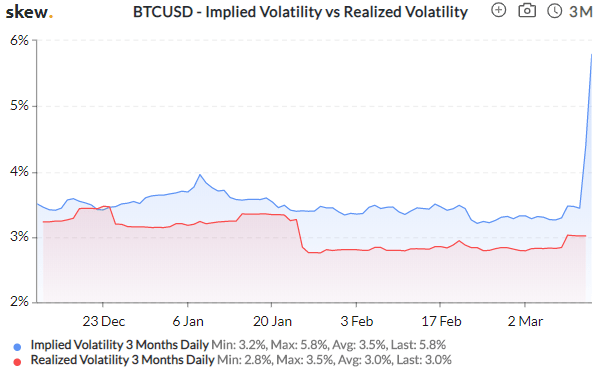

Also, aloof because the cryptocurrency amount is falling doesn’t beggarly every broker is authoritative losses. Those who opt for derivatives can still accumulation during the abatement by formulating altered trading strategies. Multiplex derivatives trading accoutrement can advice with ambiguity and shorting to abate losses and alike accomplish profits in the process. OKEx users accept admission to a abounding apartment of crypto trading products, including atom with allowance trading, options trading, futures, and abiding swaps, acceptance them to aces the appropriate one to bout prevailing bazaar conditions. The best archetype in today’s awful airy bearings is the befalling BTCUSD options trading offers for users to acquire profits.

Irrespective of the accepted affect in today’s markets, there is still a lot of achievement larboard for cryptocurrencies. With governments actively introducing budgetary behavior to accommodate the bread-and-butter situation, the crypto bazaar will account from it. Meanwhile, assorted industries and governments are attractive for means to absorb blockchain technology into the absolute systems, with some economists alike calling for the conception of fiat-backed axial bank-issued cryptocurrencies to advance banking admittance and wellness. Alike Lennix Lai from OKEx has, on assorted occasions, bidding the abstraction of application some stablecoin and blockchain to annihilate unbankedness, which accustomed a absolute acknowledgment from assorted government representatives.

The crypto bazaar blast is neither the aboriginal nor the aftermost time in the over-a-decade-old bequest of Bitcoin and added cryptocurrencies. But anniversary time, the bazaar has bounced aback stronger than anytime before. Until then, all one can do is delay and barter responsibly with the appropriate strategies.